Sebi WTM Ananth Narayan warns of market imbalance and investor complacency

Sebi WTM Ananth Narayan warns of market imbalance and investor complacency

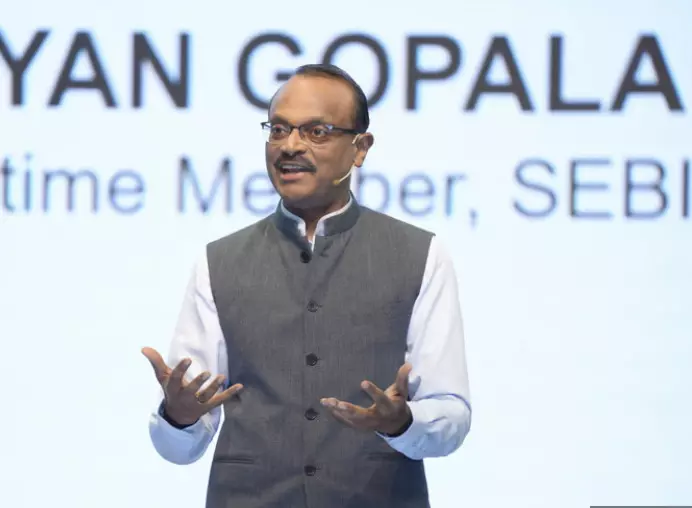

At a recent National Stock Exchange (NSE) event, Securities and Exchange Board of India (Sebi) Whole-Time Member Ananth Narayan raised concerns about an emerging imbalance in the stock market due to a significant mismatch between the demand and supply of securities. During the bell-ringing ceremony for World Investor Week, Narayan highlighted several risks faced by equity market investors, including technology-related scams, cybersecurity threats, and misleading financial influencers.

Narayan pointed out that in FY24, the influx of capital into the stock markets from various sources—individual investors, mutual funds, insurance companies, pension funds, and foreign portfolio investors (FPIs)—totaled Rs 3.6 trillion. In contrast, the supply of new securities through initial public offerings (IPOs), rights issues, and qualified institutional placements (QIPs) was only Rs 1.95 trillion. This discrepancy indicates a growing imbalance that, while currently driving short-term market growth, could lead to concerns about sustainability.

Narayan stressed the importance of investor awareness initiatives, cautioning that the recent trend of low-risk, high-return environments might be fostering a false sense of security among investors. "It is like the best of all worlds—low risk and very high return. That, unfortunately, has a negative side effect. It can build complacencies. We see a lot of young people opening accounts now; they seem to be convinced that this is a one-way street with very high returns and no risks at all. That is not the case. Just because one year had low risk does not mean there will not be risks, going forward," he warned.

Over the past five years, Indian markets have delivered a compound annual growth rate (CAGR) of approximately 15%, outperforming their Chinese counterparts. However, Narayan's comments serve as a reminder that markets are not infallible and that prudent investing requires awareness and caution.