Rising dollar demand weighs on Rupee

image for illustrative purpose

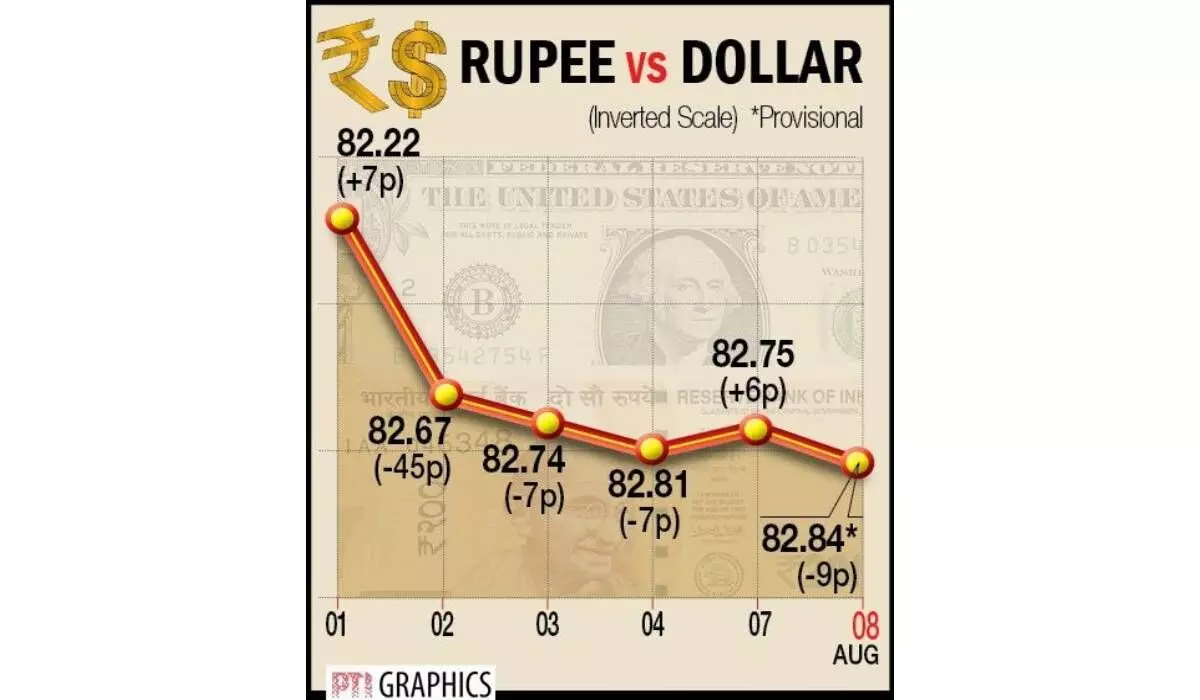

Mumbai: The rupee depreciated 9 paise to settle at 82.84 against the US dollar on Tuesday weighed down by safe-haven dollar demand and a muted trend in domestic equities.

Foreign fund outflows also weighed on the local unit, analysts said. At the interbank foreign exchange, the domestic unit opened at 82.80 against the dollar and finally ended the day at 82.84, registering a fall of 9 paise from its previous close. During the session, the local unit touched a peak of 82.78 and hit the lowest level of 82.85. On Monday, the rupee had settled at 82.75 against the dollar. The Indian rupee depreciated on Tuesday on a positive dollar and a weak tone in domestic markets. FII outflows also weighed on rupee. However, weak crude oil prices cushioned the downside, said Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas.

The US dollar gained on safe-haven demand on risk aversion in global markets and hawkish Fed speak. US Federal Reserve official Michele Bowman said additional rate hikes will likely be needed to bring inflation to its target of 2 per cent, Choudhary added. “We expect the rupee to trade with a negative bias on strong US dollars and risk aversion in global markets. Selling pressure by foreign investors may also weigh on the rupee,” Choudhary said. Traders may remain cautious ahead of RBI’s monetary policy and US inflation data Thursday. RBI is expected to keep its monetary policy unchanged. Traders may also watch out for US trade balance data. “We expect the USDINR spot to trade in the range of 82.40 to 83.30 in the near-term,” Choudhary added.