CII Vijayawada Hails Budget

CII Vijayawada Hails Budget

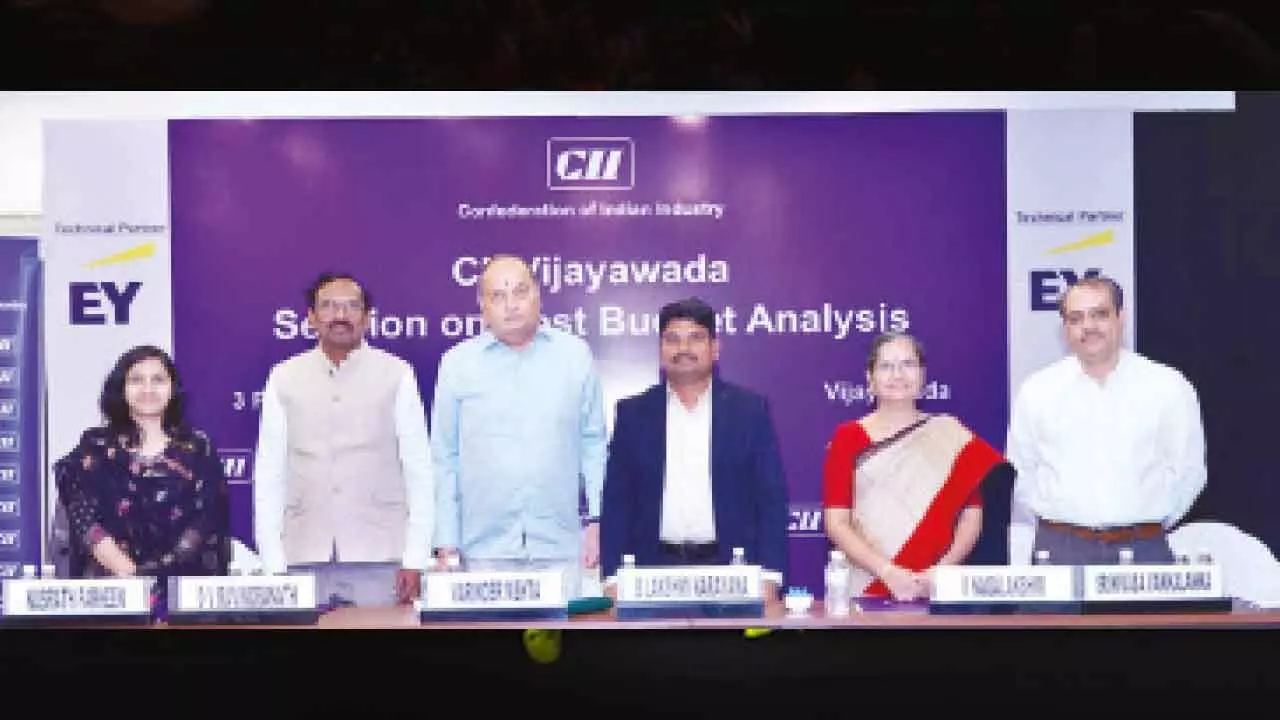

Vijayawada: Speakers at a discussion organised by the CII Vijayawada Zone on post-budget analysis, said that the carefully-drafted allocations will stimulate growth benefiting the middle class a lot by substantially increasing the exemption for levying income tax up to Rs12 lakh. Speaking on the occasion, Nusrath Farheen, Director, EY and Srinivasa V, Director, EY made a detailed presentation on direct and indirect taxes and the implications of the Union Budget 2025 on industry across all sectors. CII Vijayawada zone chairman DV Ravindranath welcomed the budget.

In his address, he stated the recent budget announcement marks a critical juncture in our journey, aiming to stimulate growth, foster innovation, and ensure sustainability. He opined, the budget is designed to address immediate needs while laying a robust foundation for long-term development. Income Tax Chief Commissioner Varindar Mehta in his address, stated the whole focus of the budget is towards simplification and rationalisation and to reduce litigation. He stated the budget is focused on benefitting the middle class.

CGST Additional Commissioner B. Lakshmi Narayana stated that GST growth rate of Guntur CGST Commissionerate is around 3.45 %, whereas the national average growth rate is 11.49 %. There are approximately 9,000-12,000 tax-payers every month figuring, who are either not filing returns or delaying returns (GSTR 3B) beyond due dates. He observed that many taxpayers are discharging entire liability in ITC, which may be resulting contravention of Rule 86B or discharging liabilities in cash very minimal.

Over 60 participants from across sectors participated in the session. Industry members actively participated and sought clarification and exchanged views on various aspects of the Union Budget.