RBI had done well with its regulatory principles for management of model risks in credit

Without a proper policy in place, the chosen model may expose even regulated entities to greater risks

RBI had done well with its regulatoryprinciples for management of model risks in credit

The central bank has also directed as to the policy for adoption and usage of third party models. Even globally there have been instances of failures of such models, which have resulted in financial and reputational loss for such institutions

The Reserve Bank of India (RBI) has been expressing its concerns across models, statistical tools, technology-related analysis, financial analytics used by banks that are indigenously developed, purchased or outsourced by external developers for the purpose of taking various decisions as regards credit, investment, risk management like market risks and operational risks. These models are developed on various assumptions or technological platforms, which need to be vetted or benchmarked with the final outcome. There is likely chance that there may be inadequate data support or inaccurate data or the assumption that may not fully represent the suitable representation or faulty assumption. Unless fully checked or vetted, this may result in undesirable outcome, which, in due course, may put the institutions in greater difficulty.

Hence a model risk is a risk that occurs when a financial model measures quantitative or qualitative information, which, due to various inaccuracies like inadequate or inaccurate data, programming or technical errors and misinterpretation of the model outputs, lead to the organisation to adverse outcomes. The assumption behind making the model may be so faulty that the decisions could to major financial losses, which could be avoided in the first place with some pragmatic calculations.

Organisations should have a model risk executive entrusted with the responsibility to go into the depth of the processes, the adequacy or otherwise and suitability of the assumption. He should also find if any inherent weaknesses or errorshave led to unexpected financial loss or adverse outcomes for having relied completely on such a model.

The current guidelines by RBI are related to various models used by regulated entities as part of their credit management lifecycle for borrower selection, credit scoring/rating, pricing, risk management, credit loss provisions. RBI indicates that such models are inherently exposed to uncertainties as they are based on assumptions which may not manifest as envisaged and may take different forms on the ground.

It is due to these factors that the RBI feels that model risks in credit may expose banks to implications on prudential aspects of credit management, compliance risks and also reputational risks. Though it acknowledges that such models have enabled faster credit decisions, the central bank feels that without a proper policy duly approved by the board, the model may expose the regulated entities to greater risks.

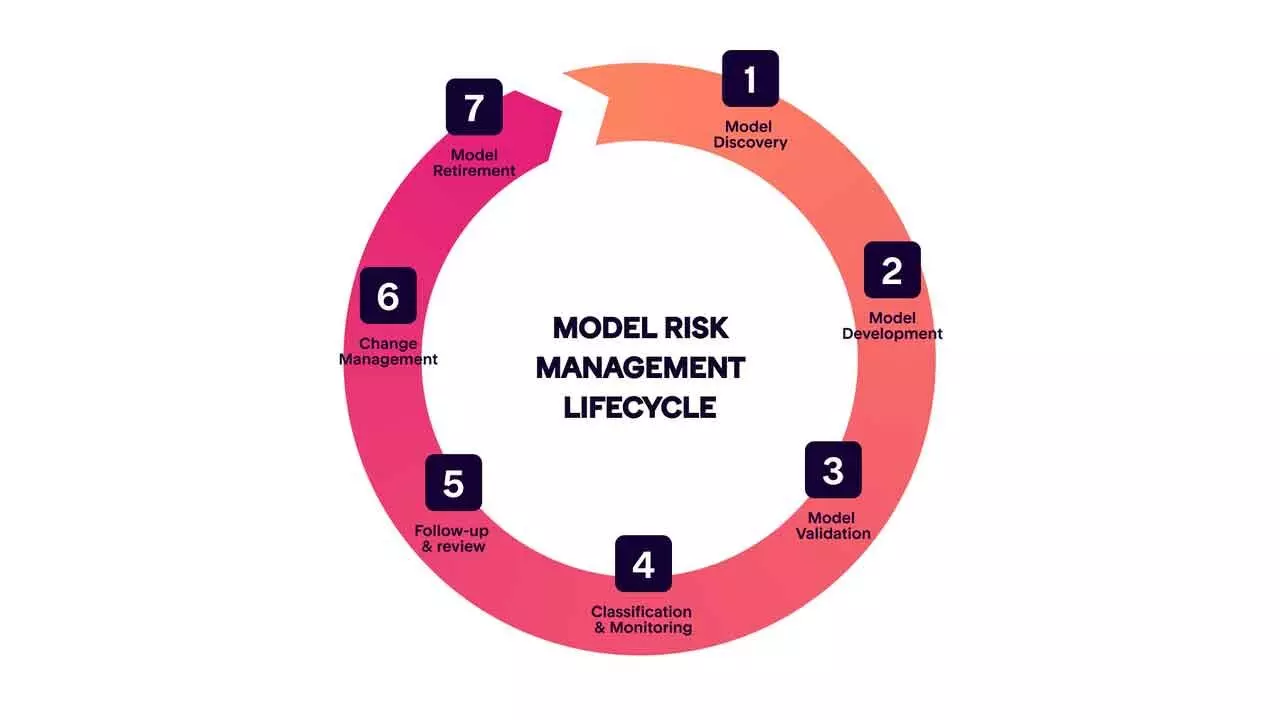

In view of the criticality of such models in lifecycle management of credit, RBI has directed the regulated entities to put in a place the detailed board approved policy. It has given broad guidelines that such a board-approved policy shall cover governance and oversights commensurate with model materiality, processes around model development or selection, documentation for models deployed, independent vetting/ongoing validation or review processes, change control and the monitoring and reporting framework, including the role of internal auditor.

The central bank has also directed as to the policy for adoption and usage of third party models. Even globallythere have been instances of failures of such models, which have resulted in financial and reputational loss for such institutions. Apparently, the RBI would have also noticed or felt it appropriate for the regulator to give regulatory guidelines for model risk in credit as the usage of varying models in regulated entities would have been extensively used. Without such monitoring and control, it is likely that an unexpected outcome may result in regulatory concerns apart from the adverse impact on such regulated entities.

The regulatory guidelines along with governance and oversight consist ofmodel development and deployment particularly on the scalability and flexibility to meet the needs of dynamic business conditions. The model should be integrated into core banking and other important tools like assets liability management, liquidity management, risk management system of RE and it should be consistent, unbiased, explainable and verifiable for the purpose of validation. Any subjective assessment made to override model outcomes that should be consistent with the policy and such deviations are as per the approved policy and the same shall be subject to audit.

The guidelines suggest that such models are to be independently verified and validated at suitable intervals, perhaps on anyearly basis.

The validation exercise can only be done by independent experts within the organisation or by external experts. This is essential as it can go into the development of the model, accuracy and robustness, the assumption made or relied upon. Such validation and testing will help the organisation to spot weaknesses in the model or instances of bias or discrimination, and help take corrective measures.

The responsibility of the board and senior management has been critical in knowing the complexity of such model risks as to framing suitable policy support. The policy should put in place suitable benchmarks and the validation report by experts should be placed before the board’s risk management committee or its designated sub-committee for necessary corrective actions.

Models of credit risk have not been able to predict and measure credit risk appropriately, particularly in times of global financial crises or any major economic failure in terms of growth or macroeconomic fundamentals changing suddenly for various reasons.

To put it in nutshell the RBI has timed the regulatory guidelines on model risks in credit risk management in view of the current global uncertaintiesto perfection.

We could expect RE taking immediate steps in line with RBI guidelines as credit risk, along with other risks, is an important element in deciding the financial resilience of banks.

(The author is former Chairman & Managing Director of Indian Overseas Bank)