AI can help Joe Biden’s team catch wealthy tax cheats

In a latest development, President Joe Biden is set to make public a set of new tax increases on wealthy Americans. Rather than raising taxes, maybe he should just focus on collecting what some of them already owe.

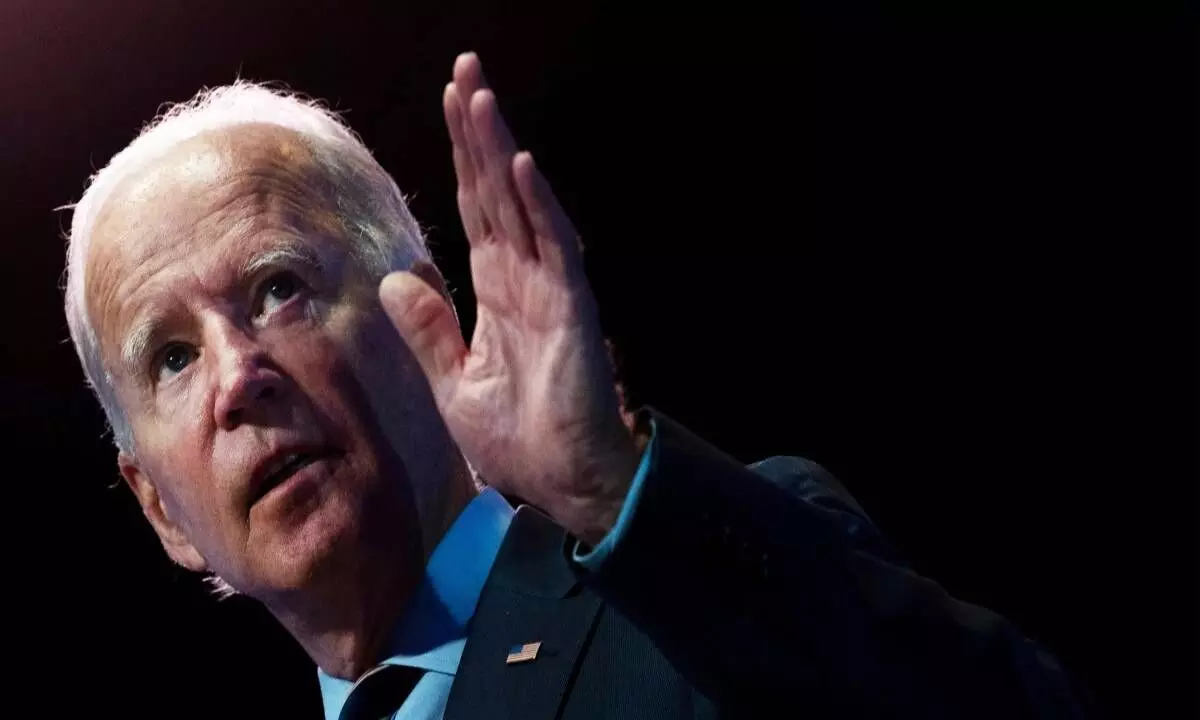

image for illustrative purpose

In a latest development, President Joe Biden is set to make public a set of new tax increases on wealthy Americans. Rather than raising taxes, maybe he should just focus on collecting what some of them already owe.

Every year, the IRS takes in $600 billion less than it should. By one estimate, half of that is because of underreporting by those among the super-wealthy who hide income by setting up sophisticated partnerships or other entities. If you’re anxious about the amount of US debt, those numbers should grab your attention.

With Artificial intelligence could change that balance of power, helping the archaic, beleaguered agency do a better job of going after the real money.

Till now, the IRS just doesn’t have the resources to chase them down. Following years of budget cuts and understaffing, the IRS has mainly targeted poor families with audits because doing so is easier and cheaper than pursuing the complicated tax matters of wealthy filers.

The Inflation Reduction Act allocates almost $80 billion to the IRS over the next decade. Once IRS commissioner nominee Daniel Werfel is confirmed, one of his first orders of business should be dedicating some of the funding to tap AI to help revamp the entire audit process.