Nifty: Fibonacci time cycle theory indicates a potential short-term bounce

Nifty: Fibonacci time cycle theory indicates a potential short-term bounce

The Nifty50 saw a significant surge last week, rising 4.26% from 22,353 to 23,400. This sharp rally has reignited optimism among investors, shifting sentiment from fear to cautious hope. As speculation builds, the crucial question remains: is this a genuine market reversal or just a short-term bounce?

Is This a True Reversal or a Temporary Surge?

The long-term trend for Nifty50 is still bullish, but recent movements suggest a shift in the medium-term outlook. The sharp decline from 26,200 to 22,000 has raised doubts, causing many traders to reassess the market's direction. Despite the bounce to 23,400, the broader trend remains unchanged, with key indicators suggesting caution.

The Golden Cross vs. Death Cross

Two significant indicators—Golden Cross and Death Cross—are often used to gauge market trends. A Golden Cross occurs when the 50-day Exponential Moving Average (50DEMA) crosses above the 200-day Exponential Moving Average (200DEMA), signaling bullish momentum. On the other hand, a Death Cross, where the 50DEMA falls below the 200DEMA, signals a bearish trend.

Currently, the Nifty50 chart reflects a Death Cross, with 66% of its constituents and over 75% of stocks in broader indices such as Nifty100, Nifty200, and Nifty500 also showing signs of bearish momentum.

Nifty50 Chart Analysis

Examining the Nifty50 chart, the 50DEMA remains below the 200DEMA, confirming the Death Cross. The Moving Average Channel analysis further underscores the bearish sentiment, with the 50DEMA channel positioned beneath the 200DEMA channel.

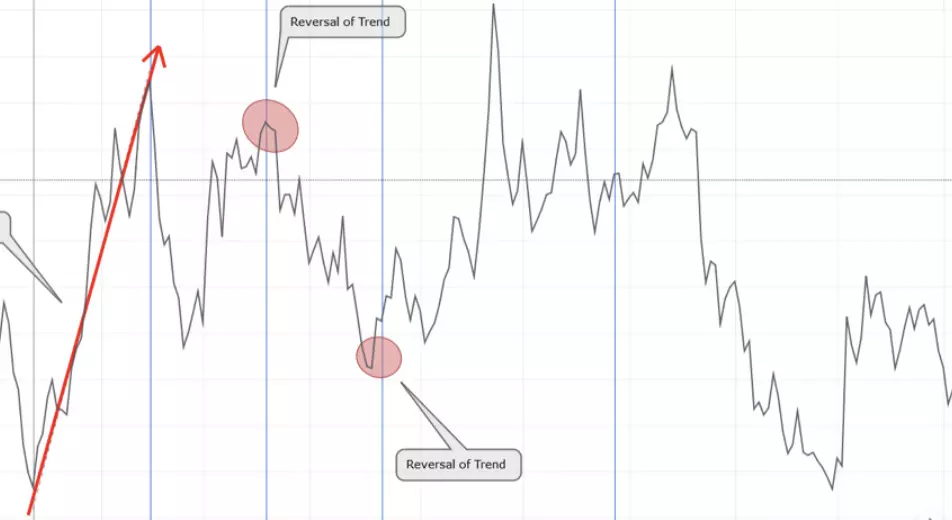

Additionally, the market has formed a lower high and lower low pattern, which is a bearish signal according to Dow Theory. This suggests that the recent bounce may simply be a temporary relief within the ongoing downtrend.

A critical resistance zone lies between 23,800 and 23,900, indicated by a dotted black trendline. This zone will be pivotal in determining whether the bounce can break through and signal a reversal, or if the market will continue its downward trajectory.

The Test Ahead

Should Nifty50 break above 24,250, a previous high, it could invalidate the bearish setup, signaling the potential for a market reversal. However, a failure to break this resistance could confirm that the downtrend remains intact.

Fibonacci Time Cycle Theory

According to the Fibonacci Time Cycle theory, a crucial period for a potential reversal falls between March 27 and April 2, 2025. This period coincides with the monthly expiry, which could bring heightened volatility. Traders should stay alert during these days as market dynamics could shift dramatically.

The bounce from 22,000 to 23,400 in Nifty50 is encouraging, but the market remains at a critical juncture. The 23,800-23,935 resistance zone and the upcoming Fibonacci time cycle period will be key to determining whether this is a short-term bounce or the beginning of a more substantial market shift. As the trend remains bearish overall, traders should remain cautious and closely monitor price action in the coming days.