FIIs pullback put downside pressure on Re

The local unit falls 32 paise to close at 82.24/USD

image for illustrative purpose

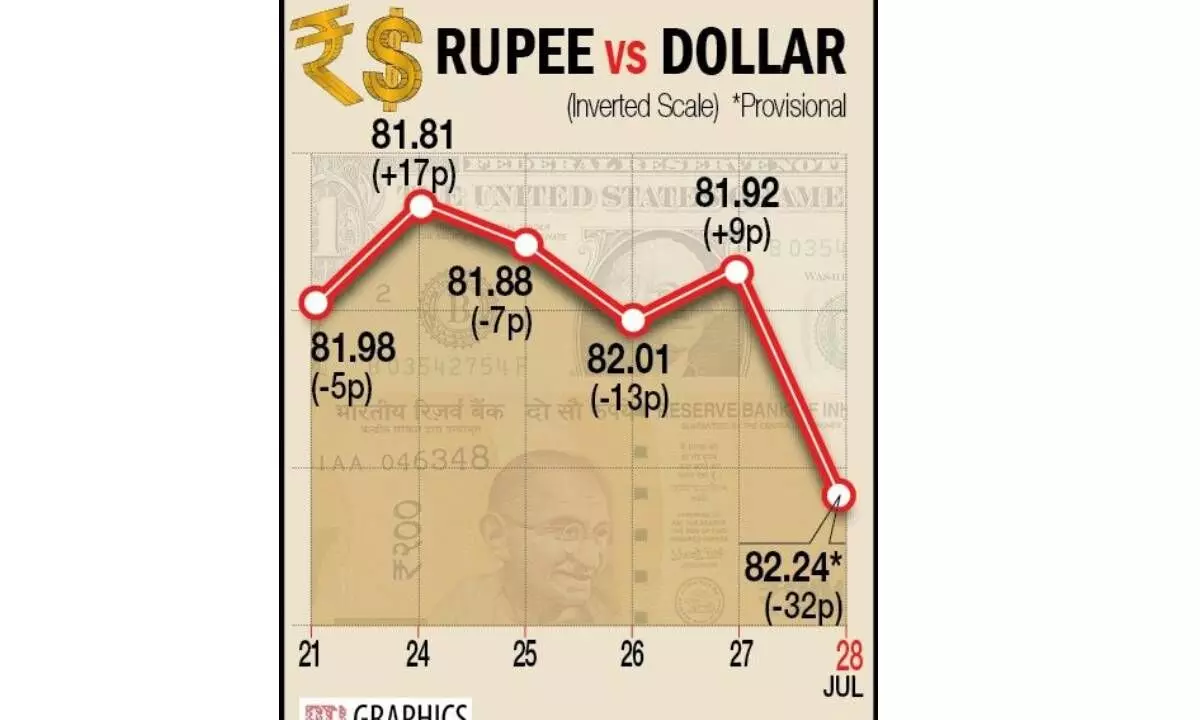

Mumbai: The rupee plunged 32 paise to close at 82.24 against the US dollar on Friday amid renewed foreign fund outflows and negative trends in domestic equity markets.

An elevated level of crude prices nearing $84 a barrel also weighed on the domestic unit even as the American currency gained strength on the back of better-than-expected macroeconomic data from the US, forex traders said. The dovish tone from European Central Bank (ECB), which raised interest rates on Thursday, also boosted the US dollar. At the interbank foreign exchange market, the local unit opened weak at 82.30 against the US dollar. During intra-day, the domestic currency touched the peak of 82.19 and hit the lowest level of 82.34. The rupee finally settled at 82.24, 32 paise lower from the previous close of 81.92 on Thursday.

“Indian rupee fell on Friday on the strong US dollar and weak domestic markets. The surge in crude oil prices further pressurized the domestic unit. The US dollar gained on strong economic data from the US... This provided more room for US Federal Reserve to hike interest rates further. The dovish tone from ECB also strengthened the dollar,” said Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas.