Why banks have to push PMJDY account holders into greater economic engagement

It has been a rewarding 10-year socio-economic journey for Pradhan Mantri Jan Dhan Yojana

Why banks have to push PMJDY account holders into greater economic engagement

Banks with a 53 crore solid customer base under PMJDY should make use of these customers to maximize their relationship by connecting them to various deposit schemes as also provide need-based credit access

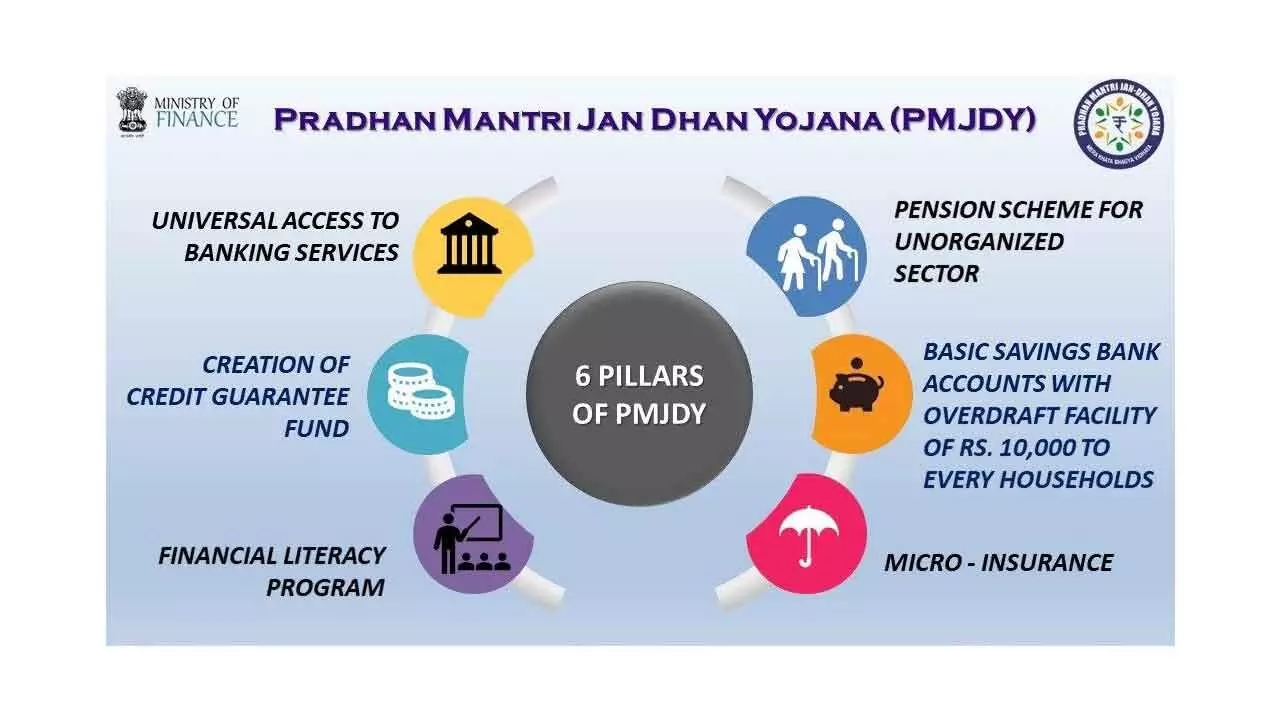

Launched by Prime Minister Narendra Modi on August 28, 2014, Pradhan Mantri Jan Dhan Yojana (PMJDY) has had a stellar 10-year journey that is bound to achieve many milestones going forward. The push given to financial inclusion remains unparalleled.

Making available banking facilities to those who had no access whatsoever to such facilities and offering them a chance to open PMJDY accounts without any minimum balance is a visionary move that augurs well for the Indian economy. The focus on women and channelizing their savings through banks is a welcome development as it adds to the family wealth.

