Nifty Expected to Attain 27,867 Level in the Next 12 Months: PL Capital Report

Charts from the PL survey

Hyderabad: PL Capital - Prabhudas Lilladher, one of the most trusted financial services organisations in India, in its latest India Strategy Report – Festive Optimism Amidst Geopolitical Uncertainty stated that Nifty is currently trading at 19.4x, 1-year forward EPS, representing a 1.6 per cent premium over its 15-year average PE of 19.1x. In the Base Case, PL Capital values Nifty at its 15-year average PE of 19.1x, using a Sept 2026 EPS estimate of 1459, resulting in a 12-month target of 27,867 (previously 26,820). In the Bull Case, PL Capital applies a 5 per cent premium to the 15-year average PE, valuing Nifty at 20x, leading to a bull case target of 29,260 (previously 28,564). In the Bear Case, Nifty could trade at a 10 per cent discount to its long-term average, with a target of 25,080 (previously 24,407).

Capital Goods, Infrastructure, Ports, EMS, Hospitals, Tourism, New Energy, E-commerce, and Telecom are emerging sectors to watch out, provided they are available at the right valuations. PL Capital believes that the market and street estimates are already priced in a strong demand rebound during the upcoming festival and wedding seasons and any disappointment in demand during this period could lead to further downward revisions in EPS estimates.

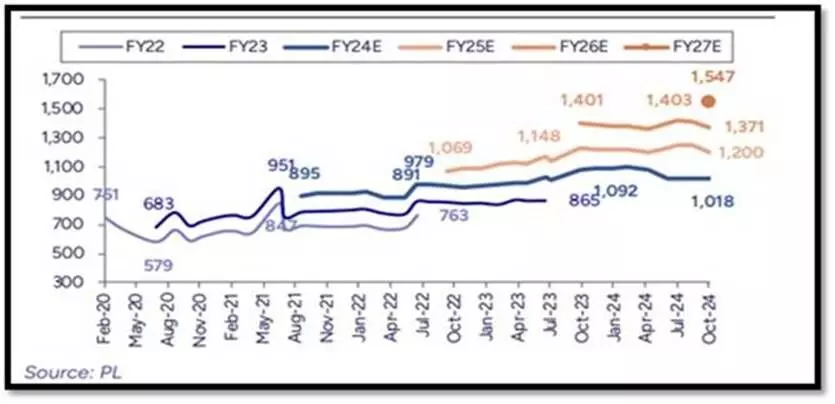

Nifty EEPS has been revised down by 3.8 per cent and 2.8 per cent for FY25 and FY26, respectively, while the company introduces FY27 EPS projections. PL Capital anticipates an EPS CAGR of 15 per cent over FY24-27, with expected EPS values of Rs1,200, Rs1,371, and Rs1,546 for FY25, FY26, and FY27.

Strong EBIDTA growth is expected to continue in the Hospitals, Pharma, Capital Goods, and Chemicals sectors, with Auto, Banks, and Durables also likely to post double-digit growth. Rural demand for staples is showing signs of recovery, though Q2 results may reflect some impact from prolonged rains. Discretionary spending remains positive in areas like travel, housing, jewellery, and two-wheelers, while passenger vehicles (PV), quick-service restaurants (QSR), apparel, footwear, and building materials are still facing challenges. Sectors such as Auto, Capital Goods, Pharma, and Hospitals are likely to report robust margin expansion, whereas Building Materials, Consumers, Media, Oil & Gas, and Cement are expected to see a decline in margins.

Infrastructure spending and project ordering have picked up, but FY25 is likely to be volatile due to upcoming elections in Maharashtra, Jharkhand, and Delhi.

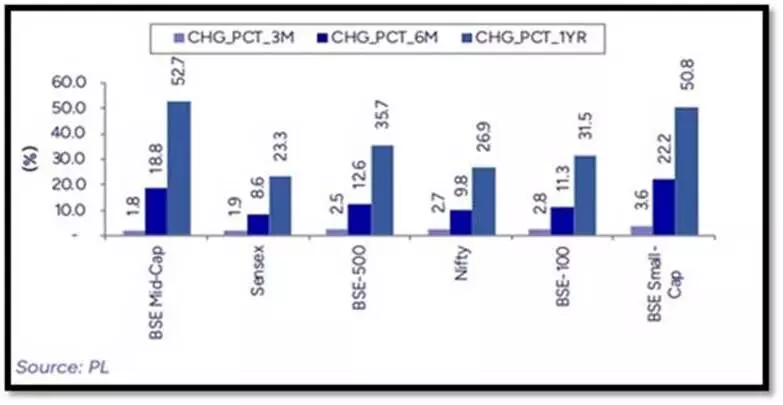

The market has shifted in favour of defensive sectors as the valuations in many cyclicals have become quite expensive, even after accounting for sustained growth. With expectations of higher growth and lower risk, sectors like FMCG, IT Services, Pharma, and Consumer Durables have experienced a strong rebound. The return variation between large-cap and mid-cap indices has narrowed significantly over the past three months. The difference in returns between large cap and small cap indices is now less than 1 per cent for the three-month period, though the gap remains substantial over the six- and twelve-month periods. FII inflows have risen by Rs335 billion over the past six weeks, despite recent bouts of strong selling. DII inflows remain robust, totalling Rs891 billion.

Conviction Picks Changes

High Conviction Picks: PL capital is removing Siemens, Praj Ind, Apar and Lupin Labs after recent rally in stock prices, although the company is positive on these names from medium to long term. The company is also adding Bharat Electronics, Crompton Consumer, Cyient, JB Chemicals, Jindal Stainless and Safari in conviction picks.