Big governments, not free markets, fuelled inequality

Ruchir Sharma's new book, ‘What Went Wrong With Capitalism,’ challenges the common belief that govt has shrunk in recent times

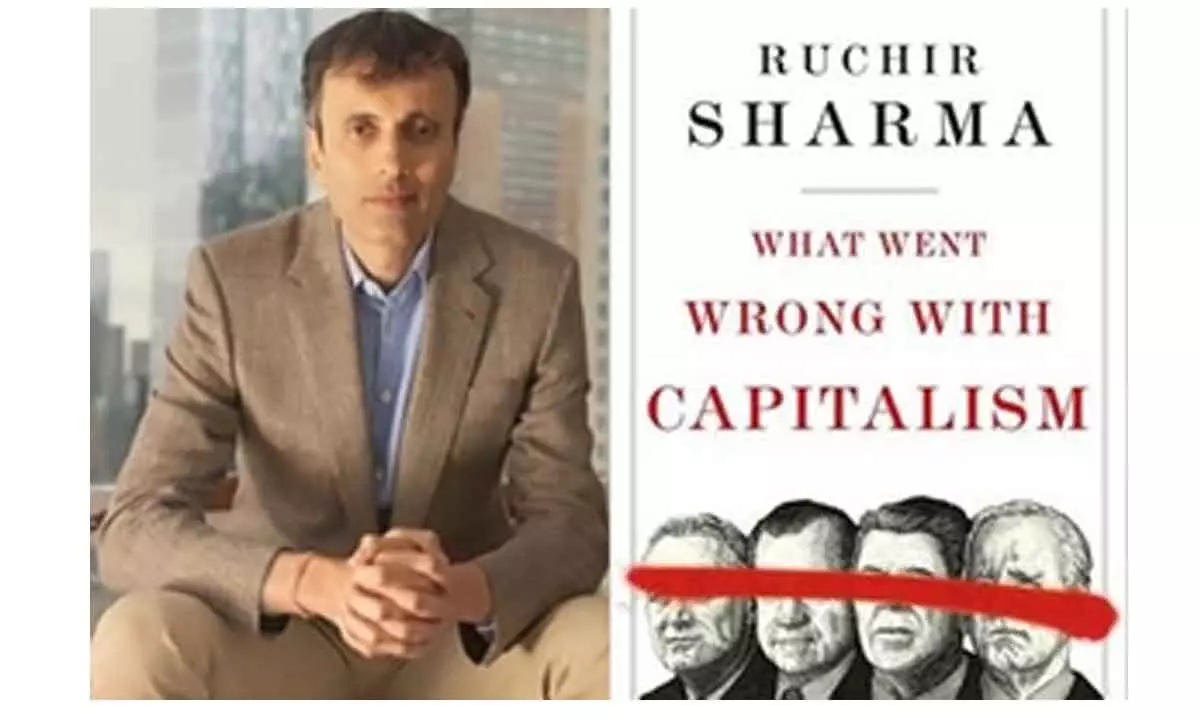

image for illustrative purpose

Sharma blames this growth for creating an unfair system where the wealthy and big corporations benefit from government interventions funded by public debt. This, he argues, stifles competition and economic growth, leading to the public anger we see today

The 'New York Times'-listed bestselling author and head of the Rockefeller Capital Management's international business, Ruchir Sharma, will be out with his new book, 'What Went Wrong With Capitalism', on June 16. It will be the 'Financial Times' columnist's fifth book after 'The 10 Rules of Successful Nations', published in 2020.

Making the announcement, the publishing house, Penguin Random House UK, said that in the upcoming book, Sharma "rewrites the standard histories, which trace today's popular anger to the anti-government rebellion that began under Margaret Thatcher and Ronald Reagan."

A book that promises to help us understand the growing popular anger in the capitalist world (at the moment expressing itself in the protests raging across US campuses), its fundamental argument, according to the press statement from the publisher, can be summed up in this statement: "Four decades of downsizing government - cutting taxes, spending, and regulations - left the financial markets free to run wild, fuelling inequality, slowing growth - and alienating much of the population."

Sharma, a Shri Ram College of Commerce alumnus, first drew attention to the breadth of his vision with his debut book, Breakout Nations (2012), which made the journal 'Foreign Policy' rank him as one of the top global thinkers.

In his upcoming book, Sharma, according to the publisher's press statement, "exposes the story of a shrinking government as a myth". The statement adds: "With a historical and global sweep, [Sharma] shows that the government has expanded steadily as a regulator, borrower, spender, and micro-manager of the business cycle for a century. Working with central banks, particularly in the last two decades, governments created a culture of easy money and bailouts that is making the rich richer, and big companies bigger."

In an observation that may explain the appeal of the left-of-centre US Senator Bernie Sanders among young Americans, Sharma says "progressive youth are partly right that capitalism has morphed into 'socialism for the very rich'."

Sharma notes: "The broader issue, however, is socialised risk for the poor, the middle class and the rich; the government is trying to guarantee that no one ever suffers economic pain by borrowing heavily to prevent recessions, extend recoveries, and generate endless growth."

"The result," he adds, "is rapidly rising debt and declining competition - exactly the environment in which oligopolies and billionaires do best."

Says the book's blurb, "This rare capitalist critique of capitalism offers a timely warning. To a surprising degree, politicians on both the right and left now assume that popular anger with capitalism arose in a period of shrinking government, and so offer answers that involve more government - more spending, or regulation, or walls and barriers."

The blurb goes on to note, "If their historical assumptions are incorrect, their proposed fixes are likely to double down on what went wrong in the first place. There is no returning to the 19th century when the government did little more than deliver mail, but the balance has shifted too far towards state control, leaving too little room for economic competition."

No matter whether your politics are progressive or conservative, Sharma argues, the answer has to be less government and more cautious central banks.

Commenting on his "most ambitious book yet", Sharma says, "This book is a pandemic baby, conceived in that dark period when governments were both locking down businesses and spending trillions to support people shut in at home.

"Though many saw this crisis as entirely novel, what I saw was the logical culmination of all that has gone wrong with capitalism, namely, decades of increasingly interventionist government, narrowing the scope of individual freedom and initiative and economic freedom."