Aggressive Call, Put options writing

The range-bound trading in the last few sessions had triggered major option writing in both Call and Put strikes

image for illustrative purpose

The resistance level remained unchanged at 26,000CE for the second week and the support level rose by 1,000 points to 25,000PE. The last week witnessed aggressive option writing at ATM strikes as the range-bound trading in the last few sessions had triggered major option writing in both Call and Put strikes.

The 26,000CE has highest Call OI followed by 25,700/ 25,800/ 25,300/ 25,200/ 25,500/ 26,100/ 26,200 strikes, while 26,500/ 25,800/ 26,000/ 25,700/ 25,800/26,900 strikes recorded hefty build-up of Call OI. Marginal OI fall is visible from Call ITM strikes from 25,200 onwards.

Coming to the Put side, maximum Put OI is seen at 25,000PE followed by 25,200/ 24,900/ 24,000/ 24,500/ 24,400/ / 23,000 / 23,500/ 22,250/ 22,300/22,350/ 22,400 strikes . Further, 22,250/ 22,300/ 22,350/ 24,000/ 24,500/ 24,800/25,000/ 25,100/ 25,150/ 25,200/ 25,300 strikes witnessed strong addition of Put OI. Only 23,000PE recorded a minute fall in Put OI.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “Looking at Nifty’s derivatives data, the highest Call Open Interest was observed at the 25,500 and 25,700 strikes, while Put writers were at the 25,000 and 25,200 strikes.”

If the markets sustain the ongoing upward moment, then it may induce further gains towards new peaks. If not, it leads to some pressure on key indices.

“With the market hovering at record highs, buying activity has surged in pharma, realty and IT sectors on the weekly chart. In contrast, FMCG and PSU banks lagged behind. The Nifty index rose by over 1.5 per cent, while the Bank Nifty gained approximately one per cent on a weekly basis,” added Bisht.

BSE Sensex closed the week ended August 30, 2024, at 82,365.77 points, a net recovery of 1,279.56 points or 1.57 per cent, from the previous week’s (August 23) closing of 81,086.21 points. For the week, NSE Nifty also rose by 412.75 points or 1.66 per cent to 25,235.90 from 24,823.15 points a week ago.

Bisht forecasts: “For the upcoming period, the sentiment remains positive as long as the Nifty trades above the 25,000 psychological level. Traders are advised to avoid taking new short positions above this level and to wait and see how the market responds to any new positions established during the month.”

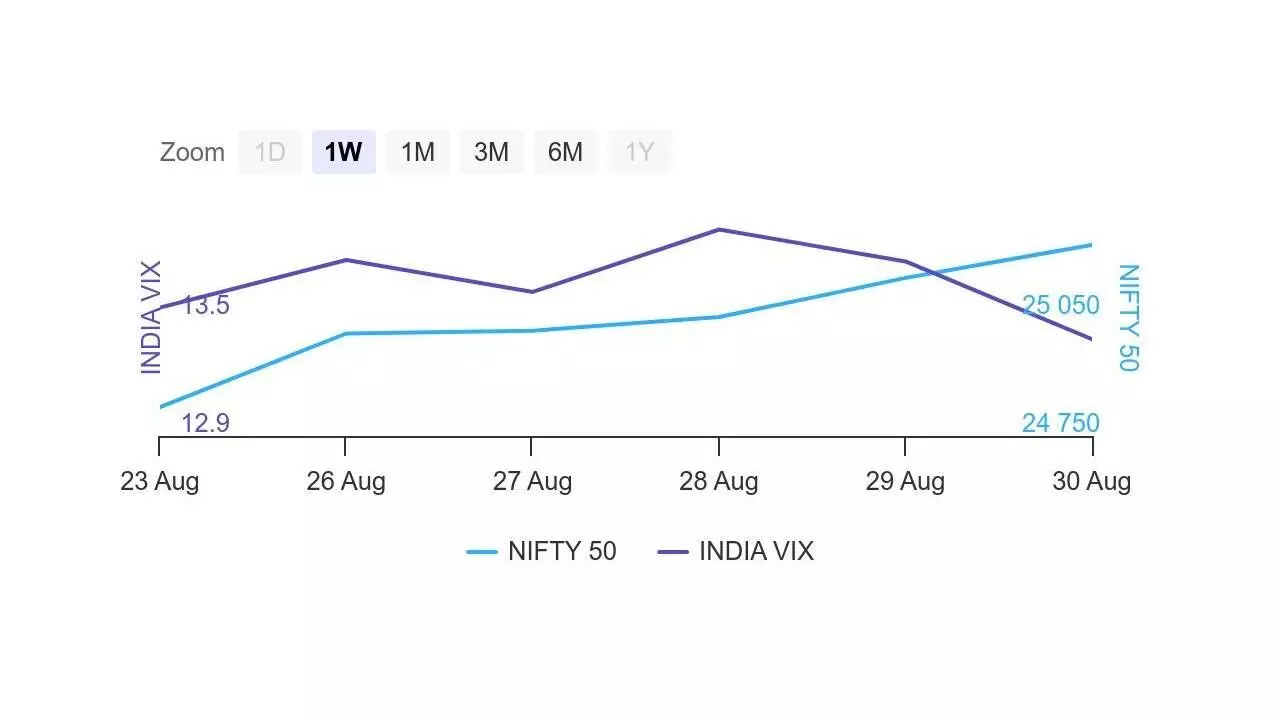

India VIX fell 2.86 per cent to 13.39 level. “The India VIX, a key indicator of market volatility, concluded the week over 13 per cent. Implied Volatility (IV) for Nifty’s Call options settled at 11.70 per cent, while Put options concluded at 12.03 per cent. The Put-Call Ratio of Open Interest (PCR OI) stood at 1.50 for the week,” said Bisht.

However, relatively aggressive Put writing was seen and the highest Put base is now placed at ATM 24800 and 24500 strikes. Thus, if Nifty sustains current levels then a move towards 25200 levels cannot be ruled out.

“The Nifty’s rollover rate has risen to 77.49 per cent, surpassing the three-month average of 72.57 per cent and the previous rollover rate. Conversely, the Bank Nifty’s September rollover rate stands at 67.75 per cent, which is below both the three-month average and last month’s rollover rate,” observed Bisht.

Bank Nifty

NSE’s banking index closed the week at 51,351 points, marginally higher by 417.55 points or 0.81 per cent from the previous week’s closing of 50,933.45 points. “For the Bank Nifty, the highest Call Open Interest was at the 51,500 and 52,000 strikes, while for Put Open Interest concentrated at the 51,000 strike,” remarked Bisht.