Broad-range trading as resistance, support levels widening

No major short additions in index futures as it was more of cash-based selling last week; FIIs again turned net sellers; Net longs in Index futures remained near 1.4 lakh contracts

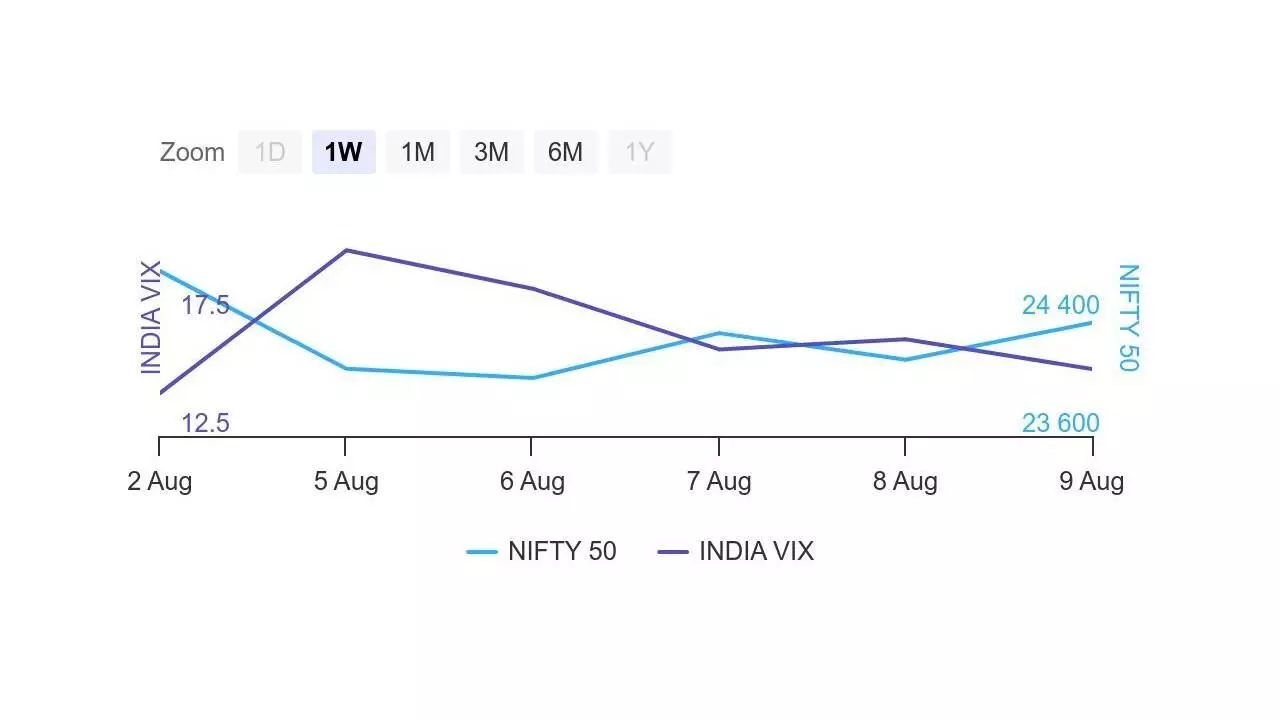

image for illustrative purpose

The resistance level rose by 1,000 points to 25,000CE and the support level declined by 3,000 points to 23,000PE indicating losing steam of rally in the market.

The 25,000CE has highest Call OI base followed by 25,500/ 26,000/ 25,300/ 25,200/ 25,100/ 24,900/ 24,800/ 24,700 strikes, while 25,000/ 24,700/ 24,900/ 25,100/ 25,300/ 26,000 strikes recorded heavy build-up of Call OI. ITM strikes on Call side from 24,300CE onwards recorded modest fall in Call OI.

Coming to the Put side, maximum Put OI is seen at 23,000PE followed by 23,500/ 24,000/ 24,100/ 23,600 /23,700/ 23,300/ 23,200/ 22,900/ 22,800 witnessed reasonable addition of Put OI. No Put strikes reported OI fall.

Dhirender Singh Bisht, associate vice-president (technical research-equity) at SMC Global Securities Ltd, said: “In the derivatives market front, Nifty options indicated the significant Call Open Interest at the 25,000 and 24,400 strikes, while the substantial Put Open Interest observed at the 24,300 and 24,000 strikes.”

Nifty recorded significant Call writing in last 2 sessions as domestic markets turned sluggish. According to ICICIdirect.com, Put writing was largely absent, while highest Call base is at 25,000 strike as noteworthy additions were seen at ATM 24,700 and 24,800 strike as well. Analysts say that positive bias should be avoided till we are not witnessing closure among Call strikes.

“A global sell-off and profit-taking were major factors behind the Indian market’s losses, with the Nifty shedding around 1.5 per cent and The central bank, RBI kept the key rate unchanged, and positive US jobless claims data contributed to a rebound from the recent lows. Nifty traded above the 24,000 mark. Last week, pharmaceutical and FMCG stocks outperformed the market, while profit-taking was seen in the metal, PSU bank, and financial services sectors,” said Bisht.

BSE Sensex closed the week ended August 2, 2024, at 79,705.91 points, a net loss of 1,276.04 points or 1.57 per cent, from the previous week’s (July 26) closing of 80,981.95 points. For the week, NSE Nifty also fell by 350.20 points or 1.41 per cent to 24,367.50 points from 24,717.70 points a week ago.

Bisht forecasts: “We expect that in the coming week markets are expected to consolidate and likely to trade in range. The strong support area for Nifty is in the zone of 24,100-24,000, while on the higher side, the 24500-24600 zone will likely act as a strong hurdle for Nifty.”

No major short additions were observed in index futures and it was more of cash-based selling in the last week. FIIs again turned net sellers as they offloaded almost every day last week. The net long in Index futures remained near 1.4 lakh contracts last week. However, liquidation was observed in the stock futures segment where they have reduced their long exposure sharply last week and their net longs has reduced to 6.3 lakh from 7.8 lakh contracts seen during the week.

India VIX fell 7.63 per cent to 15.34 level on last Friday. However, the volatility index rose sharply last week and closed the week above 15 level. US VIX also rose sharply to over year high amid ongoing sell-off in US equities. For any recovery, India VIX should move below 12.5 level once again this week.

“Implied Volatility (IV) for Nifty’s Call options settled at 14.82 per cent, while Put options concluded at 15.67 per cent. The India VIX, a key market volatility indicator, closed the week at 16.60 per cent. The Put-Call Ratio of Open Interest stood at 1.38 for the week,” observed Bisht.

No major changes by FIIs in F&O space despite week-end weakness as their net long positions in index futures rose marginally to 1.45 lakh contracts from 1.3 lakh contracts. Similarly, retail participants also continued their net short positions with just 49,000 contracts. However, FIIs in stock futures segment liquidated their long positions as their net longs declined to 6.3 lakh contracts from 7.6 lakh contracts seen last week.

Bank Nifty

NSE’s banking index closed the week at 50,484.50 points, lower by 865.65 points or 1.68 per cent from the previous week’s closing of 51,350.15 points. “Bank Nifty fell by over 1.5 per cent and managed to close above the 50,000 psychological level. As for the Bank Nifty, significant Call Open Interest stood at the 50,500 and 51,000 strikes, while the highest Put Open Interest was seen at the 50,000 strikes,” remarked Bisht.