Scattered options OI bases point to wide-range trading

India VIX rises18.14% to 17.32 and is indicating volatile trading this week

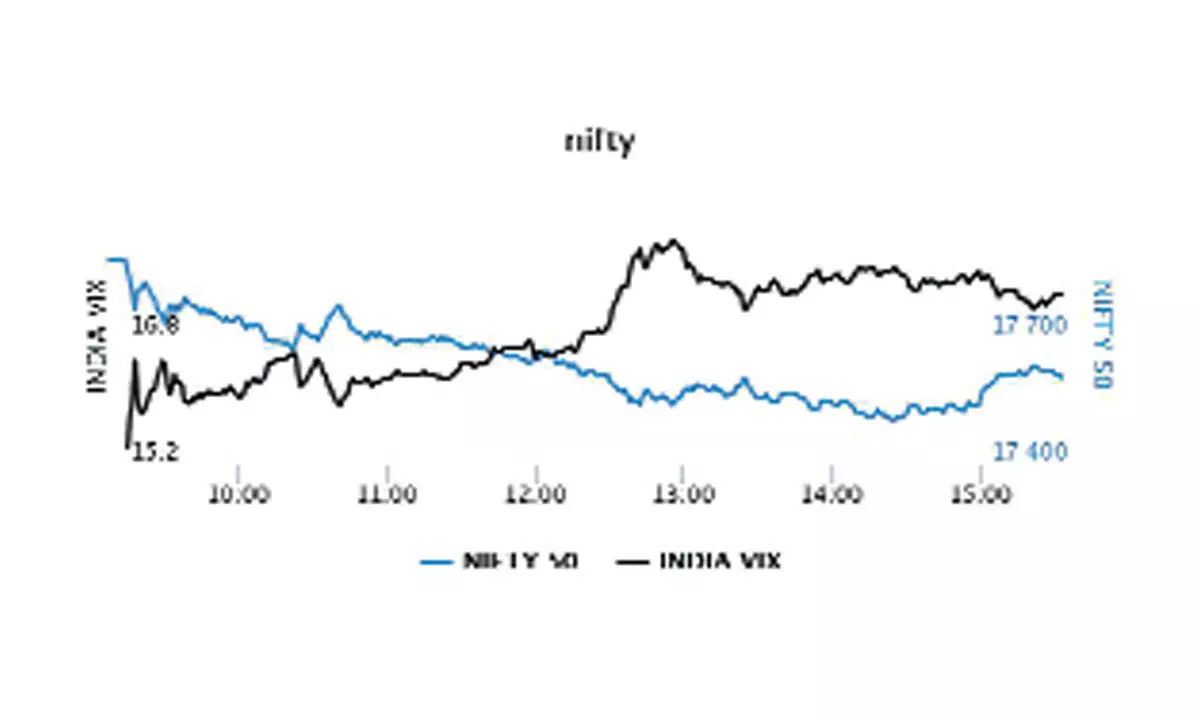

image for illustrative purpose

The latest options data on NSE after the last Friday session indicates volatile trading for the week ahead as highest Call Open Interest (OI) is seen at 19,000CE, a 900 points higher band from the previous week, while support level declined by 1,100 points to 17,000PE.

The highest Call OI is seen at 19,000CE followed by 18,000/ 18,200/ 17,9000/ 18,700/ 18,500 strikes, while 18,000/19,000/ 18,900/18,700/ 18,200/ 17,800 strikes recorded significant build-up of Call OI.

Coming to the Put side, the 17,000PE has maximum Put OI followed by 16,500/17,300/ 17,100/ 17,600/ 16,800 strikes. Further, 17,000/ 16,800/16,500/ 17,100 strikes witnessed reasonable addition of Put OI.

Dhirender Singh Bisht, senior research analyst (derivatives) at SMC Global Securities Ltd, said: Nifty's highest Call Open Interest concentration was seen at 18000 strike, whereas on put side, the highest concentration is at 17000 strike. Further, 17500, 17300 and 17100 strikes also hold some minor Open Interest on Put side. Bank Nifty doesn't hold significant Open Interest on Put side whereas Call writing was seen on higher levels."

BSE Sensex closed the week ended January 27, 2023, at 59,330.90 points, a major decline of 1,290.87 points or 2.12 per cent, from the previous week's (January 13) closing of 60,621.77 points. NSE Nifty ended the week at 17,604.35 points, fall of 423.15 points or 2.34 per cent, from 18,027.65 points a week ago.

Bisht forecasts: "A fresh upside in Nifty could only trigger above 18000, however, if 17500 is taken out, then one might see a deeper correction in terms of profit booking till 17000 levels. After spending lot of time in a defined range of 17800 to 18200, Nifty has given breakdown below key support of 17800 and now trading near immediate support of 17500 level. For upcoming sessions, we keep our stance cautious for the Indian markets as further selling pressure can drag Nifty more down towards 17300-17100 levels as well. We advise traders to remain on the sideline as volatility could grip markets on the back of upcoming Union budget."

"Last week a sharp selloff was seen in stocks after Hindenburg research report published the concern over the debt position by Adani Group. On the weekly basis, Nifty corrected by more than two per cent, whereas Bank Nifty declined by more than five per cent," observes Bisht.

For the January derivatives series, Nifty ended at 17,888 level, series-on-series, a loss of 1.64 per cent and Bank Nifty declined by 3.71 per cent to 41,641 points. On the Open Interest front, Nifty reduced 4.2 per cent as February F&O series began with 132 lakh shares in OI.

On the rollover front, Nifty saw higher rollover of 79.23 per cent against 79.21 per cent and the three-month average of 79.06 per cent with a rollover cost of 95.95 point and with OI reduction

with price closing down, which indicates some of the long unwinding in Nifty, long has not got carried forward. Bank Nifty, on the other hand, saw an addition of 6.8 per cent in Open Interest with a decline in prices, indicating short building seen in the index.

Bank Nifty saw a rollover of 84.06 per cent from previous month's 86.28 per cent and the three-month average of 83.74 per cent with rollover cost of 216.8 points. With a high rollover, Bank Nifty has got shorts getting carried forward to the next series. The overall market-wide rollover was 92.07 per cent versus 91.37 per cent in the previous series.

India VIX rose 18.14 per cent to 17.32 last week. With a significant rise in India VIX, which is a sign of a volatile market, it is advisable to not to write options as a sudden movement is expected in the market.

"Implied Volatility (IV) of Calls closed at 14.22 per cent, while that for Put options closed at 15.11 per cent. The Nifty VIX for the week closed at 14.66 per cent. PCR of OI for the week closed at 1.40 lower than the previous week," added Bisht.

The Put-Call Ratio (PCR) in February started on a negative note at 0.67. On the other hand, the volatility index in this month has been continuously inching higher currently, hovering at 14.65 per cent.

Bank Nifty

NSE's banking index closed the week at 40,345.30 points, 2,161.50 points or 5.08 per cent lower from the previous week's closing of 42,506.80 points.