Explained: How Did DeepSeek’s New AI Model Wiped Out $593 billion From Nvidia?

The introduction of DeepSeek AI’s low-cost artificial intelligence platform has caused shockwaves across the United States tech stocks and equity markets worldwide. Nvidia tanked almost 17%, losing $593 billion overnight.

Explained: How Did DeepSeek’s New AI Model Wiped Out $593 billion From Nvidia?

The introduction of DeepSeek AI’s low-cost artificial intelligence platform has caused shockwaves across the United States tech stocks and equity markets worldwide. Nvidia tanked almost 17%, losing $593 billion overnight.

The disruption hit Nvidia the hardest, while also having damning consequences on US stock market indices including S&P500 and Nasdaq. Fears over a new AI platform, built at just a fraction of a cost, compared to tech heavyweights, caused jitters across the equity markets.

Here’s a look at how Nvidia lost $593 billion in a single day.

What is DeepSeek AI?

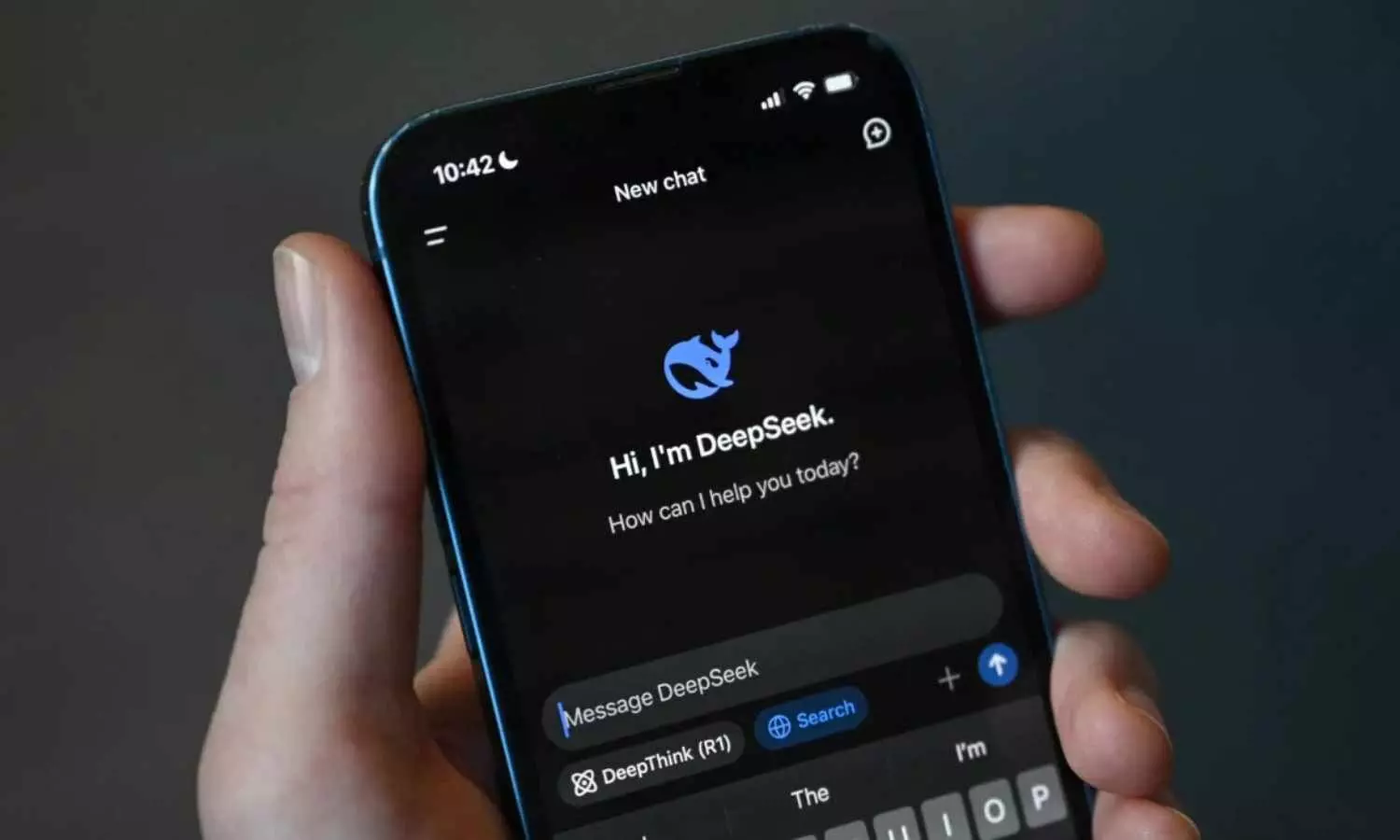

A Chinese startup named DeepSeek unveiled an AI assistant claiming that it uses less data, and that too at just a fraction of a cost, compared to other alternatives including OpenAI's ChatGPT, Google's Gemini among others.

DeepSeek AI outpaced ChatGPT in terms of number of downloads from the US iOS Apple's app store. Interestingly, DeepSeek has beaten ChatGPT on Apple stores spanning across UK, Australia, Canada, China and Singapore.

DeepSeek's models include DeepSeek-V3 and DeepSeek-R1. However, little is known about Hangzhou, the startup behind DeepSeek, majorly owned by Liang Wenfeng who is the co-founder of quantitative hedge fund High-Flyer, a report said.

As per DeepSeek’s official post on WeChat, the company launched its V-3 model on January 10, which used Nvidia's lower-capability H800 chips for training. Surprisingly, it spent less than $6 million. Moreover, Deepseek’s R1 is 20 to 50 times cheaper than OpenAI's o1 model.

How did the stocks react?

While Nvidia fell by 17% overnight, Broadcom Inc and Microsoft were down by 17.4% and 2.1% respectively. Meanwhile Google’s parent Alphabet was down by 4.2%, Reuters reported.

Downturns were also witnessed in the Philadelphia semiconductor index, which fell by 9.2% respectively, while Nasdaq’s Marvell Technology was down 19.1%.

Shares of Vertiv Holdings, Vistra, Constellation were down by 29.9%, 28.3% and 20.8% respectively.

What did the experts say?

If DeepSeek’s claims are true, it “is the proverbial ‘better mousetrap’, that could disrupt the entire AI narrative that has helped drive the markets over the last two years”. Adding: “It could mean less demand for chips, less need for a massive build-out of power production to fuel the models, and less need for large-scale data centers”, said Brian Jacobsen, chief economist at Annex Wealth Management in Menomonee Falls.

On these recent developments, Donald Trump stated on January 27 that DeepSeek should be a “wakeup call” and could lead to a positive development.

Where did the investors divert their money?

Most outflows from tech stocks were diverted towards safe-haven government bonds and currencies.

A trading executive told Reuters, “The increased volatility in tech stocks will prompt banks to adjust their risk management, potentially holding fewer shares or managing positions more carefully as clients unwind their holdings.”