Focus on stock-specific trading

The benchmark index forms an inside bar on charts; All technical indicators outperforms compared to broader market, signaling bullish momentum

image for illustrative purpose

On a monthly expiry day, the NSE Nifty bounced from the day's low and closed with a decent gain. The Nifty closed at 17,736 with an 80.6 points gain. The Nifty IT is the only loser with 0.52 per cent. The recovery is mainly led by the Nifty Metal index with 2.71 per cent. The Energy and Realty indices also gained by 1.31 per cent and 2.96 per cent. Infra and PSE indices are up by over one per cent. The sector indices gained by less than a per cent. The market breadth is positive as 1016 advances and 876 declines. About 68 stocks hit a new 52 week high, and 58 stocks traded in the upper circuit. ICICI Bank, Reliance and HDFC Bank were the top trading counters on Thursday in terms of value.

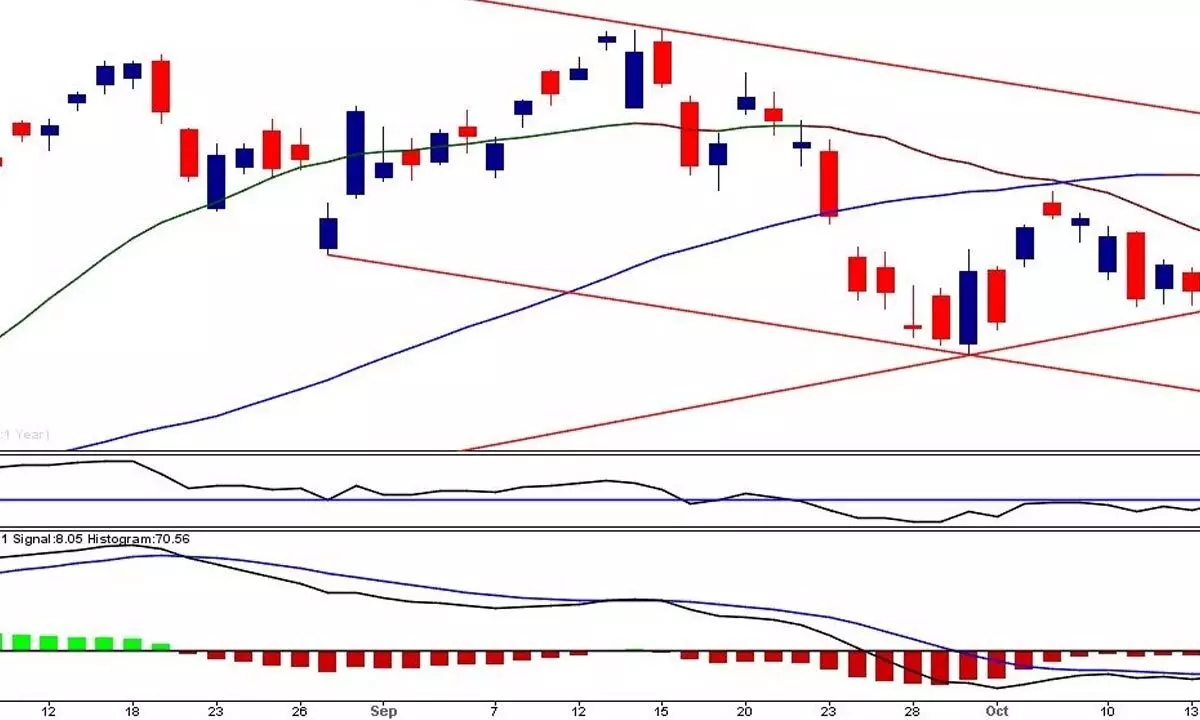

The expiry day volatility hit the market in the last hour of the trading. The Nifty sharply bounced over 80 per cent in the last hour. In a truncated week, the Nifty gained 173 points in four trading sessions, including Muhurat trading. The Nifty has formed an inside bar today. As mentioned earlier, Tuesday's high is crucial immediate resistance for the market direction. As the price action is limited to the previous session, there are no major technical developments that occurred on Thursday. The last three day's intraday price action is more or less similar. In the last five trading sessions, the Nifty failed to protect the opening gains in the four sessions. This shows the inherent weakness in the market. The volume is higher than in the previous session. The Nifty is in a neutral zone now. It has to clear the 17,812-18,115 zone for a strong bullish bias. In any case, it fails to do so, Tuesday's low is the immediate support, which is at 17,637. In a nutshell, the 17,637-812 are the crucial support and resistance for today.

As the weekend approaches, it may be a Herculian task to clear these levels. The Nifty is still above the key moving averages. It is 1.33 per cent above the 50DMA and 2.83 per cent above the 20DMA. The RSI has reached above the 60 zone, which is a strong bullish zone. The MACD histogram maintains the bullish momentum. The Elder impulse system has formed another bullish bar. As the Nifty is in the leading quadrant with RRG RS and Momentum are in the above 100 zone, and showing outperformance compared to the broader market. For now, as long as trading is within Tuesday's range, avoid index trading and focus on stock-specific activity.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)