Volatile trading for gold, silver likely this month

After gaining over 8% on MCX, gold futures rose 1.4% in April so far and may continue to move in broad-range trading

image for illustrative purpose

Hyderabad: Precious metals- gold and silver- may continue to trade with high volatility this month owing to mostly global headwinds. However, rising demand for yellow metal due to Akshaya Tritiya and wedding demand is strong in the domestic market.

In April, Gold may trade in a range of Rs53,000-61,000 per 10 grams and silver may also witness huge volatility and trade in the range of Rs63,000-74,000/kg levels. On Comex, gold may trade in a range of $1935-$2015 and silver may trade in the range of $22.90-$25.00.

Gold futures (10gm) on MCX were trading at Rs60,447 (April 20) as against 59,612 on March 31. Silver prices performed better than gold with an almost 15 per cent gain in Comex and 13 per cent gain in MCX due to twin support of the rise in gold and base metals. Silver futures on MCX traded five per cent higher at Rs75,830 on Thursday (April 20) when compared with Rs72,218 on March 31.

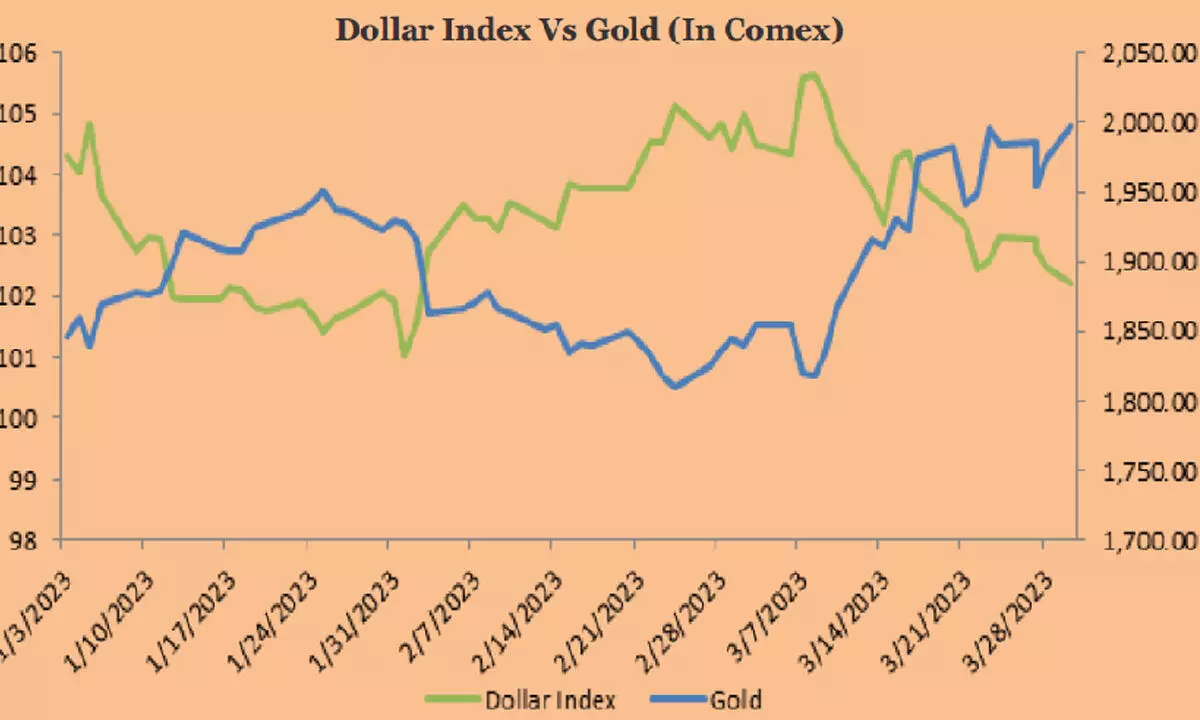

“In March, gold prices registered more than eight per cent gain on Comex after its biggest monthly decline in February since June 2021. The gold prices also posted a second straight quarterly rise, the best quarterly result since Q2 2020, as growing bets that the US Federal Reserve will slow the pace of interest rate hikes drew investors to the metal,” Ravinder Kumar, research associate (commodities technical) at SMC Global Securities Ltd, told Bizz Buzz.

Gold gained $150 in March, its best month since July 2020. The recent global banking turmoil drove bets that the Fed would tone down its rate hike approach. The Fed indicated it was on the verge of pausing further increases in borrowing costs, boosting non-yielding gold’s appeal. On the physical front, China’s February net gold imports via Hong Kong nearly tripled from the previous month, according to the latest report from SMC Global Securities.

Recent banking sector stress and the possibility of a follow-on credit crunch bring the US closer to recession. However, US Federal Reserve officials said there was no indication financial stress was worsening.

“A somewhat firmer dollar and a rebound in equity markets and risk appetite may probably drive gold lower, but bullion is likely to get continued support from big macro developments. The US central bank last month raised rates by an expected 25 basis points, but its policy statement no longer said ongoing increases would likely be appropriate, indicating a clear shift in its stance,” adds Kumar.

According to the CME FedWatch Tool, there is a 48.4 per cent chance of a 25bps rate hike in May. It is unclear whether the volatility in the banking sector is over. Barclays warned that the banking crisis is likely far from over, as a second wave of deposit outflows is coming.

The economic conditions will only get worse as it takes up to 12 months before consumers start to feel the effects of the Federal Reserve's monetary policy tightening. While interest rates, at five per cent, are still relatively low compared to historic levels, the rate of change has been unprecedented.

In the meantime, the gold-backed ETF trends are reversing after significant outflows last year. In the past two weeks, ETF net buying was at 36 tonne.