Climate change will have a direct bearing on the monetary policy

Regulators all over the world are faced with the inflation versus growth dilemma

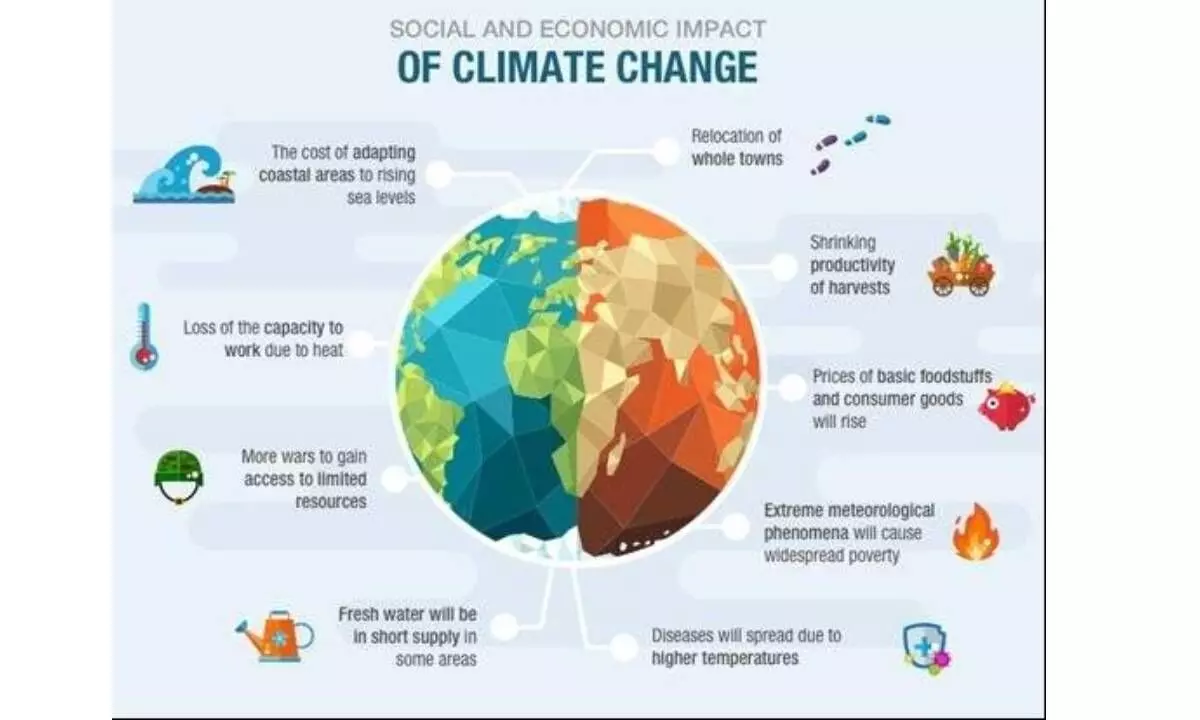

image for illustrative purpose

After the pause on hike in repo rate and the commitment to tame inflation even as hinting at increase in headline inflation in the short term due to high increase in prices of tomatoes, vegetables and food items like pulses and wheat, the situation has further complicated matters and projections. Even though the Union government is taking steps to improve the supply of essential items, there is a fear that the underlying headline inflation may remain elevated for some time thereby forcing the regulator to think of all the instruments to tame inflation.

The recent liquidity tightening measures taken by prescribing incremental CRR, though for a short period to reduce liquidity in the market, has already impacted the money market, liquidity becoming negative for some time before becoming short surplus, call money rates going beyond RBI Repo rates, forcing the banks to take certificate of deposits at high rates, and few banks borrowing from RBI windows that were provided. There is a fear that RBI, weighing on withdrawal of accommodation, may extend the incremental CRR by some more weeks.

The Union Finance Minister Nirmala Sitharaman said in the plenary session of B 20 summit that "the tendency to use interest rates as the only solution for dealing with inflation has its own downside."

Regulators all over the world are faced with the dilemma of inflation versus growth. The continued action on the part of the central bank to follow quantitative tightening as well as increase in reference rates to achieve the target set for comfortable inflation, had an immediate impact in reducing the growth rate.

Federal Reserve Chair Jerome Powel said during US Central bank's annual conference "Although inflation has moved down from its peak - a welcome development - it remains high and we are prepared to raise rates further if appropriate, and hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective."

If the Fed Reserve continues to resort to increase in interest rates to tame inflation for domestic factors, this will have a big impact on the action to be taken by the central banks of other countries, including India. This is because we are also dependent on foreign flows. We will be forced to increase Repo rates to keep up the margin between two reference rates.

Moreover, we are confronted with the domestic factors, which are affecting the supply factors. The uncertainty as to monsoon in the entire month of August, the rains were scarce, with rainfall deficiency of up to 40% and the dry weather conditions are likely to remain for some time in a few weeks of September.

The IMD has predicted that the next two weeks are crucial to determine degree of water stress. This rainfall deficit and uneven distribution, may affect the growing kharif crops. It is reported that water scarcity threatens pulse crops amid 8% drop in the area under cultivation. This may further fuel the food related inflation further up before getting into normalcy. This may require further steps from the Centre to ease the supply side bottlenecks and ensure adequate supply of wheat, pulses and other food items along with the supply of vegetables enough in the market to ease the price rise. Meanwhile, there is a demand from certain quarter from farmers that they should be given a fair price for their crops, which may get affected by the government ban on exports and allowing imports.

Globally, the Russia-Ukraine war is becoming complicated and with this geo political situation worsening, the supply of wheat and pulses are getting affected.

The recent Russian action of suspending the deal allowing Ukraine to export grains has already resulted in destabilisation of global food markets. The continuation of war in Ukraine has increased fears of global food crisis.

The impact of climate change world over, including in India has started to impact food production, large destruction to physical assets, resulting in financial risk and impacting the economic, financial and social impact. These aspects will have an impact on monetary policy as well on supply chains. These are the issues to be dealt by the all stakeholders, particularly the government, regulator and private corporate and each citizen being the responsible corporate citizen to avoid misery and hazards to the well-being of people.

In the current circumstances, the RBI will continue to watch evolving situation, take pro-active steps with different instruments, to ease inflation at an acceptable level, in the short term and medium term to bring to its committed target of four per cent. Meanwhile, the government will take positive steps for supply of food items and commodities and assist regulator in helping the inflation to moderate.

Sitharaman has suggested a five-point agenda for sustainable growth namely "central banks must keep growth priority in mind, while taming inflation, emphasis on investment for spurting growth, global focus on investment in public health & education, climate change finance and diversification of supply chains".

These are key issues confronted by both the regulator and the government world over, and we are in a better position by timely action which has kept our GDP growth drivers reasonably intact.

We hope that we will succeed in controlling inflation and achieve the GDP growth of 6.5 % as envisaged.

(The author is former Chairman & Managing Director of Indian Overseas Bank)