Need to watch FII inflows as year-end nears

The broader participation and cool off in VIX has led the recovery from the day’s low

image for illustrative purpose

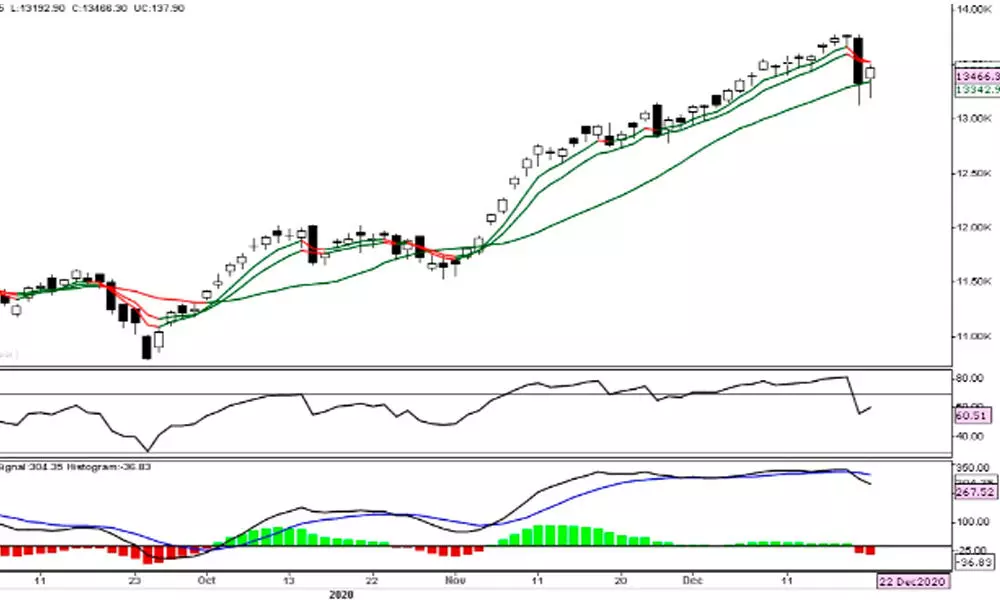

The broader participation and cool off in VIX has led the recovery from the day's low. The market recovered after a dip in the first session smartly led by the IT and Pharma sector stocks. The BFSI sector also participated in the later part of the day. The Nifty was up by 137.90 points or 1.03 per cent and closed at 13,466.30. The IT index rallied by 3.36 per cent and the Pharma advanced by 2.22 per cent. Metal and Infra indices were up by 1.36 per cent and 1.45 per cent respectively. The volatility index India VIX fell by 5.20 per cent. Overall market breadth is at 1:1 advance-decline ratio. We need to watch the FII flows into the market as the year-end nears, and the pre-budget consultation has begun.

The market retraced almost 50 per cent of Monday losses. It formed an inside bar. Soon after opening in positive territory, it fell sharply below 13,200 levels. For the second consecutive day, it fell below the 20DMA and closed above it. The history of recent swings repeated once again today. In the recent past the on August 3, of October 15 and November 25 falls were followed by an inside bar. Even today the identical candle formed, after Monday's fall. Incidentally, the August 31 fall happened again on Monday.

And also it took support at 20DMA. But, later falls took support at 8EMA. The current fall is interesting as it was at new lifetime high and bigger than the prior fall. For now, the 20DMA -13,343 will act as support. Consider this support on a closing basis. At the same time, 5 and 8EMA, both being at the same place 13,520-526 will act as a resistance for now. Between this 200 point, range trading will become very difficult. As long as Friday's high 13,773 protected on the upside, the consolidation may continue for some more time.

We need to watch the consolidation will be within the Monday's big bar range or will it drift down towards 12,800, which is prior swing low. With Monday's fall, the technical structure is damaged for sure as the MACD histogram shows the increase in bearish momentum. Even the ADX shows that the trend strength is declining. In these conditions, position sizing and risk management is an important aspect of the trading. A break above or below of above said range would lead a decisive directional move. Be on the guard.

(The writer is a financial journalist, technical analyst, trainer, family fund manager)