Don't settle for safe: How market-linked products can help you achieve bigger goals

While fixed income products offers a false sense of accomplishment and guaranteed results, it hinders personal growth and fails to account for inflation and the power of compounding

image for illustrative purpose

“Samasya Ye Nahin Ki Lakshya Badaa Aur Rastein Mein Baadhaa Hai

Samasya Ye Hai Ki Lakshya Chhota Aur Raah Aasaan Jyaada Hai.”

Translation: The problem isn’t that the goal is big, and the path is difficult & vast,

The problem is that the goal is smaller, and the path is easier & fast.

Sometimes what seems like an obvious and easier path may not lead to meaningful and satisfying goal in our life. Renowned American writer, Henry David Thoreau has expressed the same in following lines “The price of anything is the amount of life you exchange for it”. This emphasizes the importance of having substantial goals and willingness to face obstacles to achieve them.

When the goal is small and the path is significantly easier, it can lead to a situation that gives you a false sense of satisfaction and prevents you from trying harder and disrobes you of ambition. In such situation, one may settle for mediocrity opting for what is convenient and easy rather than striving for excellence. This mindset can hinder personal and collective growth, as one becomes content with small things they fail to push themselves beyond their comfort zones for greater achievements.

Let’s understand this better with an example:

It is easier to opt to purchase plastic flowers to adorn one’s home than making endeavours of visiting a flower vendor, carefully selecting live plants, understanding its lifecycle, and ensuring its proper care and maintenance before and after placing it into the home decor. However, the latter choice, though requires more efforts and time, can result in a visually stunning, lively, and vibrant house ambience.

Same logic applies in the context of investing in market-linked products versus traditional Vanila fixed income products.

In the case of traditional Vanila fixed income products, the goal is typically small and the path to achieving this goal is quite easy and comes with an additional sweetener known as guarantee whereas market-linked investment products for example mutual funds scheme, though promises and historically delivered as well, the much higher returns but through emotionally difficult path. In the process, the investor must withstand the vagaries of market. The taxation of market-linked products is more investor friendly. Besides, there is no TDS and no tax liabilities on accrual basis. The tax incidence comes only at the time of redemption. This makes the investment in market-linked investment products even more investor friendly.

Why Market-Linked Products Offer More Than Security

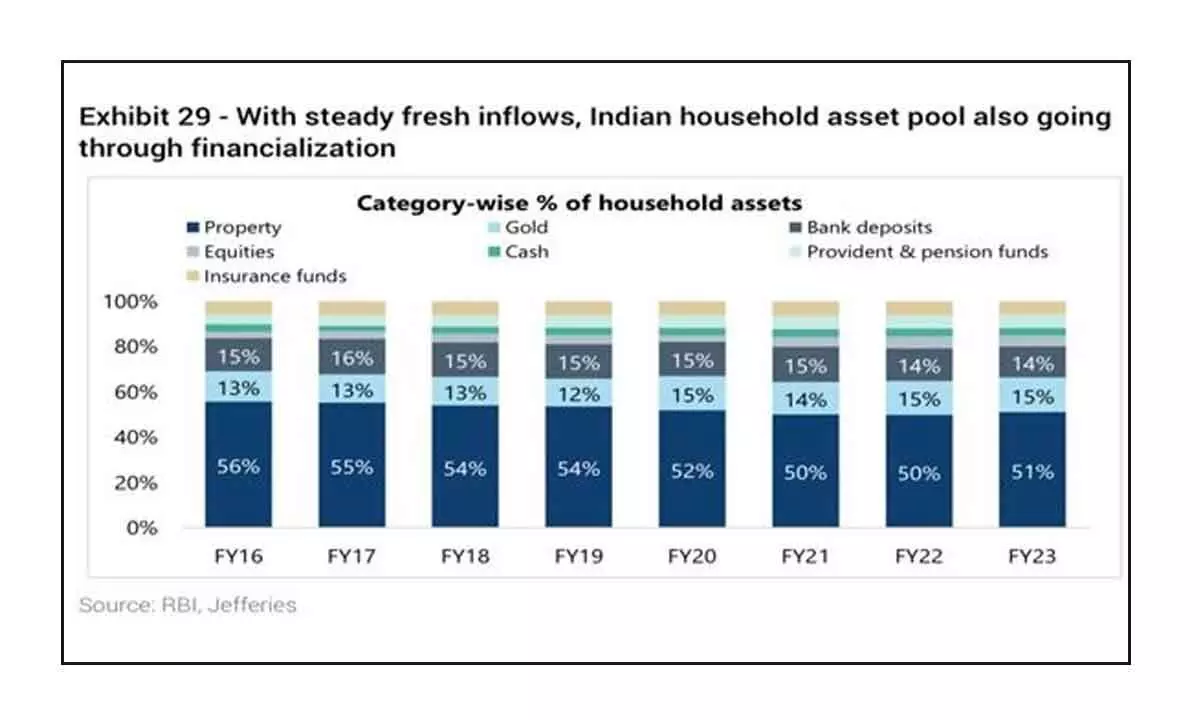

A small graphical presentation of where majority of Indian households save. The trend is changing in favour of market-linked investment products.

Overall, in a nutshell a small goal coupled with an easy road may seem like a good way. It offers the promise of apparently certain results with minimal effort. However, this does not consider the eroding capacity of inflation and wonder of compounding when success comes too easily, it often lacks the depth and makes us bereft of realising power of perseverance and patience.

I would end on an apt note from Warren Buffett, though primarily known as an investor rather than a writer, has offered sage advice that aligns with this sentiment. He famously said, "Risk comes from not knowing what you're doing." This can be interpreted as caution against settling for smaller goals or taking the easier path without fully understanding the risks involved. In the world of mutual funds, where investors often seek convenience or short-term gains, Buffett's words remind us of the importance of being informed and pursuing larger, well-researched investment goals rather than opting for what seems easier in the moment.

(The writer is Senior Vice President, SBI Funds Management Ltd)

(Translation & Synopsis by Nirmala Valavan, Sr Manager, SBI Funds Management Limited.)