With Nifty volatile, better to avoid positional trades

Strength in market trend is not enough to push the price to new highs

image for illustrative purpose

DURING the last five days, wild moves have triggered multiple positional stop losses on both sides as the Nifty opened with up-down gaps. The weekly series opened with an opening down and registered 'Black Friday' of 526 points loss. The Nifty futures closed with 17 points loss since the last expiry. It oscillated in 796 points range. On Friday, it opened with 209 point gap and lost by 522 points. The next three days gap openings and filled the Friday gap. But, on Thursday again, with 219 points gap down opening hurt the long positions badly. This means two days' of huge gap downs and three days of gap up opening created jitters among the positional traders. Technically, from weekly expiry to expiry (Thursday close to Thursday close), it has changed little; in fact, it formed a Doji as it lost just 17 points.

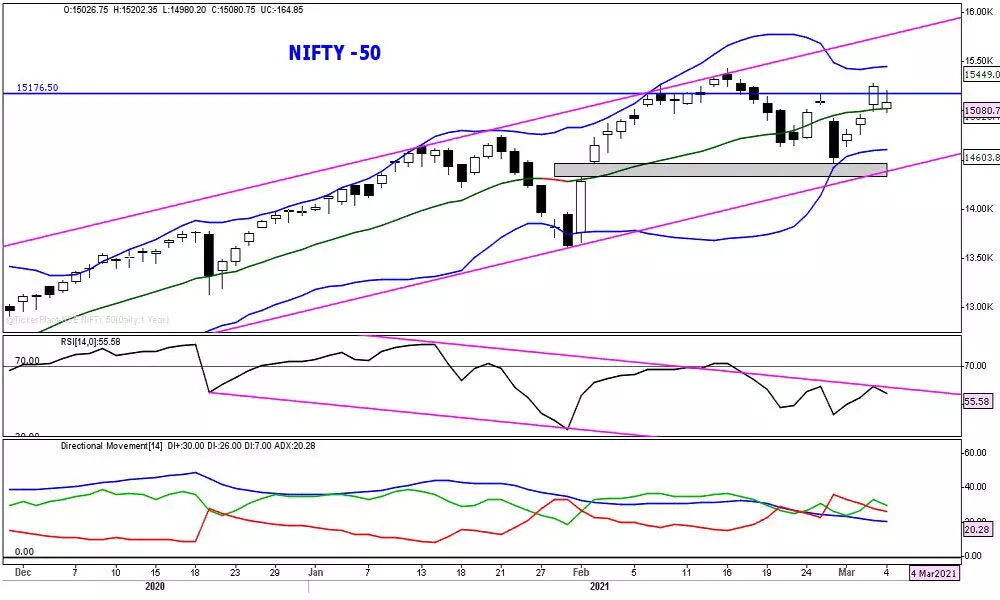

The Nifty actually failed to close above the last Thursday's high, for the second consecutive day, which can be considered as a failed breakout. Last Thursday high was also a minor swing high. To resume the uptrend, it must close above the 15,176-15,273 zone of resistance. The prior closing is at 15,340. On the downside, a close below the prior day low is important to the bears to dominate the market.

Interestingly, the Nifty went up by 5.5 per cent from last Friday low to Wednesday high, but the ADX is below the +DMI and -DMI and is continuously declining. MACD histogram failed to enter the positive territory.

This structure shows that the strength in trend is not enough to push the price to new highs. Keep an eye on RSI 60 level. If the RSI moves above 60 on a daily closing basis, The Nifty will turn positive. It faced resistance at 60 on Wednesday. The Nifty formed a long upper shadow small body candle, resembles a bearish shooting star. In case it closes above 15,176 on Friday, the previous week's bearish engulfing implications will be still valid for next week too. As the market has turned volatile, it is better to avoid aggressive positional trades.

(The author is a financial journalist, technical analyst, trainer, family fund manager)