RBI’s shallow rate cut after five years

The current economic outlook allows for one additional rate cut of 25 basis points in the near future. Inflation risks in the global environment include tariff actions by the US and retaliatory measures from other nations.

RBI’s shallow rate cut after five years

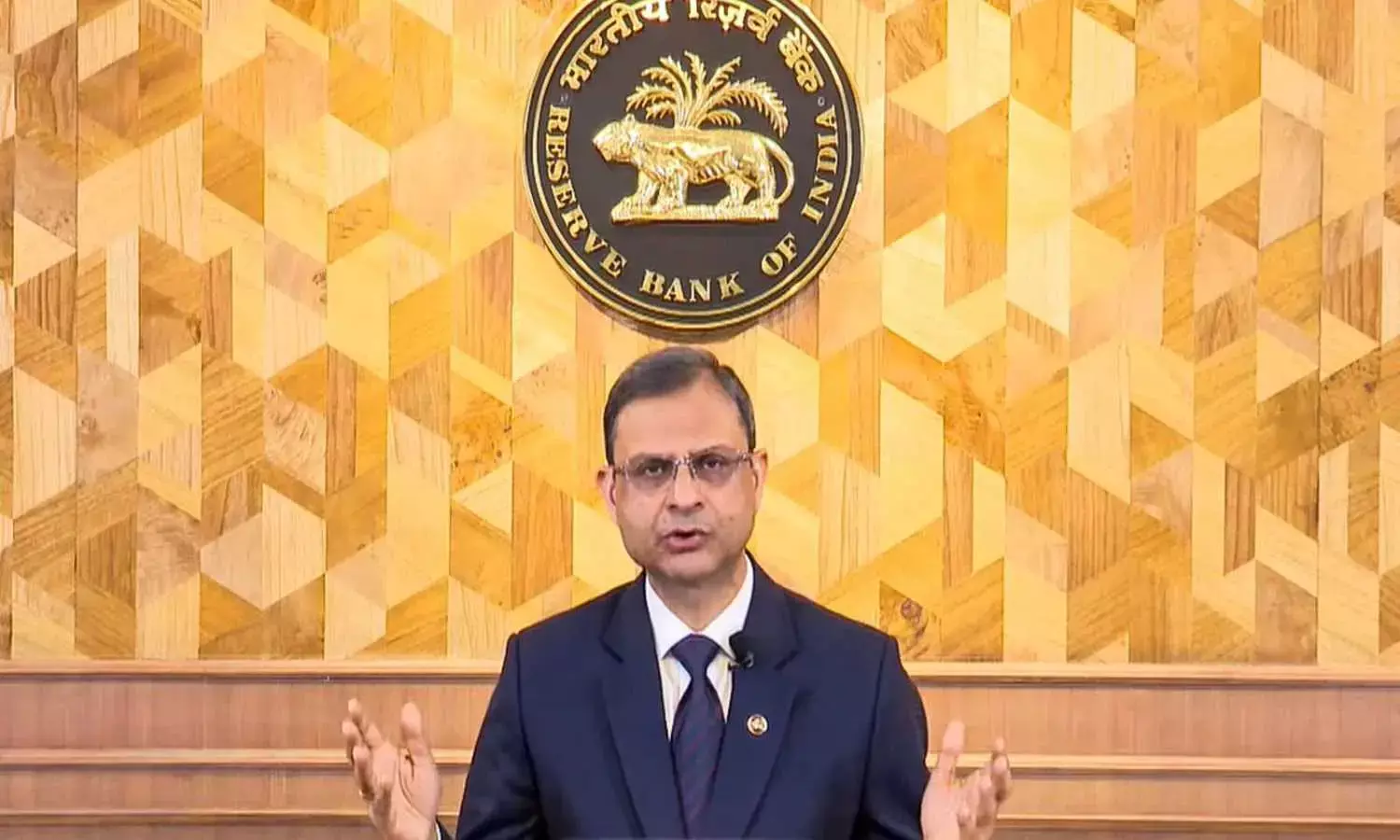

During its February 2025 review the RBI Monetary Policy Meeting started a new rate-cutting cycle. The trends and outlook of growth and inflation created a window for rate cuts. In the face of global uncertainty which is clearly shown by the rupee's depreciation against the US dollar the Sanjay Malhotra-led committee smartly seized this chance to proceed with their actions.

The December 2024 MPC meeting revealed that the latest CPI interest rates cut exceeded 6 per cent reaching beyond the medium-term target range ceiling of 2-6 per cent. The GDP growth decline to a disappointing 5.4 per cent during the second quarter of 2024-25 demonstrated that rate cuts were no longer an option. The February 2025 RBI policy updates appeared to be a viable candidate for a rate cut because inflation had significantly declined and was predicted to continue moderating through 2025-26.

The MPC decided by unanimous vote to cut the repo rate by 25 basis points and stayed neutral as anticipated. The MPC reduced RBI interest rates to 6 per cent from 6.25 per cent in April 2019 and kept a neutral stance. ICRA estimates that the current inflation and growth projections will allow for a single additional rate reduction of 25 basis points soon but the timing must be adjusted according to domestic and global conditions.

The CPI inflation rate is projected to decrease to 4.2 per cent for 2025-26 from 4.8 per cent in 2024-25 according to the MPC’s estimates. The projection expects a notable decrease in food inflation to drive this change while core inflation simultaneously sees a slight increase. Food inflation will decrease because of supply improvements from healthy rabi planting and sufficient reservoir levels and budget schemes for perishables and pulses which will help low and middle-income households. From a macroeconomic standpoint the Union Budget demonstrates considerable generosity through its Rs 1 trillion tax cut allocations.