Mkts bleed as BJP tally falls short

Bears On Prowl: Sensex, Nifty tank nearly 6% in sharpest free fall in 4 yrs

image for illustrative purpose

Hyderabad: A day after witnessing its biggest single-session gain of over three per cent in three years, Dalal Street on Tuesday suffered a worst day in four years since Covid-19 as BSE Sensex and NSE Nifty tumbled by almost six per cent after Lok Sabha poll results confirmed BJP performance much below the exit poll estimates.

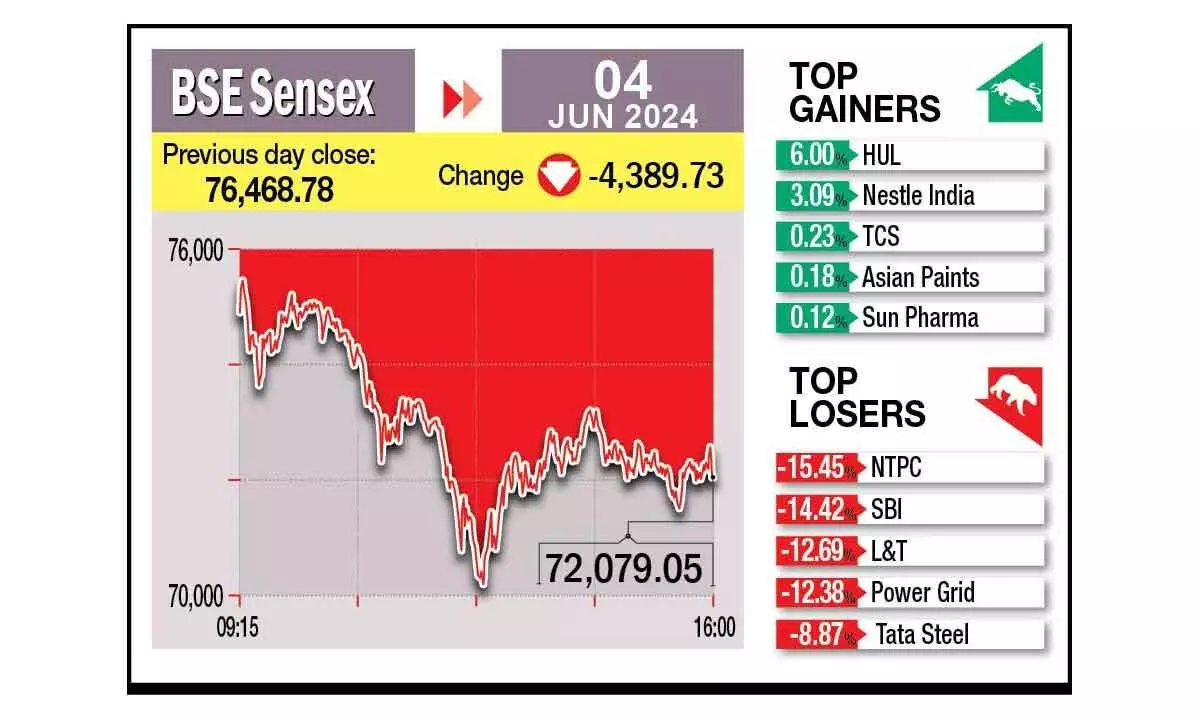

At end of the session, BSE Sensex fell 4,389.73 points or 5.74 per cent to 72,079.05 points. NSE Nifty declined by 1,379.40 points or 5.93 per cent to 21,884.50 points. Bank Nifty too suffered a steep fall as NSE’s banking index tumbled 7.95 per cent or 4,051.35 points to 46,928.60 points.

In intra-day session, the barometer tanked 6,234.35 points or 8.15 per cent to hit a nearly five-month low level of 70,234.43. Similarly, NSE Nifty tumbled 1,982.45 points or 8.52 per cent to 21,281.45 during the day.

The day’s low was 70,271 points level at 12:29pm when Sensex tumbled by 6,197.78 points. The latest market crash has wiped out all the gains in last four months. Previously on March 23, 2020, Sensex and Nifty tanked by 13 per cent, when lockdown was imposed due to the Covid-19 pandemic.

Disappointed with the first one hour of counting results, Sensex opened gap down of 1,591.46 points or 2.08 per cent at 74,878.32 points and further fell to 73,668.64 points in first 30 minutes of trading. The fall was unabated as the counting results were below the expected lines of exit polls. Later it marginally recovered to 73,206 points at 1:54pm and continued at this range till the end of session.

“The unexpected outcome of the general election sparked a wave of fear selling in the domestic market, reversing the recent substantial rally. Despite this, the market maintains its expectation of stability within the coalition, led by BJP as the major election winner, thereby mitigating substantial downside in the medium term. This is likely to lead to a major shift in political policy with a focus on social economics, which will have a positive effect on the rural economy,” said Vinod Nair, Head (Research), Geojit Financial Services.

The number of stocks to hit a 52-week high stood at 83 while 271 stocks fell to their 52-week low. As many as 3,349 stocks declined while 488 advanced and 97 remained unchanged on the BSE.

“Markets have reacted sharply to the initial trends of the NDA leading on around 290 seats which look way behind the exit polls which were projecting around 350-370 seats. With the NDA still looking to form a government, though with the important support of coalition partners, markets look jittery about the prospects of strong decision making,” said Manish Chowdhury, Head (Research), StoxBox.

Markets believe that the reformistic approach, which was a hallmark of the previous two terms, might take a backseat in the third term. However, our sense is that it is still early to jump to conclusions and should ideally wait for a clearer picture, he added.

In the broader market, the BSE midcap gauge tanked 8.07 per cent and smallcap index plunged 6.79 per cent. Among the indices, utilities dived 14.40 per cent, power tumbled 14.25 per cent, oil and gas by 13.07 per cent, services by 12.65 per cent, capital goods by 12.06 per cent, energy by 11.62 per cent and metal by 9.65 per cent.

(With inputs from agencies)