Mkt may enter consolidation mode as DIIs offloading

Domestic institutional investors (DIIs) turned major sellers in last 2 sessions, where they offloaded Rs5,316-cr worth equities

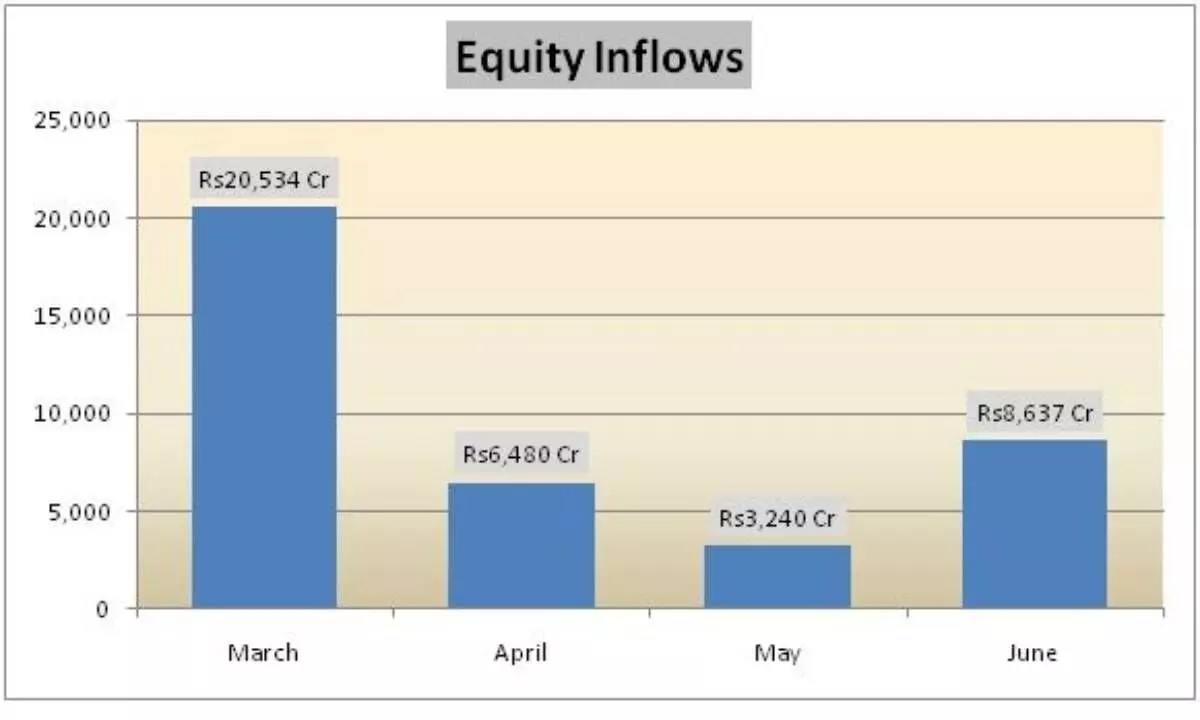

image for illustrative purpose

New Delhi Domestic institutional investors (DIIs) have emerged as major sellers during the last two trading sessions with cumulative selling of Rs5,316 crore, says VK Vijayakumar, Chief Investment Strategist at Geojit Financial Services.

After the recent surge that took the benchmark indices to new highs, the market is likely to move to a consolidation mode, he said. The latest US non-farm jobs data (2.09 lakh jobs created in June) shows that the labour market is cooling off. But since core inflation remains sticky around 5 per cent, the US Federal Reserve is likely to raise rates by 25bp on July 26. Anticipating this, bond yields have moved up with the 10-year yield above 4 per cent. He added that this macro construct will restrain the ongoing rally in the mother market and this will have its impact on the Indian market too.

Moreover, DIIs have emerged as major sellers during the last two trading sessions with cumulative selling of Rs 5,316 crores. At lower levels, FIIs may again buy aggressively since India continues to be a consensus favourite destination for FIIs. In brief, the market is likely to move into a consolidation phase, he said. Financials will support the market during dips since the Q1 results will be good and valuations are reasonable.

The flood of FPI flows into India continues with Rs21,943 crore of inflows (including bulk deals) till July 8, says Vijayakumar. If this trend continues, monthly FPI flows in July will exceed the figures in May and June, which were Rs43,838 crore and Rs47,148 crore, respectively, he added. Domestic institutions turn major sellers in last two sessions