9 of 10 startups fail, I'm aiming to rectify that

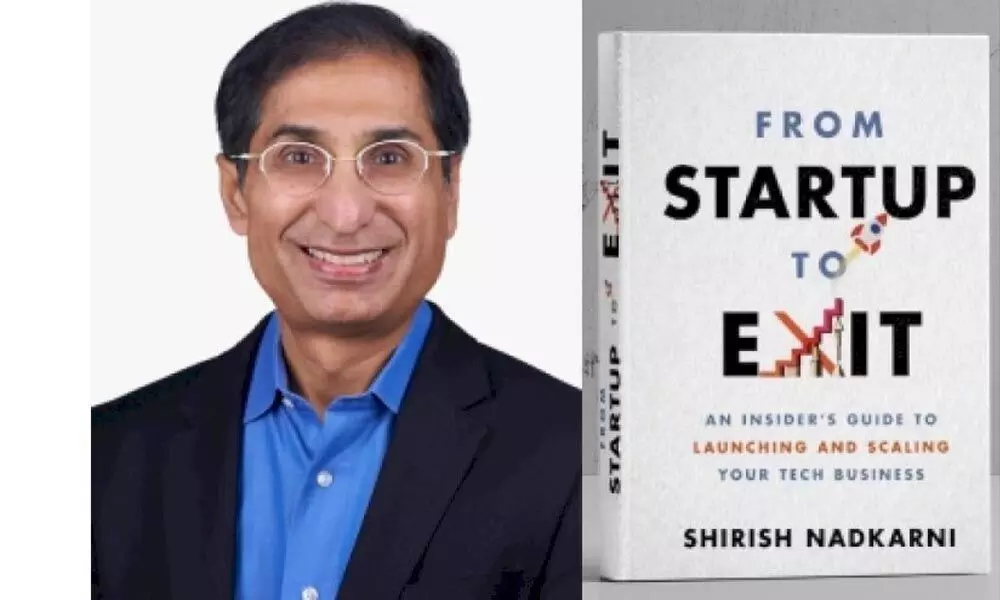

Shirish Nadkarni, a serial entrepreneur with 20-plus years of experience in creating consumer businesses in his new book lays down strategic and tactical methods ‘to change the world’

image for illustrative purpose

New Delhi: With nine out of 10 start-ups failing, Shirish Nadkarni, a serial entrepreneur with 20-plus years of experience in creating consumer businesses that have scaled to tens of missions of users worldwide, challenges that equation in his new book in which he lays down strategic and tactical methods "to change the world". "I have an idealistic mission with my book. Nine of 10 start-ups fail. However, the one that succeeds can change the world as Microsoft, Google and others have shown. My goal is to change that equation so that more entrepreneurs are inspired and more start-ups succeed and change the world," Nadkarni told IANS in an interview of his book "From Startup To Exit e An Insider's Guide to Launching and Scaling Your Tech Business" (HarperCollins Leadership).

"At a strategic level, the best way to achieve product market fit is to either leverage a technology trend (e.g. the shift to mobile) or to ride a global macro trend e.g. globalization which drove the success of (my start-up) Livemocha. At a tactical level, it is important for the founder to really address a burning pain point for the customer, where the customer is actively looking to solve a problem. VCs fund aspirins not vitamins," he elaborated.

"VCs are looking to fund companies with strong teams, big ideas and demonstrated traction. It is important to build a compelling story that captures the imagination of the VC community. You need to demonstrate a strong expertise in the market you are addressing and a deep understanding of the problem domain," Nadkarni added.

In writing the book, he drew upon his own experiences and supplemented this by interviewing a number of successful entrepreneurs and VCs "to understand the key learnings that they had gained in building successful companies from the ground up. For the sections on terms sheets and intellectual property I also interviewed prominent lawyers to get their insights on these topics", Nadkarni said.

The book is divided into five sections

In Part I: Ideation, the author discusses what makes a good idea for a start-up, outlining the strategic considerations to determine the viability of an idea e for example a platform shift to disrupt incumbents, like Amazon and Netflix have done.

In Part II: Company Formation, Nadkarni discusses the fundamentals of forming a company and outlines the various options, which include S corporation, LLC (limited liability company), and C corporation and the pros and cons of each.

Part III: Fundraising details the various sources of doing so at various stages of a company and outlines different types of vehicles such as convertible debt, SAFEs, Series Seed, venture debt, and crowdfunding and their pros and cons.

Part IV: Running Your Company discusses various aspects of growing and managing a company, including hiring great employees, building a vibrant company culture and becoming a great leader.

In Part V: Finding an Exit, Nadkarni describes the two options for doing so e through an acquisition or through an IPO.

"The journey from ideation to founding to an exit is a long and arduous one that very few entrepreneurs successfully make," Nadkarni writes, pointing to the important lessons he has learned through three different start-ups, raising more that $30 million in funding and achieving two successful exits.

Thus, the book has three main take-aways

*Why do nine out 10 start-ups fail? The main reason is that they fail to achieve a product market fit. The book teaches entrepreneurs on how to go about validating their ideas thus avoiding infant mortality.

* Fundraising can be a science not just an art. The book elucidates how VCs think and helps them craft a killer start-up pitch to secure the funding that they need.

* Be careful about who you select as your VC partner. VCs lacking operating experience not only don't add value but they detract value.