Bearish bias more likely

Sensex comfortably trading below 20-day SMA and it also holding lower top formation

image for illustrative purpose

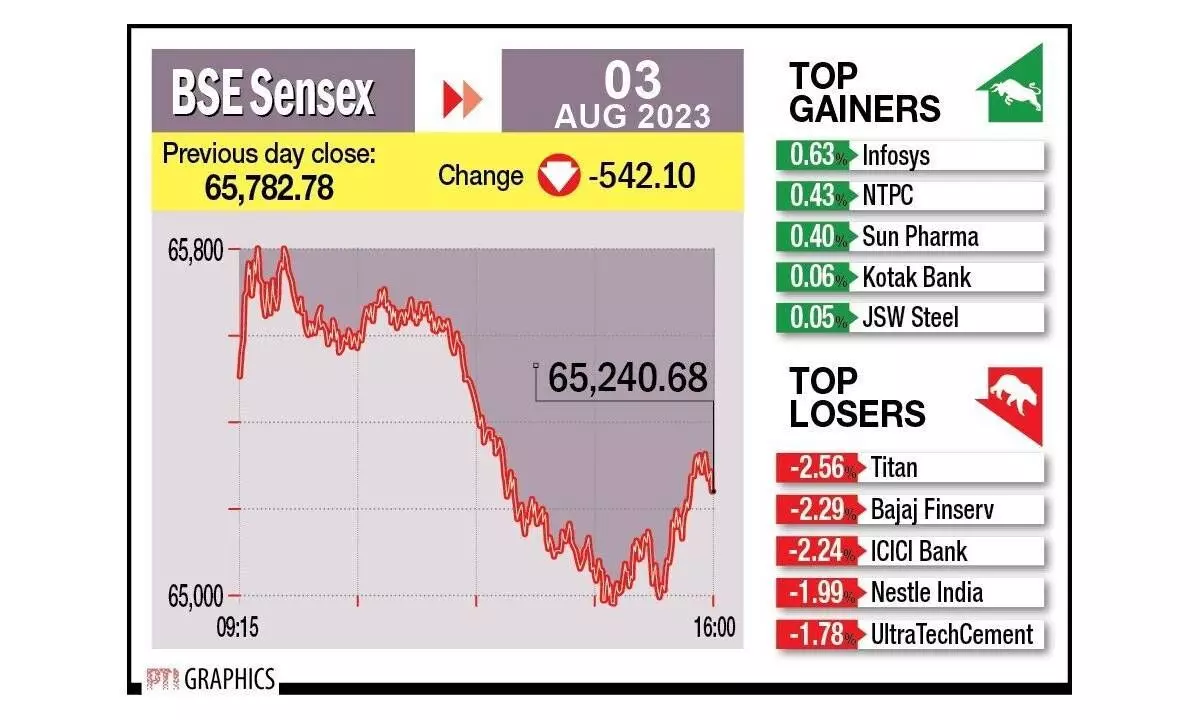

Mumbai The benchmark indices continued weak momentum, BSE Sensex was down by 542 points. Among sectors, reality and banking stocks corrected sharply whereas despite weak market sentiment buying were seen in selective pharma stocks. Technically, after a muted opening the index breached the important support level of 19,450/65,400 and post breakdown it intensified the weak momentum.

However, it trimmed some losses in the last hour of trade. Currently, the index is comfortably trading below 20-day SMA (Simple Moving Average) and it also holding lower top formation on intraday charts, which supports further down side from the current levels.

“We are of the view that, the short-term texture of the market is weak, but oversold. Hence, the market could bounce back sharply, if it traders above 65,100,” says Shrikant Chauhan of Kotak Securities. On the higher side, the market could move up till 65,400-65,500. On the flip side, below 65,100 the selling pressure is likely to accelerate. Below which, the market could slip till 64,900-64,800.