Bearish Nifty closes below 30WMA

The current downswing is a lower high after October lifetime past two consecutive weeks of negative closings showing the market's inherent weakness

image for illustrative purpose

The domestic equity markets extended the corrections for the second consecutive week amid global volatility. The NSE Nifty declined 515.20 points or 2.92 per cent. The BSE Sensex declined by 3.2 per cent. Broader market indices, the Nifty Midcap-100 and Smallcap-100, were down by 2.4 per cent and 3.7 per cent, respectively. Nifty-500 index was also lower by 3.01 per cent. The PSU index was the top performer with 6.9 per cent. The Nifty IT index, down by 6.2 per cent, was the worst performer. Realty and Metal indices declined by 5.2 per cent and 4.4 per cent, respectively. On Friday, FIIs sold Rs.5045.34 crores, and the DIIs bought Rs.3358.67 crores. During this month, FIIs sold Rs.37,721.87 crores worth of shares, and the DIIs bought only 18,279.75 crores. During the week, the Volatility index touched 24.1375, the highest after May 2021.

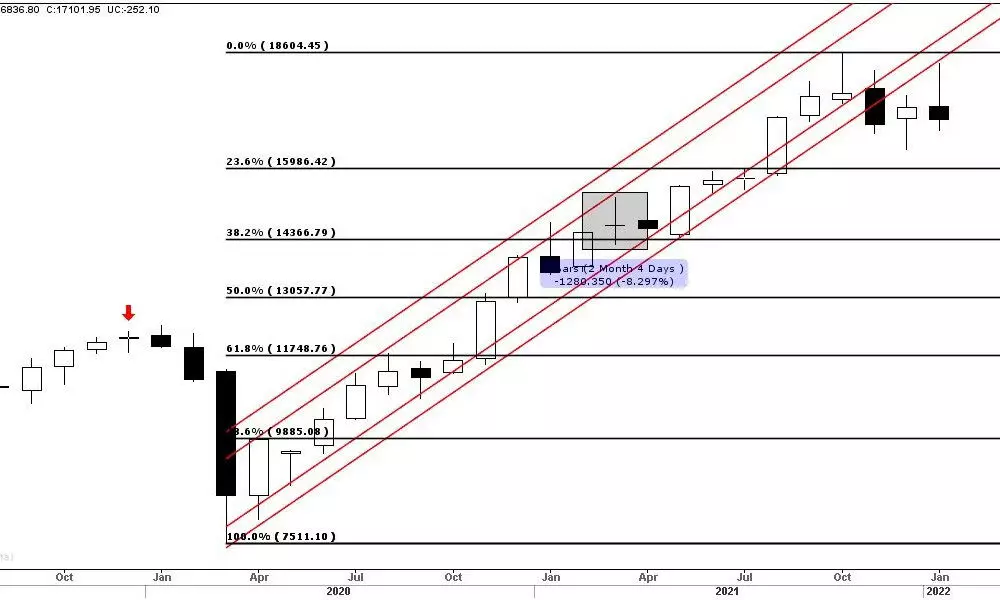

Technically, Nifty is showing weakness as it trades below all key short and medium-term averages. On a monthly chart, it is forming a Shooting Star and a lower high candle. During the last four months, the Nifty has formed two big size Shooting Stars and a Bearish Engulfing. The December rally was sold and formed another Bearish Engulfing candle. As a rule of investment, the Nifty has turned bearish as it closed below the 30-week moving average, and the weekly momentum is clearly on the downside. Even on the daily chart, it has formed a Shooting Star, as it declined by over 300 points from the day's high. It faced stiff resistance at 50 per cent retracement level of the prior uptrend and 38.2 per cent of the down move. This Fibonacci confluence zone of resistance will become the strongest resistance before the budget. The zone is between 17380-415. The 20 and 50 DMAs are in a downtrend. It is also below the 100 and 150 moving averages. The last hope of 200DMA is placed at 16609.

Since March 2020, only twice it registered three consecutive weeks of negative closing. From October lifetime high, three-times, it made two consecutive weeks of negative closings. For the last two weeks, the index is closed below the prior week's low, showing the market's inherent weakness. On the monthly chart, too, it made lower high and bearish candles.

After breaking out of a downward channel, the Nifty retested the sloping breakout line. It was just on the line on Friday. The current downswing's high is also a lower high after a lifetime high. At the same time, the current downslide is yet to close above the previous day high to give the bullish reversal signs. The index is not even tested the shortest period average of 5EMA. To resume the upward move, it requires to close above the prior day high. The daily MACD is declined below the zero line, and the Histogram shows an increased bearish momentum even in the gaining days. The RSI is also below the 40 zone and in a bearish zone. Let us watch for 30-33 zone for valid historical support.

In the last ten years, the Nifty closed negatively for seven times in the budget week. Combining this historical fact with the technical evidences, it is better not to have a bullish view, at least till the budget presentation is done. Watch for 17427-17586 zone of resistance. Only a move above this will be positive and can test 17764. But, a move below 17000 will be negative and can decline below the prior low of 16410 and test 16210. But any decisive close below 16210 on a weekly basis will indicate a long-term downtrend. The current week low of 16836 would act as key support as it coincides with the 80 per cent retracement of the December-January rally (16410-18350), placed at 16798. These are the level to be watched next week.

The current distribution day count stands at four, as two distribution days were added during the week. The broader market also faces extensive technical damage, not just the benchmark index. Investors should proceed with caution as the market has been downgraded to an Uptrend Under Pressure. Unless a stock shows exceptional fundamental and technical strength, no new addition to the portfolio is advised.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)