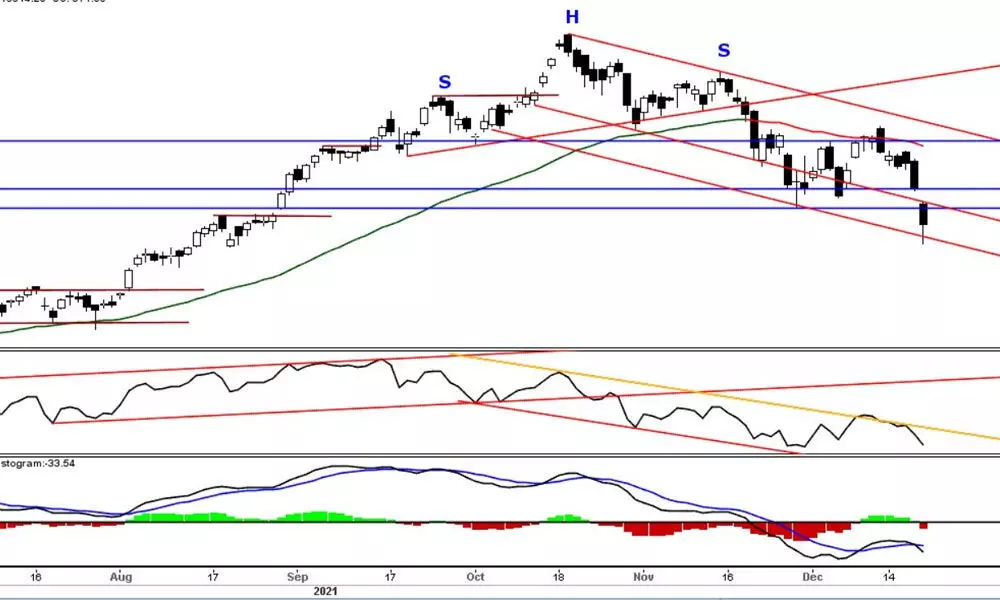

Daily MACD indicating a fresh sell signal

The equity markets nosedived again on fears of Omicron virus spread and global sell-off

image for illustrative purpose

The equity markets nosedived again on fears of Omicron virus spread and global sell-off. The NSE Nifty fell by 371 points or 2.18 per cent and settled at 16614.20 points. All the sectors indices closed in the deep red zone. With some positive on heavyweight stocks, the Nifty Pharma index is outperformed with just a 0.35 per cent decline. The Realty, PSU Bank index and the Smallcap-100 indices fell by over four per cent. The other sector indices declined two-three per cent on heavy selling pressure. The volatility index, India VIX up by 16.08 per cent and closed at 18.965. The overall market breadth is extremely negative as 1837 declines and just 238 advances. About 90 stocks hit a 52 week low, and 280 stocks traded in the lower circuit. This data shows the weakness persists in the market.

As we expected, the NSE Nifty declined sharply below the prior swing low. It opened with a huge gap down and breached all key supports. Though it recovered 200 points from the low, it closes deep in the red with a 2.18 per cent loss. It took support at the downward channel demand line. It also took support at 161.8 per cent Fibonacci extension of the fall of prior swings.

The index closed below the lower Bollinger band. The daily stochastic oscillator is in extreme overbought condition and gives a small bounce signal. The RSI is near oversold condition. With this technical evidence. The probability of a bounce is high. But, the daily MACD has given a fresh sell signal. Overall, the market structure is clearly bearish. A bounce towards 16880-17000 will give another opportunity to exit or sell short.

On Tuesday, the Nifty may form an inside bar. The 16410-840 range will act as a support and resistance. As the market breadth is extremely negative across the sector indices and broader market, it is better to avoid going long in the market. The index added another distribution day. Any further addition of distribution days in the next two weeks will be extremely negative for the market. As the declines are more impulsive, and all the Nifty stocks are not in the buy zone. About 80 per cent of the derivatives stocks have been in the strong bearish zone. The Nifty-500 index, which represents 90 per cent of the market capitalization (mcap), is very near to the 200DMA. This indication is not good for a bullish view. Trade with appropriate risk management.

(The author is financial journalist, technical analyst, family fund manager)