Higher premium on Nifty futures signals upward journey

FIIs built-up long positions in F&O space, while retail investors increased short positions

image for illustrative purpose

The resistance level rose by 1,000 points to 27,000CE, while the support level remained at 25,000PE for a second consecutive week.

Highest Call base is seen at 27,000CE followed by 26,000/ 26,500/ 29,000/ 25,800/ 26,200/ 26,300/ 25,500/ 25,000/ 25,900/ 26,200 strikes, while 29,000/ 27,100/ 27,100/ 26,700/ 26,200/ 26,600/ 25,700 strikes recorded significant build-up of Call OI.

Decline in Call OI is visible from 25,600 ITM strike inwards.

Coming to the Put side, maximum put base is at 25,000PE followed by 24,000/ 23,000/ 22,500/ 22,000/ 23,500/ 22,800/ 22,300/ 21,000/ 16,000/ 24,500/ 24,900/ 25,700/ 25,600/ 26,000 strikes.

Further, 25,800/ 25,700/ 25,600/25,300/25,200/25,500/ 25,800 strikes witnessed heavy addition of Put OI. There’s no offloading on Put strikes. Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “In the derivatives market, Nifty highest Call Open Interest is at 26,000 and 25,800 strikes, while for Put side highest Open Interest was observed at the 25,700 and 25,500 strikes.”

Highest call writing is visible at ATM strikes, although the volume fell following the significant upward move seen on the last weekly F&O expiry day. Put writers have been active, with significant positions between the 25,000 to 25,200 strikes. This indicates an immediate support to the index. Any dip towards the 25,000 level will present a buying opportunity.

“After the Fed’s announcement of a 50bps rate cut, the Indian market rallied, with Bank Nifty outperforming Nifty on the weekly charts. Bank Nifty climbed over 3.5 per cent, while Nifty gained more than 1.5 per cent, with both of the indices tested records high. There was notable buying seen in the realty, private banking, and financial services sectors. Conversely, the media, midcap, and oil & gas sectors lagged behind for the week,” added Bisht.

BSE Sensex closed the week ended September 20, 2024, at 84,544.31 points, a net recovery of 1,653.37 points or 1.99 per cent, from the previous week’s (September 13) closing of 82,890.94 points. For the week, NSE Nifty also moved up by 434.45 points or 1.71 per cent to 25,790.95 from 25,356.50 points a week ago.

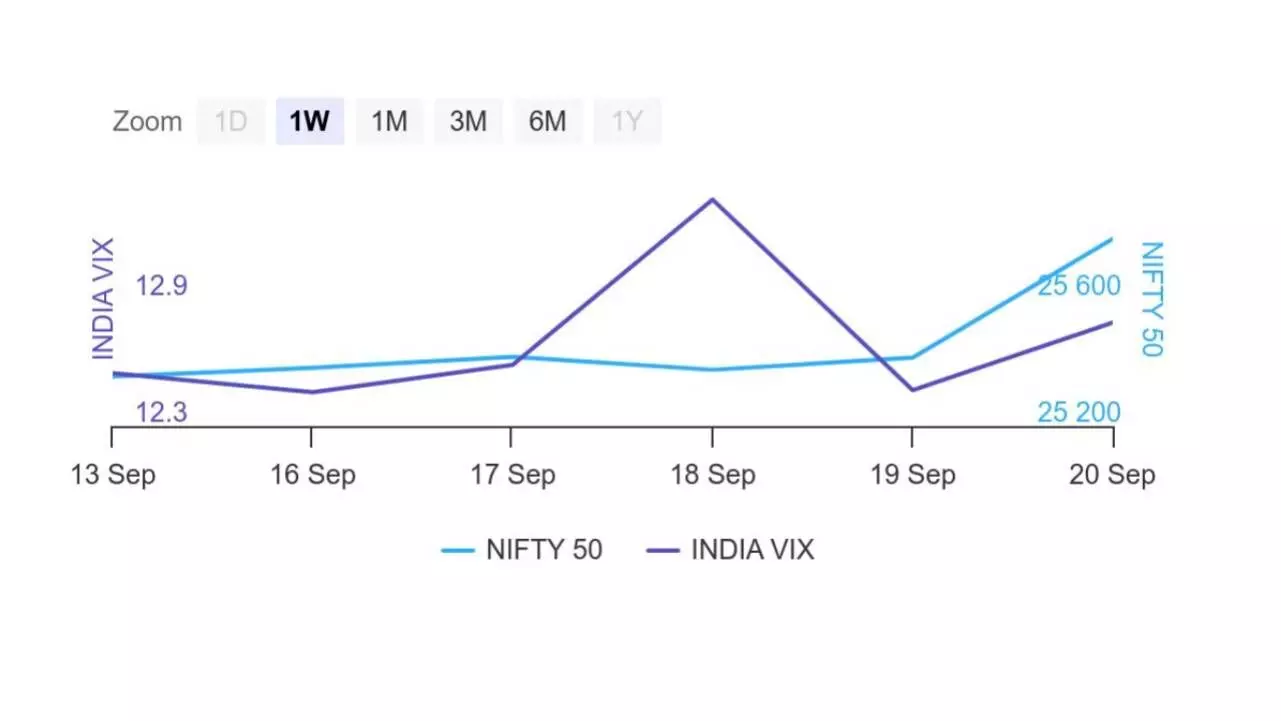

Bisht forecasts: “After witnessing a stunner rally last week, Indian markets are likely to continue their journey towards north. However, we expect that volatility is likely to grip market and traders are advised to use any dip for creating fresh longs.” India VIX rose 2.57 per cent to 12.70 level. The volatility index closed below 12 level. Analysts forecast volatility to remain low in the coming sessions, with a possible spike mid-week ahead of the FOMC meeting. “Implied Volatility for Nifty’s Call options settled at 11.47 per cent, while Put options conclude at 12.35 per cent. The India VIX, a key market volatility indicator, closed the week at 12.47 per cent. The Put-Call Ratio of Open Interest (PCR OI) stood at 1.14 for the week,” observed Bisht.

As of September 13, FIIs have invested approximately Rs22000 crore in domestic equities, including some block deals. Additionally, they injected around Rs2,300 crore in Friday session (a provisional figure), bringing total inflows to nearly Rs24,000 crore so far this month. This reflects strong confidence in large-cap stocks and suggests limited downside risk. FIIs built-up long positions in F&O space as their net long positions in index future rose to 2.1 lakh contracts from 1.6 lakh contracts. On the other hand, retail investors increased their short position and the quantum rose to 1lakh contracts.

Bank Nifty

NSE’s banking index closed the week at 53,793.20 points, higher by 1,855.15 points or 3.57 per cent from the previous week’s closing of 51,938.05 points. “For the Bank Nifty, highest call open interest is at 54,000 strike whereas for put highest open interest is at the 53,000 strike, making it the crucial level to monitor for the upcoming week as support,” remarked Bisht.