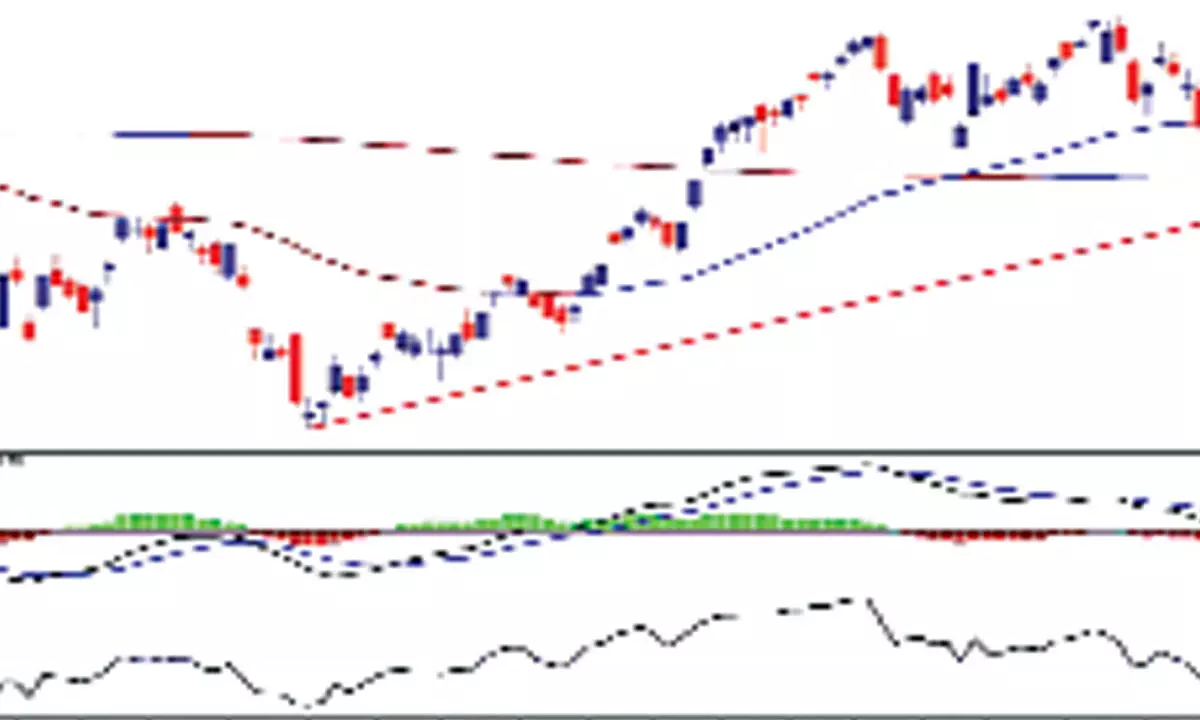

Nifty stages bearish setup with MACD declining below zero line

Index forms bearish engulfing candle; Heiken Ashi chart also formed 2 consecutive bearish candles, which are bearish

image for illustrative purpose

The equities collapsed with renewed selling pressure. The NSE Nifty declined by 257.45 points or 1.49 per cent and closed at 16983.55. All the sector indices declined on Tuesday. The Realty index suffered with a 3.07 per cent decline. The Nifty Metal and Media indices are down by over two per cent. Other sectoral indices are down by over one per cent. The market breadth is extremely negative as 1545 declines and 369 advances. About 46 stocks hit a new 52-week high, and 63 stocks traded in the upper circuit. IndusInd Bank, Infosys, and TCS were the top trading counters on Tuesday.

The resilient Nifty finally fell below the 200DMA. With the broad-based selling pressure, Nifty has registered a distribution day. Only two of the Nifty 50 stocks were able to close in the green, and the broader market breadth is extremely negative. The index erased most of the last week's gains. It retraced over 61.8 per cent of the prior minor upswing. As mentioned earlier, it is confirmed that the 17429 is the minor swing high for now. The 50-Day Exponential Moving Average acted as stiff resistance for the last two days. The Nifty also formed a bearish engulfing candle.

The last week's counter-trend consolidation has broken down with Tuesday's decline. The Momentum has increased further on the downside. The RSI is at 41.49, near to the strong bearish zone. The VWAP anchored on 17 June low acted as a support for the day. The RS line is also declining. Heiken Ashi chart also formed two consecutive bearish candles, which are bearish. On an hourly chart, the Nifty decisively closed below the moving average ribbon, and the ribbon is in a downtrend. The MACD line also declines below the zero line, which is a bearish setup. Only in case, if the index moves above Tuesday's high of 17262, it will be positive. Otherwise, it is advied to with a negative bias.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)