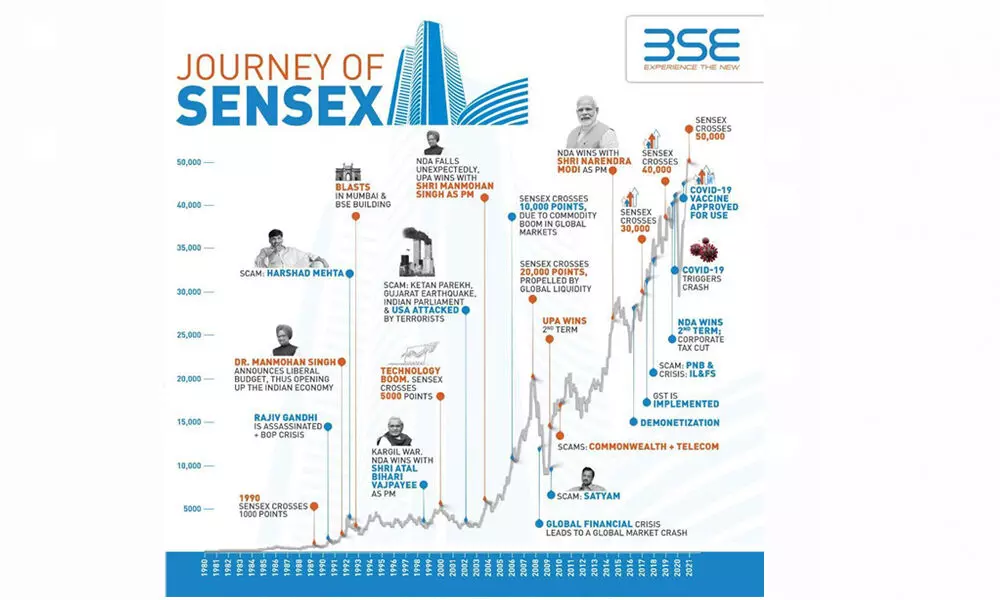

Sensex's journey from 5k to 50k in 22 years

The Sensex hit 5,000 in 1999, took eight years to climb to 20,000 and 12 years after that to hit the 40,000-mark on May 23, 2019, in intraday trade. This time, it has taken the index less than two years to gallop another 10,000 points to hit the 50,000-mark.

image for illustrative purpose

The Sensex hit 5,000 in 1999, took eight years to climb to 20,000 and 12 years after that to hit the 40,000-mark on May 23, 2019, in intraday trade. This time, it has taken the index less than two years to gallop another 10,000 points to hit the 50,000-mark.

Equity barometer the Sensex jumped more than 300 points on January 21 to surpass 50,000-mark for the first time on January 21.

A steep rise in the market in the last two years has made many stocks multibagger and data shows that as many as 58 stocks from the BSE 500 stocks rose more than 100 percent during Sensex's journey from 40,000 to 50,000 mark.

The Sensex hit 5,000 in 1999, took eight years to climb to 20,000 and 12 years after that to hit the 40,000-mark on May 23, 2019, in intraday trade. This time, it has taken the index less than two years to gallop another 10,000 points to hit the 50,000-mark.

In this less than two years' period, 58 stocks from the BSE 500 index have jumped over 100 percent, 17 have jumped over 200 percent and 5 stocks - Adani Green Energy, Tanla Platforms, Dixon Technologies, Alkyl Amines Chemicals and Alok Industries - have jumped over 400 percent, data available with Moneycontrol showed.

With a gain of more than 2,200 percent, shares of Adani Green Energy emerged at the top in the BSE 500 index, followed by shares of Tanla Platforms that rose nearly 1,600 percent since May 23, 2019.

Equity benchmark smashed all records to zoom past the 50,000-mark on the morning of January 21, but the day also recorded another high for the 30-pack index—the total number of investors registered with BSE crossed the 6-crore mark.

Data available with BSE showed that as many as 6,00,92,402 investors were registered with BSE by the morning of January 21, which is 2.98 percent up month-on-month, 7.42 percent up quarter-on-quarter and 27.37 percent up year-on-year.

Maharashtra has more than 1.3 crore registered investors while Gujarat has about 78 lakh.

The overall market-capitalisation of the BSE-listed firm is at a record high of Rs 198.9 lakh crore as of 1300 hours on January 21.

Experts say liquidity boost, low rate regime, healthy corporate earnings and robust foreign fund inflows are pushing the market high.

As per data NSDL available, foreign portfolio investors have pumped in about Rs 14,750 crore in the Indian equities in January so far.