MACD Shows Increased Bearish Momentum

For an upside move, the index must move above the 200 DMA of 23907 and 50 DMA of 24,115pts; Otherwise, it is better to avoid long positions; For short positions, it’s time to maintain stop loss at 23,907

MACD Shows Increased Bearish Momentum

The Rupee depreciation to an all-time low and the new HMPV virus fears gripped the equity market. NSE Nifty declined by 388.70 points or 1.62 per cent and closed at 23,616.06 points. The India VIX is up by 15.58 per cent to 15.64. All the sectors closed negatively. The PSU Bank index is the worst hit as it fell by four per cent. The Microcap, PSE, CPSE, Energy, Small-cap, Realty, Metal, and Commodities indices fell by over three per cent. The IT index is the outperformer by declining just 0.12 per cent. The market breadth is extremely negative as 2473 declines, and 413 advances. About 111 stocks hit a new 52-week high, and 237 stocks traded in the lower circuit. ITI, Aegis Logistics, Transrail, and Reliance were the top trading counters in terms of value.

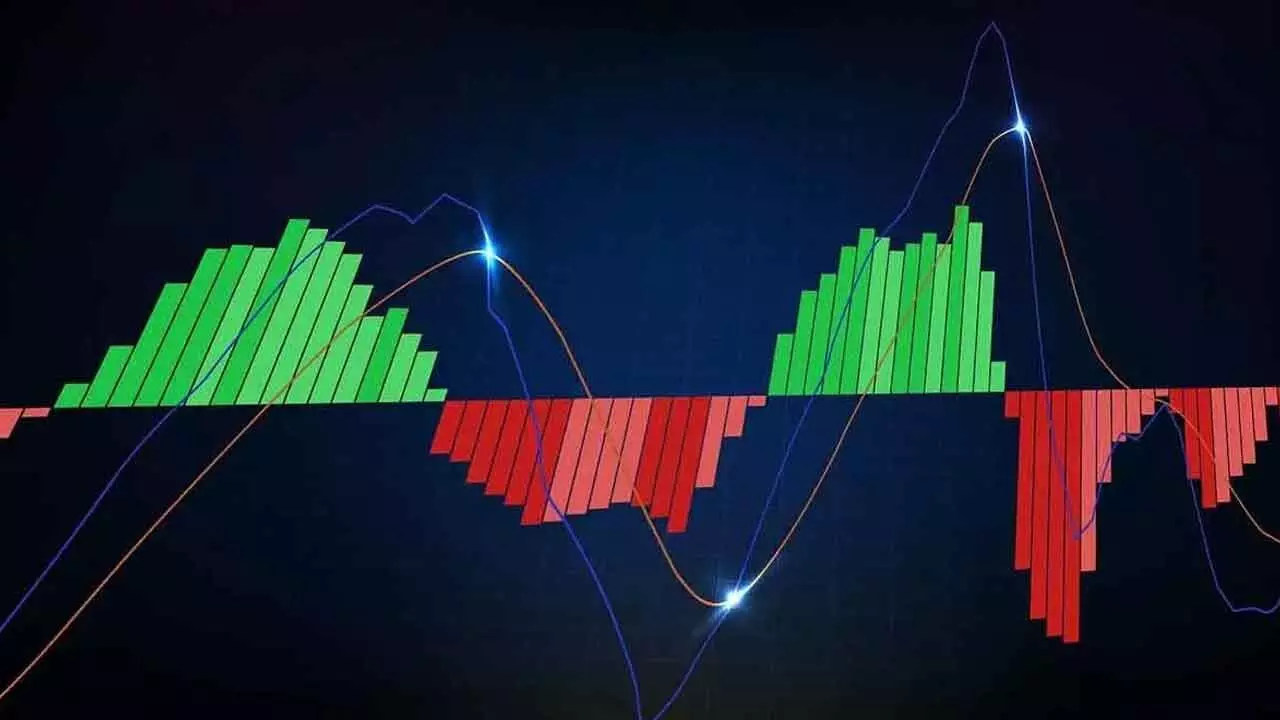

The Nifty erased the last two weeks’ gains in just two days. The high volume selling on Friday and the decline below 200DMA and 200EMA during this session are the caution for bulls. The 23,663, which is 50-week support was also breached. Even, the volumes are higher. The index escaped the distribution day, just because the volumes were lesser than the previous day. The last Tuesday’s low of 23,689 is the only last hope now. Below this, the index may also violate the previous low of 23,263. If the index declines below the 23,460 points, it will form a new minor low. The selling pressure was severe during the session as the market breadth is extremely negative. The PSU stocks were the worst hit. Soon after opening with a flat to positive bias, the equities fell sharply as the new break about the HMPV case was detected in the country. The Index registered the lowest closing after December 20. The RSI is on the 40-line support. The MACD histogram shows an increased bearish momentum. For an upside move, the index must move above the 200 DMA of 23,907 and 50DMA of 24,115 points. Otherwise, it is better to avoid long positions. For the short positions, it’s better to maintain stop loss at 23,907 points. The targets are open below the 23,263 points. Stay with negative bias.

(The author is partner, Wealocity Analytics, Sebi-registered research analyst, chief mentor, Indus School of Technical Analysis, financial journalist, technical analyst and trainer)