Options data signals sector rotation

Call writers still aggressive; Rollover cost at 66bps reflecting sizable carrying forward of long positions into August F&O series

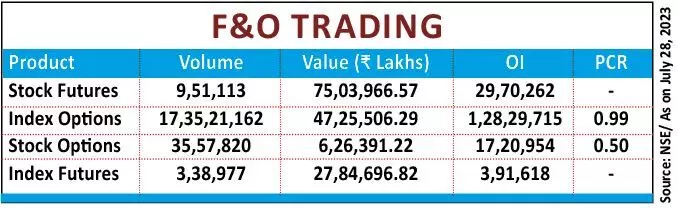

image for illustrative purpose

Resistance level eased by 100 points to 19,800CE and support level fell by 200 points to 19,600PE. The highest Call OI is at 19,800 strike followed by 20,500/ 20,200/ 19,900/ 19,700/ 19,750/ 19,800/ 20,600 strikes, while 20,200/ 20,500/ 19,750/ 19,700 strikes witnessed significant build-up of Call OI. With institutional buying slowing down, the ongoing Q1 results and global cues influencing the market direction mostly. The latest options data is pointing to sector-wise rotation rather than a wholesome trend for the domestic stock markets.

Coming to the Put side, the 19,600 strike has maximum Put OI followed by 19,500/ 19,400/ 19,300/ 19,200/ 18,800/ 19,000 strikes. Further, 19,600/ 19,500/19,450/ 19,400/18,800 strikes recorded a reasonable addition of Put OI.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “For Nifty, the highest Call Open Interest concentration is at 19,800 strike, while for Put options, it stands at 19,600 strike. As for Bank Nifty, the Call and Put OI concentration is at 45,500 strike.”

Call writers were modestly aggressive due to the sharp sell-off seen on Friday. However, Put option OI bases seem to be intact and no major closure was experienced at ATM 19800 strike, according to ICICIdirect.com. Moreover, in the ongoing move seen since March, Nifty hasn’t seen a correction of over 400 points. Hence, buying support is likely once again near 19,600 levels and resume uptrend.

BSE Sensex closed the week ended July 28, 2023, at 66,160.20 points, a net loss of 524.06 points or 0.78 per cent, from the previous week’s (July 21) closing of 66,684.26 points. During the week, NSE Nifty declined by 98.95 points or 0.50 per cent to 19,646.05 points from 19,745 points a week ago.

“Currently, the Nifty’s rollover stands at 84 per cent, higher than the previous month, indicating the potential for further momentum in the Nifty index. This month’s rollover is the highest observed in the last three months. On the flip side, the rollover in Bank Nifty remains unchanged, suggesting a consistent momentum compared to the previous month,” added Bisht.

Rising for four derivatives series in a row, Nifty concluded July F&O series with 3.6 per cent gain. The rollover cost at 66basis points reflecting aggressive long positions into August series. FIIs slowed down in their buying support in late part of July seires.

“The August series began with a lackluster to negative start in the market, witnessing stock-specific movements. Some profit booking was observed around the significant psychological level of 20,000, which consequently dragged down the key indices. During the result season, the pharma, infra and metal sectors showed promising performance, while there was notable buying activity in the Healthcare, energy and realty sectors. Conversely, the FMCG & IT sectors faced some pressure during this period,” added Bisht.

FIIs increased their net longs last week as they moved beyond one lakh contracts. The ongoing trend may continue in near term. However, renewed selling by FIIs is slowing down the rally. Nifty is likely to find support near VWAP placed tad below 19,600 level.

“The Implied Volatility of Calls closed at 10.59 per cent, while for Put options, it closed at 11.29 per cent. The Nifty VIX for the week concluded at 10.51 per cent. Additionally, the PCR of OI for the week ended at 1.36. Looking ahead, it is anticipated that the Nifty will likely trade in a range of 19,800 to 19,350 points, and any breakout beyond these levels may trigger further trends in the market,” remarked Bisht.

Despite some cool-off on Friday, net longs are still 88,000 contracts. Even FIIs have turned buyers in stock futures last week and bought over Rs8,000 crore in stock futures ahead of results. In the index options space, FIIs have remained net buyers due to sharp movement seen during the week.

Bank Nifty

NSE’s banking index closed the week at 45,468.10 points, a fall of 607.10 points or 1.31 per cent from the previous week’s closing of 46,075.20 points. “Notably, Bank Nifty has been underperforming compared to Nifty in recent sessions, and this trend is expected to persist into the next week,” observed Bisht.