Surging forex kitty supports local unit

Rupee gains 15 paise to 81.83/USD

image for illustrative purpose

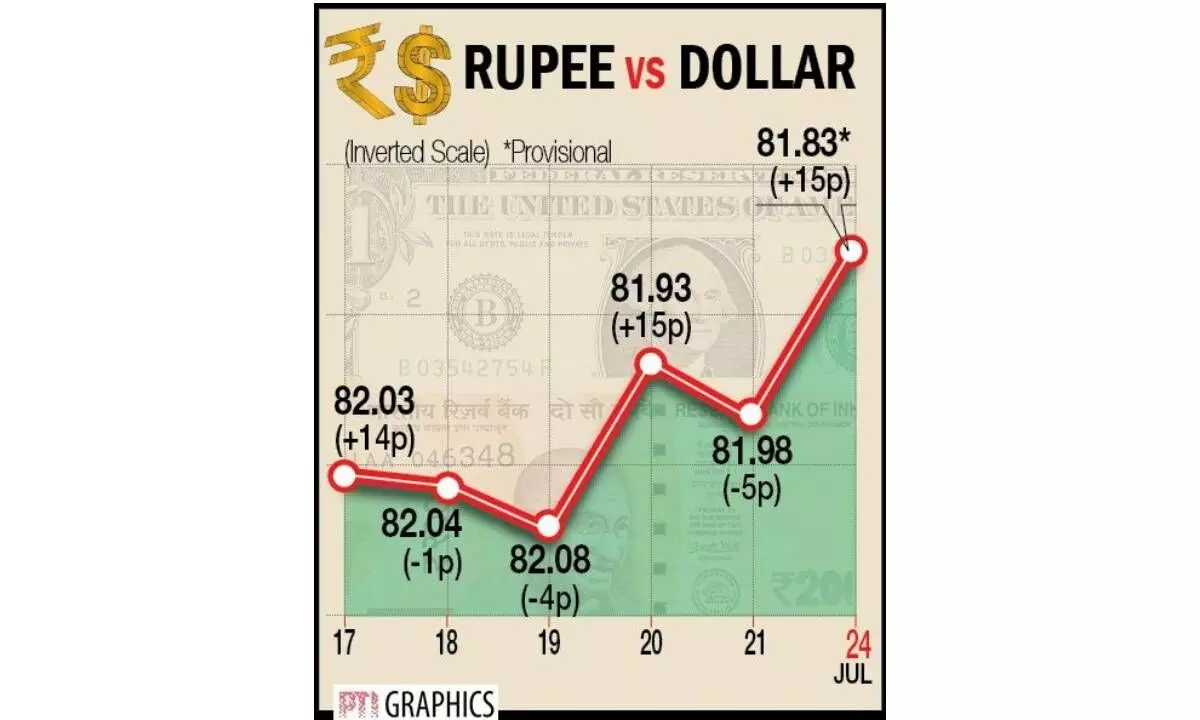

New Delhi: The rupee gained 15 paise to close at 81.83 against the US dollar on Monday, as a sharp jump in India’s forex reserves boosted investor sentiments.

At the interbank foreign exchange market, the local unit opened at 82 against the US dollar and moved in a range of 81.82 to 82.04 in day trade. The rupee closed 15 paise higher at 81.83 against the previous close of 81.98 on Friday. The Indian rupee gained on softening crude oil prices and a sharp jump in India’s forex reserves, said Anuj Choudhary - Research Analyst at Sharekhan by BNP Paribas. India’s forex reserves swelled by $12.743 billion to $609.022 billion in the week ended July 14, the Reserve Bank of India said on Friday. The overall reserves had dropped by $2.901 billion to $593.198 billion in the previous reporting week. In October 2021, the country’s forex reserve had reached an all-time high of $645 billion. The reserves have been declining as the central bank deploys the kitty to defend the rupee amid pressures caused majorly by global developments. However, a weak tone in the domestic markets and a strong US Dollar capped sharp gains. The US Dollar gained amid disappointing PMI data from Europe and the UK which showed activity contracting deeper, Choudhary said.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, rose 0.19 per cent to 101.26. Brent crude futures, the global oil benchmark, advanced 0.74 per cent to $81.67 per barrel. “We expect the rupee to trade with a slight negative bias on deteriorating global risk sentiments which may support the safe-haven US Dollar and put pressure on riskier currencies,” Choudhary said.