Don’t go for aggressive trading before Budget

Union Budget could give fresh trigger to markets-positive or negative

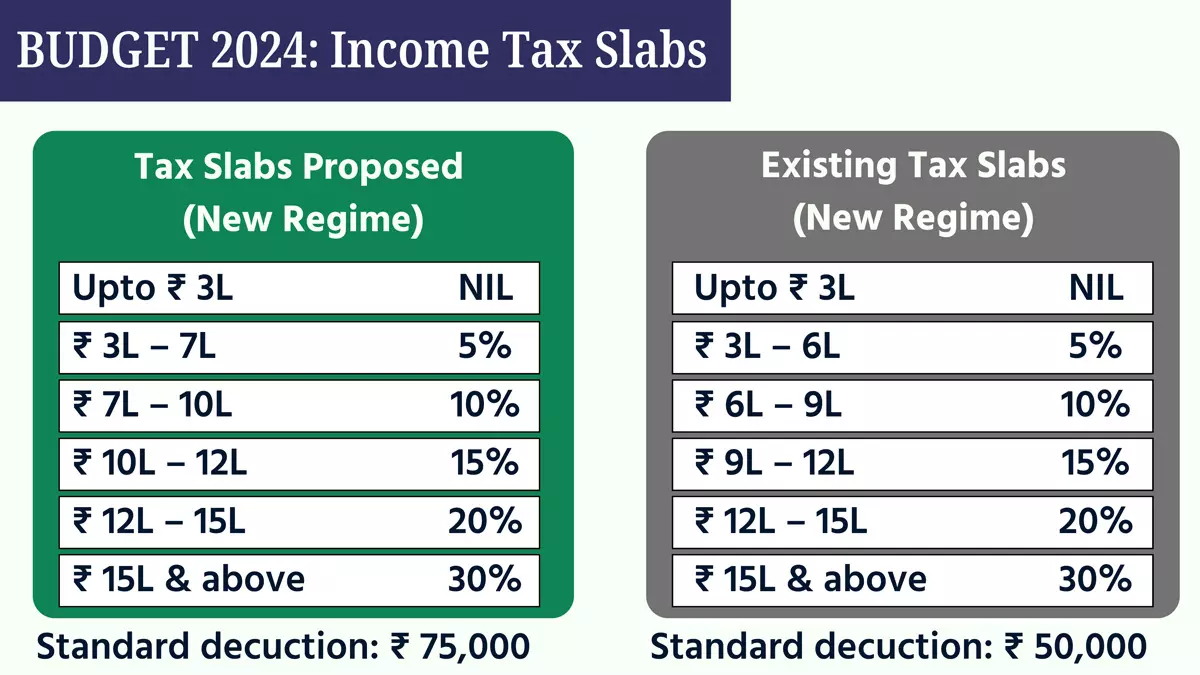

image for illustrative purpose

The index has given a weaker signal just before the Union Budget. It has formed a bearish shooting star candle on a weekly chart and a bearish engulfing candle on a daily chart

Extremely Negative Market Breadth :.

- 2181 declines

- 530 advances

- RSI sharply down

- 157 stocks in lower circuit

- 86 stocks hit a new 52-week highs

- Daily MACD gives a fresh bearish signal

Suddenly, with a weakness in the global markets, the domestic markets sharply declined on the weekend. Nifty was down by 269.95 points or 1.09 per cent and closed at 24530.90. All the sectoral indices closed with declines. The PSE and CPSE were the worst hits, with 3.19 per cent and 3.04 per cent, respectively. The oil and gas shares were down by 2.78 per cent. The Nifty Auto, Realty. Infra, Small cap and Midcap indices declined by 2.11 per cent to 2.4 per cent. The IT and FMCG were outperformed with a 0.22 per cent decline. All other sector indices are down by 0.50 per cent and 1.93 per cent. The India VIX is up by 2.17 per cent to 14.82. The market breadth is extremely negative as 2181 shares declined and 530 advanced. About 86 stocks hit new 52-week highs, and 157 stocks traded in the lower circuit. Infosys, RVNL, TTML, and HAL were in the top trading counters on Friday in terms of value.

The Nifty has given a weaker signal just before the Union Budget. It has formed a bearish shooting star candle on a weekly chart and a bearish engulfing candle on a daily chart. These candlestick patterns at the lifetime highs are more valid than at the normal swing highs. Moreover, the index rallied over 10 per cent in the shortest period without any meaningful consolidation. The down days are limited to one or two days. All the impulsive moves will undergo counter-trend consolidation, which is the basic technical analysis rule. The Nifty erased all the last three days’ gains. It took support at 8EMA for the second consecutive day. The RSI sharply down from the near extreme level.

The daily MACD has given a fresh bearish signal. The KST and Stochastic RSI also have given fresh sell signals. On an hourly chart, Nifty closed below the moving average ribbon, and the MACD line is approaching the zero line, which is also a weak signal. In a nutshell, the index has given weaker signals on all timeframes. These bearish candles must be confirmed for their implications. A positive close above Friday’s high will negate the bearish implications. As Budget is scheduled on Tuesday, expect Monday’s session to go sideways. The budget could be a fresh trigger for the trend to continue or a reversal. Avoid aggressive position sizing before the event risk. At the same time, the monthly derivatives will expire next Thursday.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)