Is higher base solely responsible for moderation in CPI number?

The CPI inflation moderated to a less unpleasant seven per cent in May, benefitting from a high base, from 7.8 per cent in April, while remaining firmly above the MPC’s upper tolerance level of six per cent. The moderation in May CPI inflation was led primarily by a favourable base and sequential slowdown in core inflation.

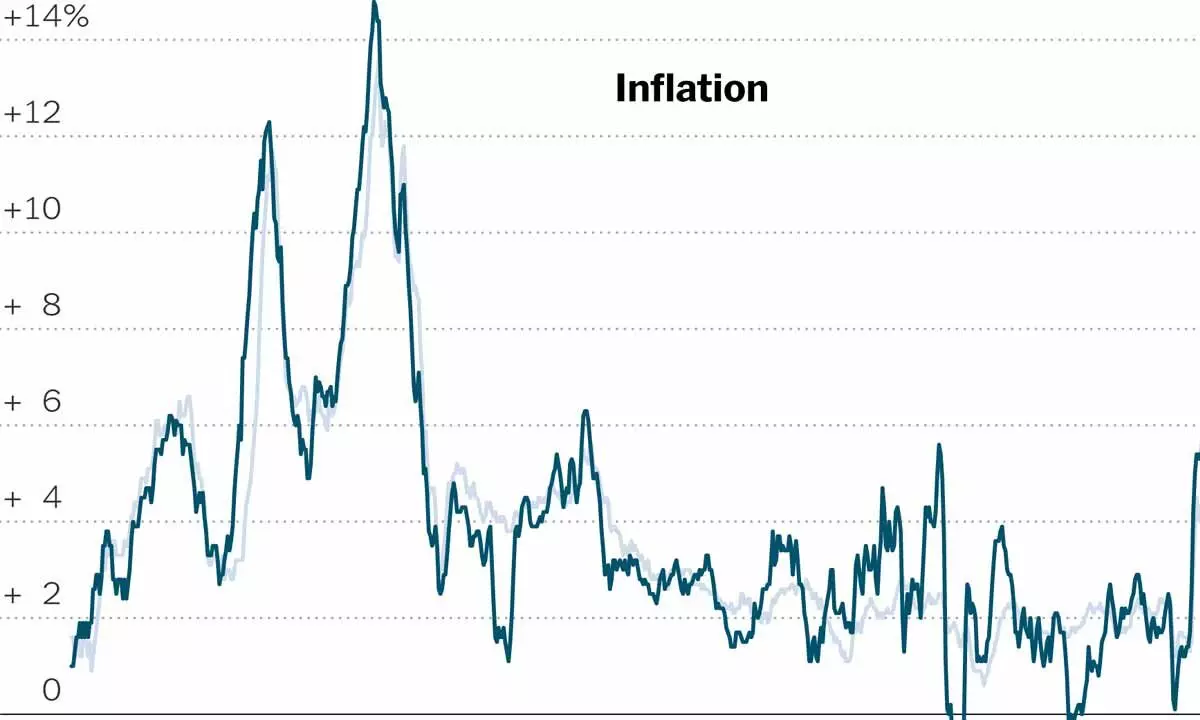

image for illustrative purpose

The CPI inflation moderated to a less unpleasant seven per cent in May, benefitting from a high base, from 7.8 per cent in April, while remaining firmly above the MPC's upper tolerance level of six per cent. The moderation in May CPI inflation was led primarily by a favourable base and sequential slowdown in core inflation.

While the mild dip in the food and beverages inflation benefitted from a high base, the cooling itself was fairly broad-based across the components. The double whammy of the rise in the crude oil price and the Rupee depreciation pose upside risks to the June CPI inflation print, even as the lower than expected momentum in the services inflation in May provides some relief.

Unless the June CPI inflation accelerates considerably from the May print, the average inflation for Q1 could undershoot the MPC's forecast of 7.5 per cent for this quarter, assuaging fears of sharp tightening in the August review.

The deceleration in rural CPI is the major reason for this slowing of inflation in May. Rural CPI decelerated to 7.01 per cent in May from 8.38 per cent in April mainly on account of health, education and personal care and effects whose combined weighted contribution declined by 35 bps and food and beverages whose weighted contribution declined by 40 bps. Urban inflation on the other hand remained sticky at 7.08 per cent. In other word, the weighted contribution of food and beverages has declined in rural areas but increased in urban areas. An uptick in economic activity in April/May is evident in high frequency leading indicators.

In fact, the RBI governor, Dr Shaktikanta Das has also endorsed it. He said on Friday last in an event that the credit offtake as per the latest available data, is as high as 12 per cent from 6 per cent in the year-ago period, which is a good sign of the nation's economic recovery. The RBI had injected Rs 12.5 lakh crore during the pandemic and half of which has already come back to the system.

Apart from other sectors, responding to the removal of restrictions, services sector retained momentum which was echoed in high frequency leading indicators recording growth in most trade and transport sectors. Contact-intensive aviation and tourism sectors recorded sequential improvement, but the recovery remains lagged and will take time to recoup.

The provisional data of ASCB for the fortnight ended 20 May indicates that, aggregate deposits grew by 9.3 per cent YoY, compared to last year growth of 9.7 per cent and bank credit grew at 12.1 per cent YoY compared last year growth of 6.0 per cent. The incremental growth in credit is Rs1.35 lakh crore, compared to last year negative growth of Rs1.18 lakh crore. Robust credit growth reported across sectors including, Industry, Services and Personal segment, which grew by 14.7 per cent YoY, as per the sectoral deployment as of April.