Hindenburg claims baseless, misleading, says REITs body

For REITs, India has established a strong and transparent regulatory framework that aligns with global best practices: Association

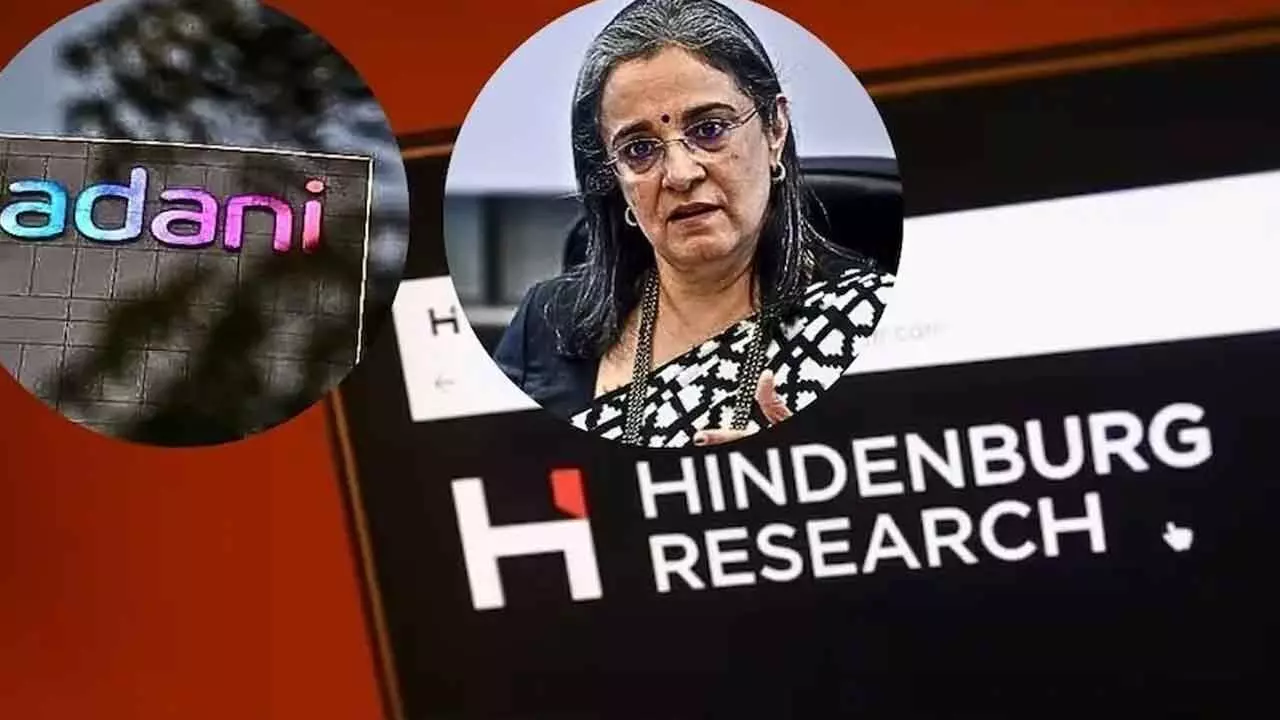

image for illustrative purpose

Currently, there are four listed REITs on the Indian stock exchanges, collectively managing assets worth over Rs 1.4 lakh crore and serving over 2.4 lakh crore unitholders

REIT norms in India

♦ Enhanced transparency in India

♦ Investor interests are protected

♦ Global investors keen on Indian REITs

New Delhi: Indian REITs Association on Monday said that claims made by the US-based short seller Hindenburg Research suggesting that the REIT framework made by markets regulator Sebi serves the interests of a select few are “baseless and misleading”.

In fact, the association has commended Sebi and its leadership for crafting a “rigorous regulatory environment” that includes comprehensive periodic reporting requirements, mandatory independent valuations, and strict governance standards. These measures are designed to enhance transparency and protect investor interests, it added.

The statement came after the Hindenburg report on Saturday alleged that recent amendments to Sebi’s REIT Regulations 2014 were made to benefit a specific multinational financial conglomerate.

In this regard, the markets regulator stated that Sebi (REIT) Regulations, 2014 has been amended from time to time. In a statement, the association said that since the introduction of REIT (Real Estate Investment Trust) regulations in 2014, India has established a strong and transparent regulatory framework that aligns with global best practices. “Developed in consultation with all market participants, this framework ensures the highest levels of investor protection for both --domestic and international institutional investors, as well as retail investors,” it said.

Hindenburg Research on Saturday launched a broadside against market regulator Sebi chairperson Madhabi Puri Buch, alleging she and her husband had stakes in obscure offshore funds used in the alleged Adani money siphoning scandal. Sebi chairperson Buch and her husband Dhaval denied the allegations as baseless and asserted their finances are an open book. Her husband Dhaval Buch is a senior advisor with Blackstone. The Adani Group termed the latest allegations malicious and based on manipulation of select public information. The company said it has no commercial relationship with the Sebi chairperson or her husband.

Indian REITs Association, which counts Brookfield India Real Estate Trust, Embassy Office Parks REIT, Mindspace Business Parks REIT, and Nexus Select Trust -- as their founding members, said that the sector’s growth has drawn significant interest and participation from prominent global institutional investors.