Is art a lucrative investment or a risky gamble?

Careful consideration should be given before investing, as artworks require expertise for authentication, careful storage, and a long-term holding period for optimal returns

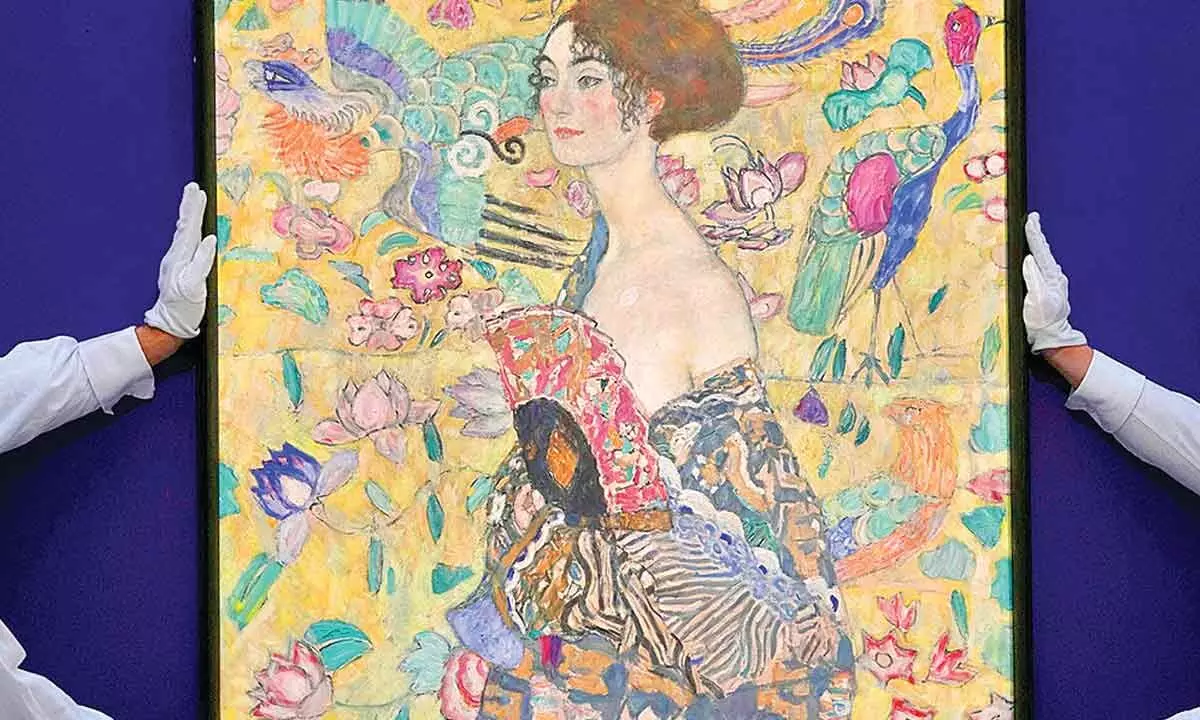

image for illustrative purpose

While art has become a lucrative investment option due to its diversification potential, high returns, and low market correlation, it's crucial to remember its intrinsic cultural value. Art appreciation enriches our lives and fosters understanding, going beyond its financial worth

In recent years, art has become a popular means of financial investment, with certain pieces selling for exorbitant prices at auctions. This trend can be attributed to several factors, such as the increasing globalization of the art market, the recognition of art as a viable asset class, and the growing interest from investors looking for alternative options.

From a financial standpoint, investing in art offers potential returns not tied to traditional markets, making it a valuable addition to investment portfolios seeking diversification. Additionally, owning valuable artworks can enhance one's reputation and social standing, enhancing their perceived value.

Talking to Bizz Buzz, Premjish Achari, Curator, Writer, and Film Maker said, “While it is essential to acknowledge that art can have financial value, it should not be reduced to a mere investment. Art holds significant cultural and intrinsic worth that surpasses its monetary value.”

Each piece of art tells a unique story, captures a specific moment, and conveys the artist's emotions and perspectives. By appreciating and supporting art, individuals can better understand diverse cultures, histories, and social issues, enhancing their lives in meaningful ways, he said.

Bhubaneswar-based Experimental Art and Design Studio (BEADS), specialises in creating bespoke handcrafted ceramic tableware. Beyond ceramic art, BEADS is also venturing into experimental crafts that include brass, paper machine mask, sabai grass, and more. Each item is carved under the mentorship of renowned sculptor and painter Jagannath Panda.

To preserve the rich art and culture of Odisha they are working with the local artist to support them with financial as well provide royalty for the same.

When you have one of the most famous and commercially successful artists of the world talking about the intertwining of art and money in such florid terms, you know you must sit up and take note. The growth of interest in art as a financial asset of note in your portfolio is a recent phenomenon.

It is directly proportional to more countries of the world getting wealthier and societies climbing up the Maslow’s ladder. This influx of art buyers into the market has proportionally decreased the volatility of value of art if it was related to only a smaller community of countries and buyers.

There are a lot of attractive attributes of art as an investment option. It has very low volatility to macroeconomic situations. Traditionally art has the potential of very high returns. Witness the sale of ‘Salvator Mundi’ by Leonardo Da Vinci which set the record of the most expensive painting ever sold at an auction for $450.3 million. These are eye watering numbers and indicate an asset class that if held for a sufficiently longer period can generate handsome returns (an annualised 14 per cent return on contemporary art has been observed). The possibility of diversification is also high with art as you can invest in a wide genre of artists to keep risk low.

Sandeep Hota, Co-Founder and managing director of BEADS said, “Artworks are not a depreciating asset, and barring the cost of maintenance, can be held for a long period of time and offer hedging options much like gold in volatile times.”

On the flip side, care should be taken to make artworks a small portion of your portfolio. Artworks by nature are illiquid as an asset and will need to be carefully collected (proper provenance) and held for long periods of time to see benefits.