Vedanta chief forecasts $9-bn profit on $30-bn revenue in 2024

Says questions over Vedanta’s debt servicing ability are ‘absolutely irrelevant’ as the group will to become a ‘net zero debt company’ in 2-3 years

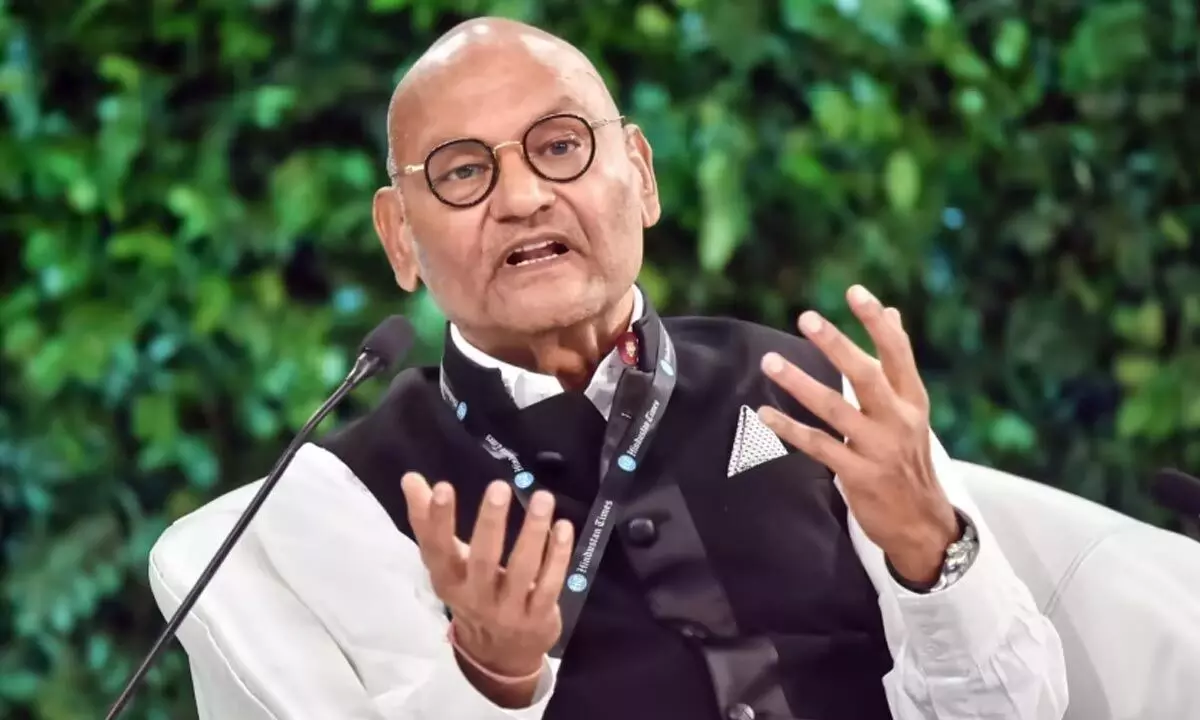

image for illustrative purpose

New Delhi: Mining mogul Anil Agarwal has said his Vedanta group has ample cash flow to service all its debt repayment obligations and that it aims to become a ‘net zero debt company’ in 2-3 years.

Agarwal said questions over Vedanta's debt servicing ability are "absolutely irrelevant" as the group will make $9 billion of profits next year on revenue of $30 billion, which would be sufficient to meet all obligations. The comments by the former scrap metal trader turned industrialist come at a time when scrutiny of highly leveraged Indian conglomerates grows following a US short seller attack on the Adani group.

"We have the lowest debt in the world for a group of our size," Agarwal, founder, and chairman of Vedanta Resources, told PTI in an interview here. And the debt is a result of investing billions of dollars across businesses, he said. "Total debt in the company is $13 billion. And we have a profit this year of $7 billion. Next year our revenue would be $30 billion and we will have $9 billion profit" across the group. The cash flows are more than sufficient to meet debt servicing obligations.

"We are very comfortable," he said. "We have never defaulted to make any payment. We always have a plan to make the payments." Earlier this week, Vedanta Resources Ltd, the parent company of Mumbai-listed mining giant Vedanta Ltd, said it has paid all its maturing loans and bonds due in this month to reduce its gross debt by a further $1 billion. Vedanta has now reduced debt by a total of $3 billion since it announced in February 2022 its intention to accelerate deleveraging. It had announced plans to reduce debt by $4 billion within 3 years, of which it has achieved 75 per cent of the committed reduction in 14 months.

Agarwal said it is "absolutely irrelevant" to talk about the debt payment capability of the group. The group, whose business spans from zinc to silver, iron ore to aluminum and oil and gas, borrows the bare minimum, and "we have enough cash flow to service that debt," he said. He went on to state that the group would be a net zero debt company in 2-3 years' time. "At the moment the plan is that in 2-3 years we will be a net zero debt company," he said hastening to add that the group may have to borrow in pursuit of its aggressive expansion plans.

Diversified natural resources conglomerate plans building capacities in zinc, oil and gas, and aluminum businesses as it believes supply will remain a challenge in the commodities' space in the medium term.

We have the lowest debt in the world for a group of our size. Total debt in the company is $13 bn. And we have a profit this year of $7 bn

- Anil Agarwal, Chairman, Vedanta Group