'These are extraordinary times': FM Sitharaman on windfall tax on oil producers, fuel exports

Finance Minister Nirmala Sitharaman has defended the government's move to impose a windfall tax on oil producers and levy a special additional cess on the export of fuel products, saying the current situation is "extraordinary".

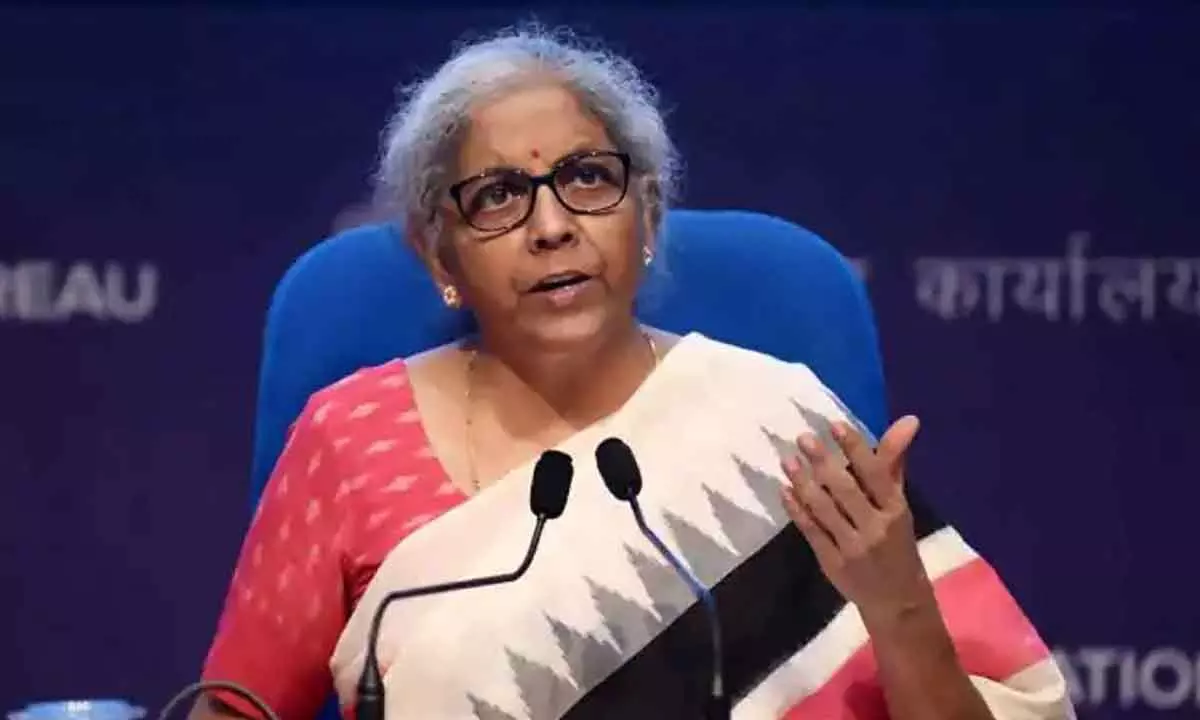

image for illustrative purpose

Finance Minister Nirmala Sitharaman has defended the government's move to impose a windfall tax on oil producers and levy a special additional cess on the export of fuel products, saying the current situation is "extraordinary".

"We are happy that exports are happening. We are happy that companies are making profits. We are happy that exports are giving them (companies) that kind of returns on what they invested, which is so required for anybody who makes those investments. But these are extraordinary times," Sitharaman said in the Capital on July 1 on the sidelines of an event marking the fifth anniversary of the implementation of the Goods and Services Tax (GST) regime.

"These are times when oil prices internationally are unbridled. They are just going on and on upwards. And for any country - like India for instance - which depends very much largely on imports, we also need to pay that kind of money to get it," the finance minister added.

Earlier today on July 1, the government announced it was imposing a cess of Rs 23,250 per tonne as special additional excise duty on crude as domestic crude producers are making "windfall gains" amid sharply higher crude oil prices. Further, cesses amounting to Rs 6 per litre on petrol and Rs 13 per litre on diesel have been imposed on their export, while a special additional excise duty of Rs 6 per litre has been imposed on the export of Aviation Turbine Fuel.

Shares of oil companies like Oil and Natural Gas Corporation and Oil India sank after the government measures were announced.

According to Sitharaman, while the government does not grudge companies making profits, it was happening at a time when the supply of fuel was being affected and measures were required to tackle the situation.

"India is now becoming a refining hub. We want that to continue... But, you have also seen, and you have reported in the media, that some of the private pump outlets which deal with consumers - some of them wholesale consumers - are now not supplying for domestic consumption. So the wholesale customers, who were benefitting from those pumps, are now coming over to public sector oil marketing companies' pumps. And they are welcome to come and take. But the supplies are also going to have to be available," Sitharaman argued.

"For India, we buy it (oil) from different places, trying to see where we can get it in a cost-effective way. We are also making sure the excise duty is cut down so that the burden on the citizen is not there. But with all this being done, if oil is not being available and they are being exported at such phenomenal profits... Good for those earning profits, but these are extraordinary times! We need some of it (oil) at least for our own citizens," the finance minister added.

"It (today's measures) is not to discourage exports. It is not to discourage India as a refining hub. It certainly is not against profit earning. But extraordinary times do require some such steps."

When asked about the revenue impact of the measures announced today, Sitharaman said she didn't want to hazard a guess.

"We have done some calculations but I am not saying that now," she said.

The finance minister, as well as Revenue Secretary Tarun Bajaj, said that prices and the conditions would be reviewed every 15 days and the situation will be assessed "to see how things are working out".