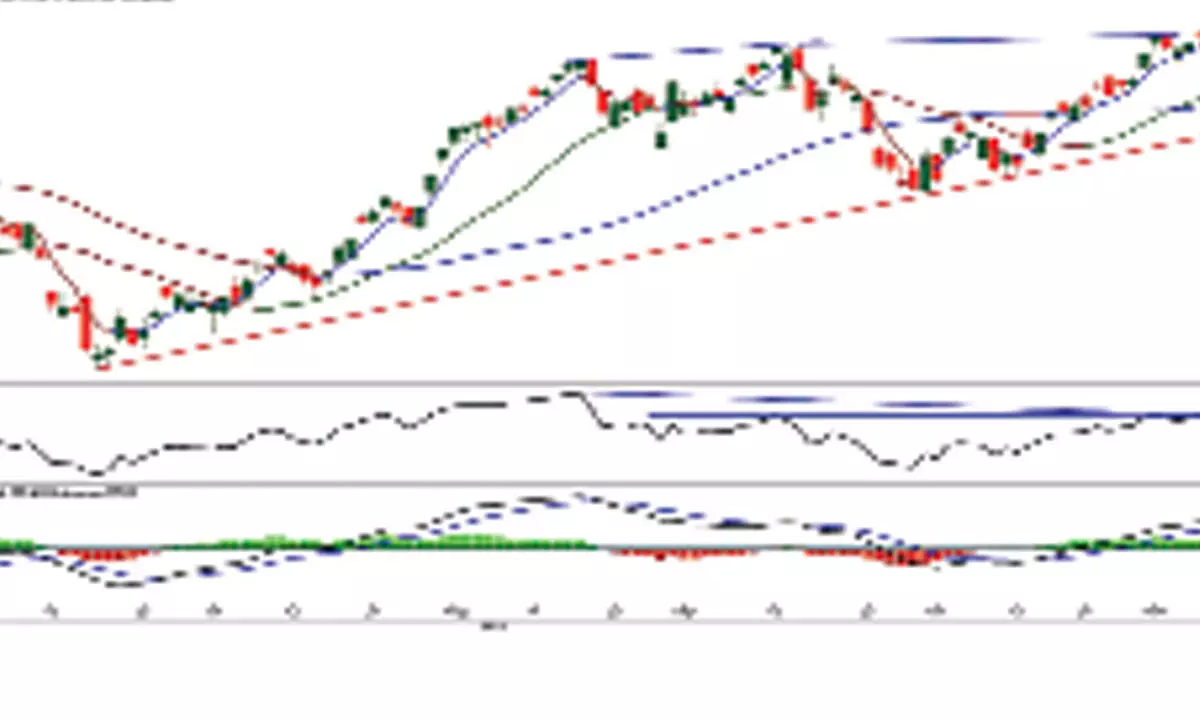

Nifty confirms earlier bearish engulfing pattern

The index is forming dark cloud cover candle on weekly and formed a long-legged Doji candle on daily charts

image for illustrative purpose

The benchmark indices erased the last four days of gains. The NSE Nifty closed with 128.8 points or 0.71 per cent and settled at 18,028.20. All the sectoral indices closed with a negative bias, but the losses were limited. The Nifty Auto and the PSU Bank indices were the top losers, with 1.95 per cent, and 1.28 per cent, respectively. All other sectoral indices are down with 0.15 to 0.85 per cent. The Market breadth is extremely negative as 1,410 declines and 493 advances. About 57 stocks hit a new 52-week high, and 72 stocks traded in the upper circuit. Axis Bank, Tata Motors and Nykaa were the top trading counters on Thursday.

Last week's breakout almost failed with a profit booking. The Nifty has forming the dark cloud cover candle on a weekly chart. On a daily chart, it formed a long-legged Doji candle. The 5EMA support was finally broken. It also closed below the 8EMA. Now the 20DMA is just 1.95 per cent away. Importantly, the Nifty closed below the moving average ribbon after 13th October, and the MA ribbon started its fresh downtrend. The Nifty has almost tested the 3rd November low of 17,959. In any case, if the Nifty closes below this, the short-trend will become bearish. Another key technical development is that, the previous day's bearish engulfing pattern got confirmation for its implications.

The recent negative divergence in RSI gets confirmation by closing below the 3rd November low. The MACD line is declining, and the histogram is further down. This shows that the momentum is waning. The Elder impulse system has formed another neutral bar. A decline below 17,959 may lead to the formation of a bearish candle. The RRG momentum decline below 100 is a big concern for the bulls. For now, Friday's open and close will be crucial for the market. A close below 17,959 will confirm the weakness and may retest the 20 and 50DMAs. To resume the uptrend, the Nifty has to close above 18,115 decisively on a weekly basis. Trade cautiously on the weekend.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)