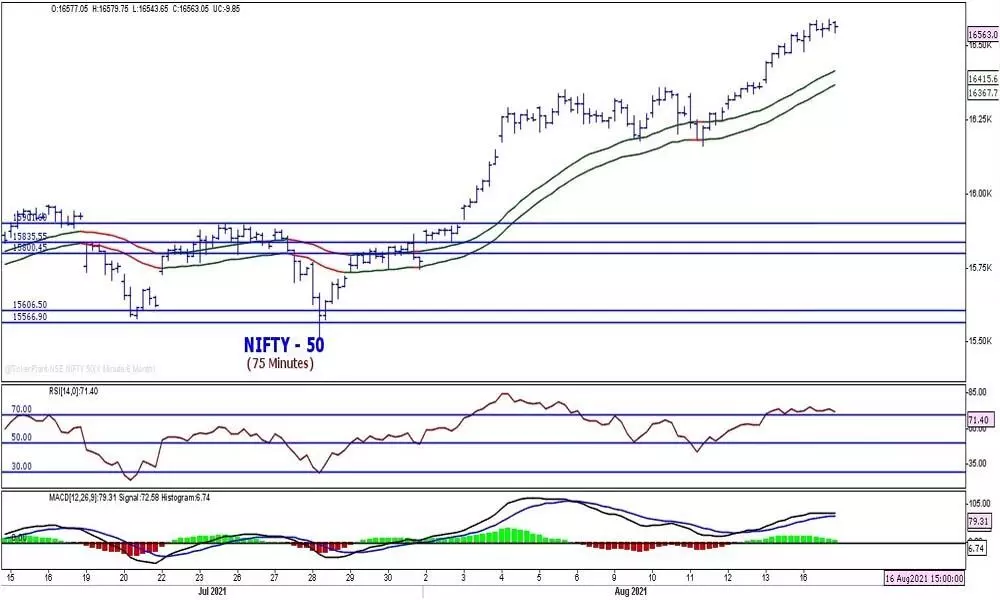

Nifty may move in tight zone

On daily chart, the indicators are in extreme overbought condition

image for illustrative purpose

Indian market reached fresh record highs. The benchmark index Nifty-50 closed at 16,563.05 points with a gain of 33.95 points. Metals and Reliance rally led the market into positive territory even though overall market breadth is negative. Tata Steel and Reliance contributed most of the index gains with a 3.95 per cent and 1.30 per cent rally. The Metal index is up by 1.48 per cent, and Energy is higher by 0.55 per cent. The Bank Nifty down by 0.21 per cent. Auto and Pharma indices are down by 0.88 per cent and 0.60 per cent respectively. The overall market breadth is negative as 1,321 declines and 631 advances. About 104 stocks hit the fresh 52-week high and 174 stocks traded in the lower circuit. India VIX is up by 3.60 per cent.

The NSE Nifty closed at a new lifetime high and above the previous day's high. It sustained the initial gains and traded in the first hour's range. With this sideways activity and negative breadth in the index, the momentum has declined. As mentioned earlier in this column, the broader market underperformance and low volume are a concern. The last 30 minutes' profit and declined Open Interest are also indicating the caution about the upside. Post-Friday breakout, the NSE Nifty formed a small body candle and signaled the consolidation on the cards. Monday's high 16,589 will be the key resistance for Tuesday. A move below 16,480 will give us negative signals. The negative divergences are still present in the much lower time frame charts. On a daily chart, the indicators are in extreme overbought condition. Like recent consolidation, the Nifty may move in a tight zone, may not give decisive trading opportunities. As there are no bearish signals, continue with the trend with strict trialing stop loss.

(The author is financial journalist, technical analyst,

family fund manager)