NSE Nifty is stable, further fall unlikely

With Union Budget in sight, volatility has eased for now

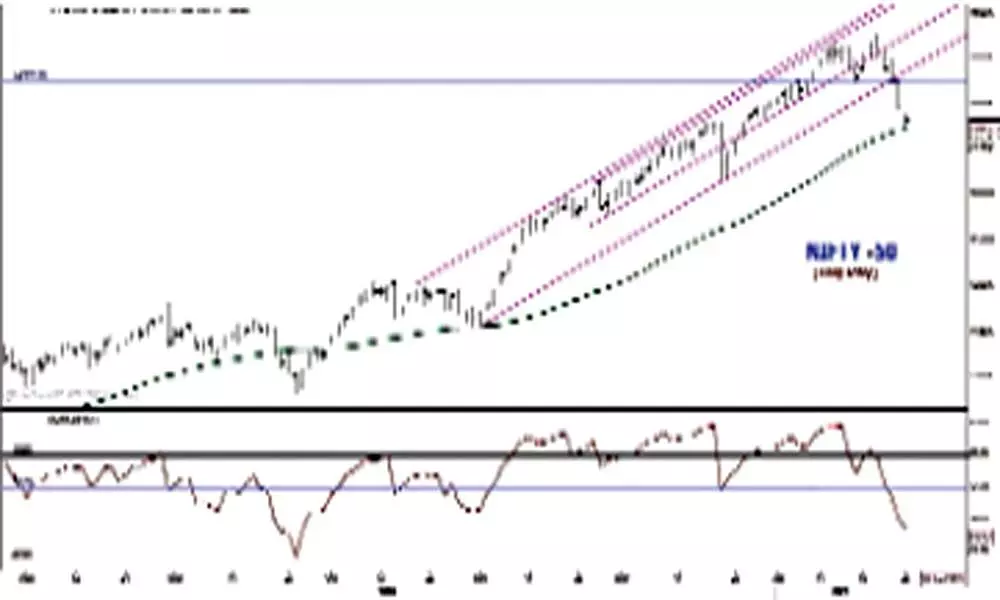

image for illustrative purpose

The fears of expected new taxes in the general Budget ruled the market on a monthly expiry day. The selling pressure continued for the fifth consecutive day. The Nifty declined 150 points and closed at 13,817. The recovery in the banking stocks saved Nifty from a bigger fall. The Nifty IT was the worst performer with 2.18 per cent fall. FinNifty, Auto, FMCG, and PSU Banking sector indices fell by over one per cent today. The Banknifty closed with 74 points gains after a thousand point recovery from the day's low. Private sector banks led by Axis Bank fuelled the rally in the sectoral index. The market breadth is at 1:1.

Volatility ruled the market on the monthly expiry day. The sharp recovery in banks by 900 points from the day's low has shown an impact on market direction. The Nifty also recovered over 100 points from the day's low. Though it closed negatively by one per cent, the Nifty has formed indecisive doji candle at the swing low. This indicates the market is not interested in going further down just before the Budget. On Friday expect a very range-bound and positive trade, or it could form an inside bar. On a monthly chart, the Nifty formed a very bearish candle shooting star.

As I mentioned earlier, historical January-March market top may repeat this time too. 14,753.44 could be a market top for now.

The Nifty took support at 62 per cent retracement level of December 21 to January 21 swing. It corrected seven per cent from the recent lifetime high. This 1,000-point correction in just five trading sessions is the sharpest one since March low. The momentum is completely negative. The negative movement indicator -DMI rose further high to 33, and it reached to the four-month high. The declining ADX is showing weakening trend strength. Importantly, the Nifty took support exactly at 50DMA.

For Friday too, this level (13,728) will act as critical support. As long as this support holds, it will try to trade within the narrow zone, as the general Budget is just one trading day away.

At the same time, only above 13,960 is positive for the market till Monday afternoon. There is the highest possibility of trading between 13,960-13,715 on Friday. The RSI is at 40 zone. Historically this leading indicator took support at 40 zone several times. At the same time, on a 75 minutes chart, it is in overbought zone and indicates limited downside for tomorrow. It is better to avoid aggressive positions on either side of the market.

(The author is a financial journalist, technical analyst, trainer, family fund manager)