Daily RSI Is In The Bearish Zone

Hourly RSI forms a positive divergence; A move above 60 will result in a positive directional bias; Trim down the short positions; It’s not the time to go aggressive as long as it sustains below the 23,251

Daily RSI Is In The Bearish Zone

The derivatives data suggests short-covering. As suspected earlier, the index has almost ended the downswing in the nine days. A close above the 22,980 will confirm another round of counter-trend. Above this, the index can test the 23,139-251 zone of resistance

The equity front-line indices ended the eight-day losing streak. NSE Nifty is up by 30.25 points or 0.13 per cent and closed at 22,959.50 points. The Healthcare and Pharma indices are the top gainers, rising by 1.31 per cent and 1.27 per cent, respectively. The CPSE, Consumer Durables, Metal, Oil and Gas, Energy, and PSE indices advanced by over half a per cent. The Microcap index is the top loser with 0.89 per cent. The Media, IT, and Auto indices are down by over 0.53 per cent. The India VIX is up by 4.71 per cent to 15.72. The market breadth is negative as 2,003 declines and 815 advances. About 734 stocks hit a new 52-week low, and 316 stocks traded in the lower circuit. Godfrey Phillips, M&M, HDFC Bank, ICICI Bank, and Reliance were the top trading counters in terms of value.

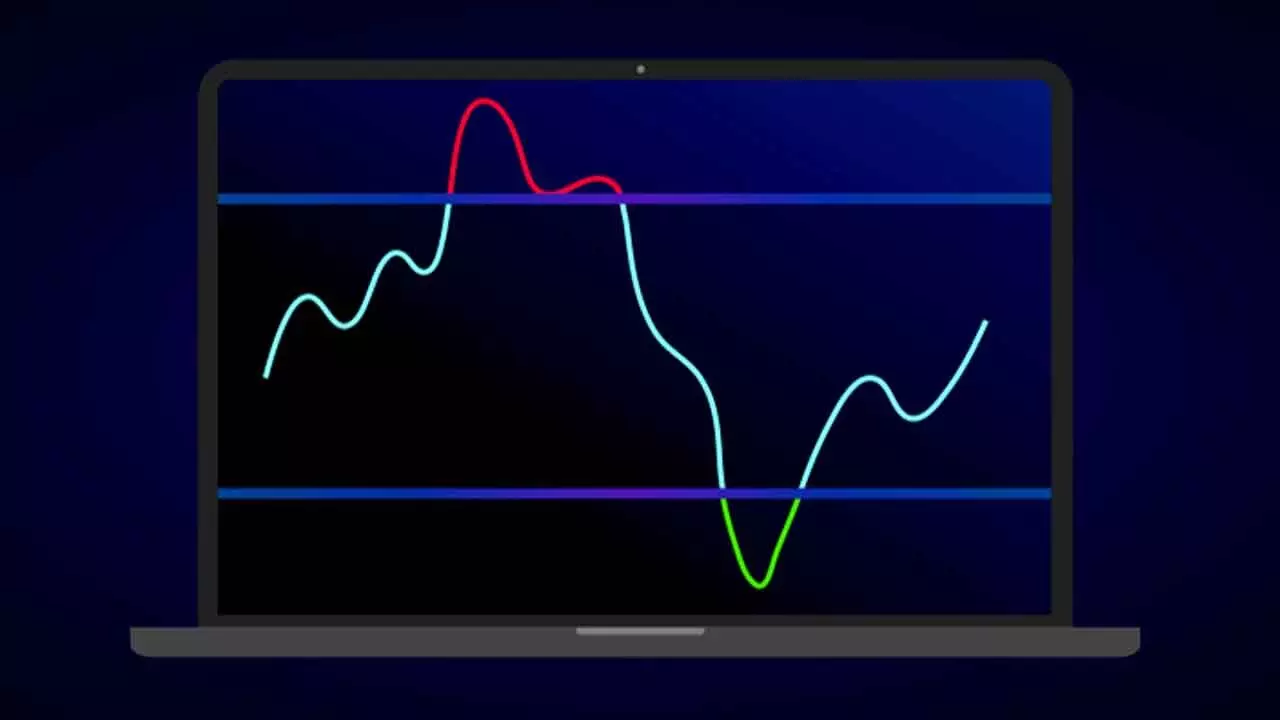

The Benchmark index, Nifty, made another low at 22,725. It bounced from the lower Bollinger band, as we expected. On a thin volume day, the market breadth is negative, and the volatility index, India VIX, is up 5.21 per cent during the day. The heavy-weight stocks HDFC Bank and Reliance led the market recovery. The Index closed at the day’s and formed a strong bull candle. It is almost near the 23.6 per cent retracement level (22,981) of the current downswing. The only concern is low volume. It is still below the hourly moving average. The hourly RSI has formed a positive divergence, and any move above 60 will result in a positive directional bias. The daily RSI is in the bearish zone. The derivative data suggests short-covering. As suspected earlier, the index has almost ended the downswing in the nine days. A close above the 22,980 will confirm another round of counter-trend. Above this, the index can test the 23,139-251 zone of resistance. The time has come to trim down the short position. At the same time, it is not the time to go aggressive long as long as it sustains below the 23,251.

(The author is partner, Wealocity Analytics, Sebi-registered research analyst, chief mentor, Indus School of Technical Analysis, financial journalist, technical analyst and trainer)