IBBI Comes Up With Timely Grievance Redressal And Enforcement Framework

They will ensure greater transparency, objectivity and equitable treatment of stakeholders

IBBI Comes Up With Timely Grievance Redressal And Enforcement Framework

Extending the grievance filing timelines, particularly for small stakeholders who may face difficulties in gathering documentation, will help ensure fair access to the redressal process

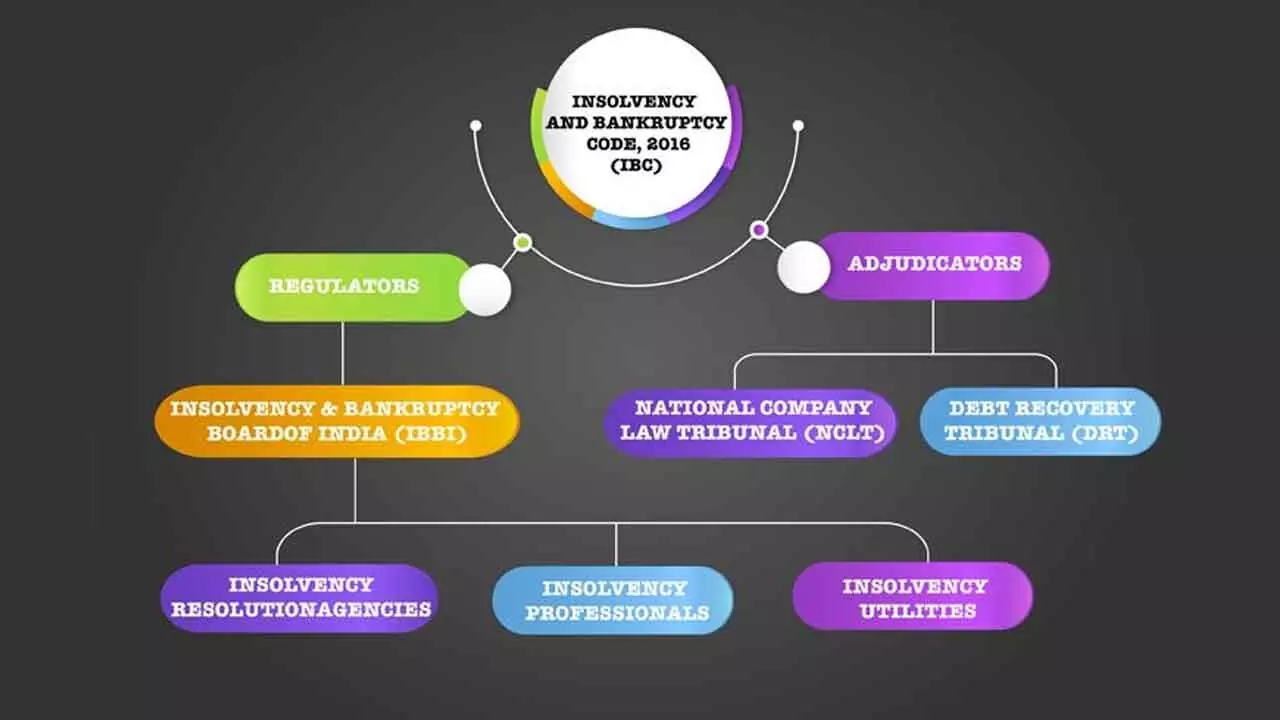

In order to reduce the delays in the resolution process under Insolvency and Bankruptcy Code 2016 (IBC), the Insolvency and Bankruptcy Board of India (IBBI) is proposing frequent changes in procedural aspects as also the regulatory aspects.

As one of the important segments of the stakeholders under IBC pertain to insolvency professionals and the work of authorised assignments to them by the Insolvency Professional Agency, the proposed reforms in the functioning of the same will have a positive impact on the operational efficiencies in the process. At the same time, they will ensure greater transparency, objectivity and equitable treatment of the stakeholders.

Jyoti Prakash Gadia, managing director of Resurgent India, a SEBI registered Category 1 merchant bank, says, “The proposed clarification regarding the role of a full-time member in the disciplinary committee demonstrates that he will be directly involved in inspection and investigation and thereby play an unambiguous and clear role in the work of the disciplinary committee. This will remove the uncertainty about the role of the full-time member and therefore improve efficiency.”

The other changes relate to rationalisation of timelines for the process and stages involved in the grievance redressal mechanism of cases against IPs. Linking the time of application to the closure date of final action instead of the date of cause of action is a very positive and logical approach to provide realistic time.

These reforms are in the interest of creating a more robust mechanism with an element of mutual trust and impartiality, she said.

The IBBI’s proposed changes to grievance redressal and AFA timelines represent a well-timed initiative as it addresses critical operational and procedural challenges in the insolvency ecosystem.

Extending the grievance filing timelines, particularly for small stakeholders who may face difficulties in gathering documentation, will help ensure fair access to the redressal process. Similarly, the relaxation of AFA timelines is necessary, as the current 45-day window is insufficient given the rigorous compliance requirements for insolvency professionals.

Harsh Bhuta, partner of Bhuta Shah & Co, says, “To further streamline the process and reduce administrative delays, introducing digital tracking for compliance will be a practical enhancement. Additionally, ensuring greater accountability in disciplinary actions is crucial for enhancing transparency and efficiency.”

These changes will not only make the insolvency process more efficient but also foster a fairer and a more inclusive system. They provide all stakeholders with a clear and accessible path for redressal, ultimately strengthening trust in the insolvency framework.