RINL's Rs 4,000-cr Boost Plan: Railways and NMDC Deals

Discover RINL's strategic asset sales targeting a Rs 4,000-cr boost by March 2024, including the railways acquiring a forged wheel plant.

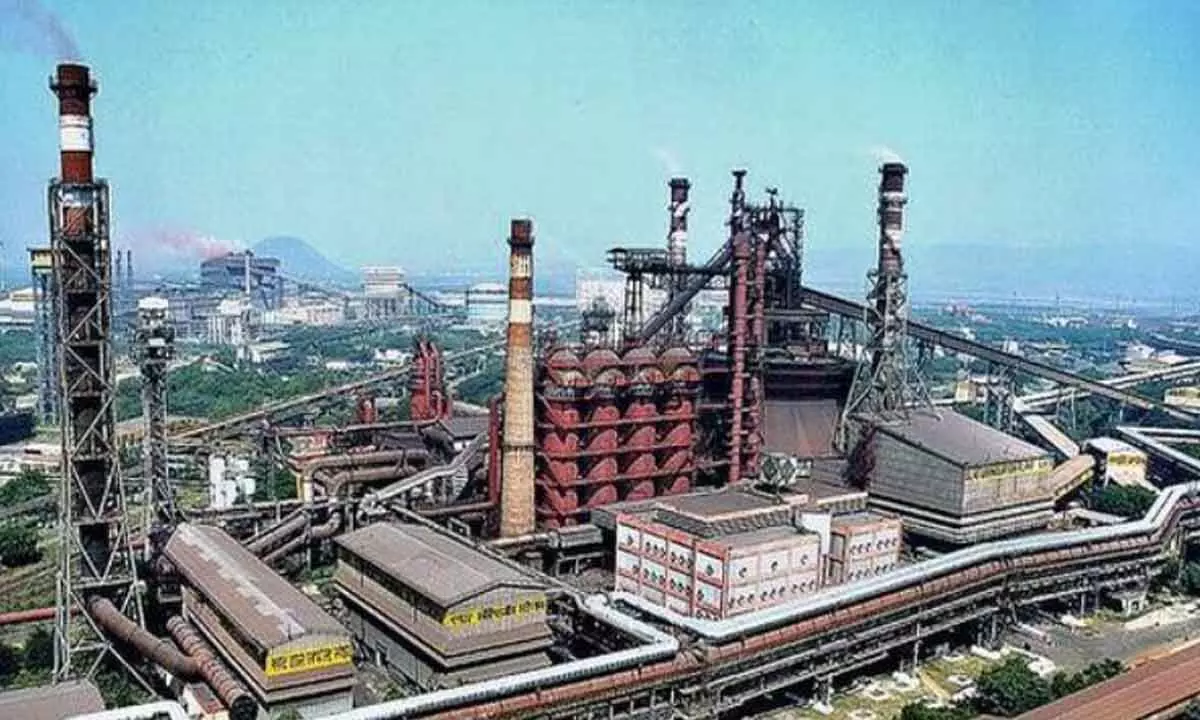

image for illustrative purpose

Strategic Asset Sales: Cornerstone of RINL's Turnaround Strategy

RINL hopes Rs 3,000-4,000 cr from asset sales will aid its turnaround by reducing debt

The Railways is set to buy RINL’s forged wheel plant in Rae Bareli for Rs 2,250 cr

RINL expects Rs 1,600-2,100 cr from selling 22 acres in Vizag and 2 acres near Autonagar

A 33-year lease of 1,150 acres to NMDC will bring RINL Rs 1,500 cr upfront plus lease rent

Visakhapatnam: Good days seem to be beckoning Rashtriya Ispat Nigam Limited (RINL), the corporate entity of Visakhapatnam Steel Plant if one goes by the calculations by the management and the trade unions.

Asset Monetization Strategy: RINL's Key to Financial Health

There is high expectation that by the end of the 2023-24 financial year, the public sector enterprise under the Ministry of Steel can mobilise at least Rs 4,000 crore, which it needs desperately to reduce its loan burden and to tide over working capital crunch through asset monetisation.

Railways and NMDC Deals: Revenue Projections for RINL

Already, the Railways has decided in-principle to buy the forged wheel plant set up by RINL at Rae Bareli in Uttar Pradesh. The sell-out of the plant is expected to fetch Rs 2250 crore. Similarly, the sale of 22 acres owned by RINL at HB Colony and two acres near Autonagar in the city are expected to fill its coffers by an estimated Rs 1600 crore to Rs 2100 crore.

NMDC Lease Agreement: Boosting RINL's Financial Position

The 33-year lease of 1150 acres located between Visakhapatnam Steel Plant and Adani Gangavaram Port Limited to mining major NMDC is expected to provide RINL a non-refundable amount of Rs 1500 crore plus lease rental.

Working Towards Financial Goals: RINL's March 2024 Target

“Our ultimate target is to mop up at least Rs 4,000 crore by March 31, 2024 to overcome the working capital crisis,” honorary president of CITU-affiliated Steel Plant Employees’ Union (SPEU) J Ayodharam told Bizz Buzz.

He said even as the decision to privatise RINL, its subsidiaries and joint ventures on January 27, 2021 completed its third anniversary recently, they hope that in view of impending elections, the Central Government will see reason and withdraw disinvestment process. The government already announced the rescinding of its decision to privatise Nagarnar Steel Plant in Chattisgarh, a greenfield 3 million tonnes integrated plant set up by NMDC in Chhattisgarh, as a prelude to elections for Assembly in that State.

Disinvestment Plans: Cabinet Approval and EoI Process

Though the Cabinet Committee on Economic Affairs cleared the proposal for disinvestment of RINL, the Department of Investment and Public Asset Management (DIPAM) is yet to seek bids for EoI to acquire RINL.

RINL Chairman-cum-Managing Director Atul Bhatt was quoted as saying sometimes ago in Kolkata that if they could mobilise Rs 3,000 crore to Rs 4,000 crore through asset monetisation like sale of forged wheel plant in UP and land parcel in Visakhapatnam, it would certainly help them to turn around by reducing debt. Weathering the challenges, the company has chalked out a ‘robust and multi-thronged’ approach for making turnaround of the plant, he stated in his Republic Day address.

RINL has at present an annual production capacity of 7.3 million tonnes. The capacity was enhanced from three million tonnes with a total investment of around Rs 16,300 crore.

Strategic Partnership with JSPL and Positive Production Outlook

The management said their MoU with Jindal Steel and Power Limited (JSPL) to resume production at Blast Furnace-3 (Annapurna) from last year-end would help increase hot metal production by about two million tonnes per annum resulting in a sales turnover of Rs 500 crore per month.

Railway Board's Approval and NMDC's Contribution to RINL's Financial Goals

Welcoming the turnaround strategy, INTUC State vice-president and Visakha Steel Employees’ Congress president Neerukonda Ramachandra Rao told Bizz Buzz that the Railway Board has cleared the purchase deal for forged wheel plants to meet its requirement. He disclosed that 90 RINL employees including 40 executives, who are stationed at Rae Bareli, have been given an option to work on deputation for five years by the Railways. He said NMDC has also agreed to pay a non-refundable deposit of Rs 1500 crore and lease rental to be fixed mutually to set up a pellets plant and a stackyard.

He said RINL and National Land Monetisation Corporation Ltd (NLMC) have already signed MoU with NBCC (India) for monetisation of non-core assets. NBCC will act as technical-cum-transaction advisor and assist the Ministry of Steel.