An equally well-thought of booster has been in issuing Rupay cards to these account holders with an insurance cover, which has been enhanced to Rs. two lakh. It is ditto with extending overdraft facility of up to Rs. 10,000 to eligible account holders.

The success rate of PMJDY has been nothing short of spectacular. Banks have covered more than 53.13 crore beneficiaries with accounts having balance of Rs. 2,31,235.97 crore. Most accounts have been opened by public sector banks at 41.42 crore, whose balance stands at a staggering Rs. 1,79,379.62 crore. Regional rural banks, private sector banks and rural cooperative banks make for the remaining ones. Approximately, 36.14 crore account holders are enjoying the benefits of Rupay cards.

The fact that 56 per cent account holders are women demonstrates the efforts to allow them equal access in terms of financial empowerment and their participation in productive activities concerning village industries and income generating avenues.

It is good to note that the average balance in these PMJDYAs has progressively moved upwards from Rs. 1065 in 2015 to Rs. 4352e.

The governments both at the Centre and States have been using Direct Benefits Transfer which has expanded to over 300 central schemes and more than 2000 state schemes by April 2023 for crediting directly to beneficiaries accounts and avoiding leakage which has helped in substantial savings. The government’s efforts in issuing Aadhar cards and making available mobile facility at a cheaper cost have enabled connectivity resulting in a wider reach.

The efforts to cover all panchayats by fibre connectivity have also enabled internet connection in far-flung areas. With more than 1197.75 million telephone subscribers as of February 2024, the overall teledensity has reached 85.64 per cent, while it is 58.92 per cent in terms of rural teledensity. This data gives an indication of the importance of wireless and wireline connectivity, which has facilitated financial inclusion.

PMJDY account holders are being provided Pradhan Mantri Jeevan Jyoti Bima Yojana and Pradhan mantri Suraksha Bima Yojana, Atal Pension Yojana. Insurance inclusion has been an area of focus for the Insurance Regulatory and Development Authority (IRDA) and the regulator has brought in greater reforms for the benefit of insurance players while the Centre works towards achieving insurance for all by 2047.

The Reserve Bank of India (RBI) has played a great role along with the government by formulating the national strategy for financial inclusion 2019-2024. This is aimed at a national action plan with clear targets to provide access to formal financial services in an affordable manner, broadening and deepening financial inclusion and consumer protection.

The push for digital India and growth of Fintech have been timely moves while UPI has made payments easy for both smart phone and normal mobile subscribers, bank mitras, ATMs and having branches in remote areas have all led to inclusivity as regards banking facilities.

However, there is scope to expand the branch network in uncovered areas as the coverage of population per lakh persons in India is much less compared to other peer countries.

It is heartening that the Financial Inclusion Index, as announced by RBI, has risen to 64.2 in March 2024 as against 60.1 in March 2023. This indicates a significant progress in financial inclusion across the country. The FI-Index comprises of three broad parameters: Access having a weight of 35 per cent; Usage with a weight of 45 per cent and Quality with a weight of 20 per cent. The financial inclusion index has been improving year after year and it reflects the cumulative efforts of all stakeholders to make financial inclusion more effective and more purposeful.

Banks with a 53 crore solid customer base under PMJDY should make use of these customers to maximize their relationship by connecting them to various deposit schemes as also provide need-based credit access. It is therefore necessary to cover these customers in economic inclusion by providing various government credit schemes as well as their own loans to engage the customers in productive economic activities to improve their savings and income. After all, these efforts will lead to economic empowerment.

Women customers must be encouraged to engage themselves in self-help group schemes, micro and rural industries and allied activities as that will enhance the per capita income besides boosting the GDP. Banks have to play greater developmental role and look at these PMJDYA account holders as captive customers for greater engagement and their own prosperity. On that count, it is a win-win situation for all stakeholders.

(The author is former Chairman & Managing Director of Indian Overseas Bank)