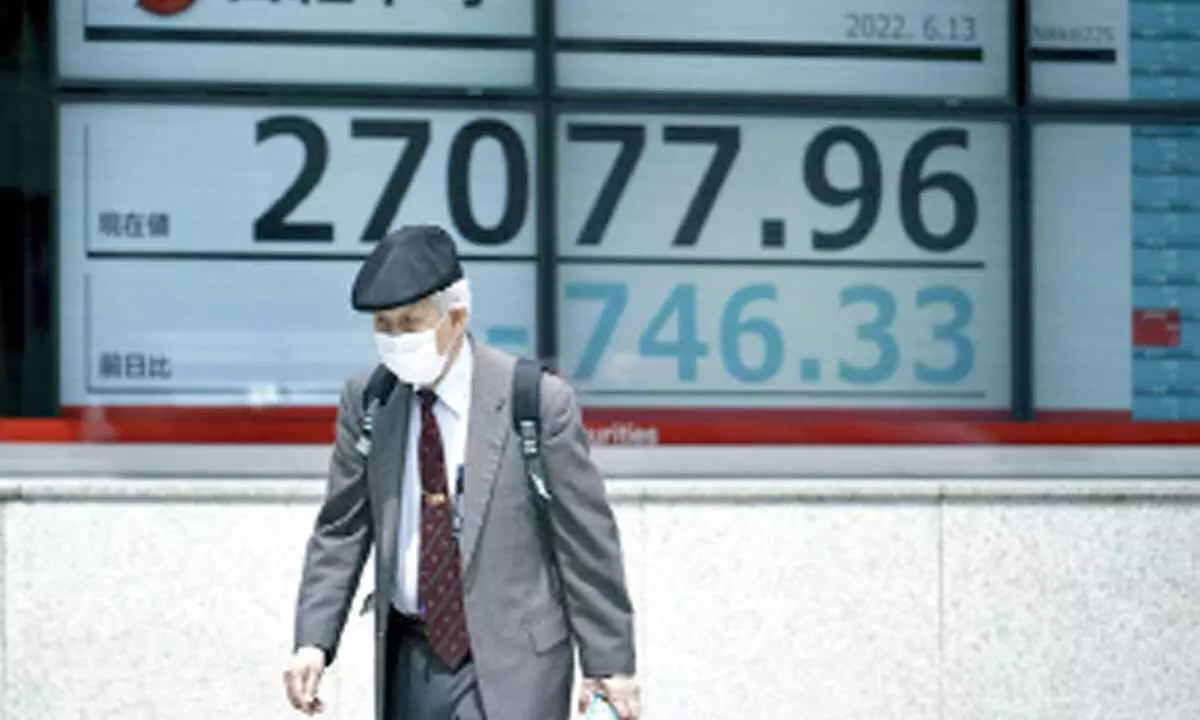

Asian indices tumble 2% amid inflation-driven retreat on Wall St

Nikkei 225 index lost 2.6%, Hang Seng skidded 3%, Kospi declined 3.18%, Shanghai index dropped 1%, while US futures slipped more than 1%

image for illustrative purpose

Bangkok: Shares sank in Asia on Monday after a report that US inflation worsened last month sent stocks reeling on Wall Street.

Major regional markets dropped more than 2 per cent in early trading Monday, while US futures slipped more than 1 per cent. On Friday, the S&P 500 sank 2.9 per cent, locking in its ninth losing week in the last 10 days. Investors had hoped the highly anticipated consumer price report would show the worst inflation in generations had slowed a touch last month, passing its peak. Instead, the US government said inflation accelerated to 8.6 per cent in May from 8.3 per cent the month before. Investors took Friday's report to suggest the Federal Reserve will persist in raising interest rates and making other moves in order to slow the economy, to try to force down inflation. Tokyo's Nikkei 225 index lost 2.6 per cent to 27,018.01 and the Hang Seng in Hong Kong skidded 3 per cent to 21,145.27. In South Korea, the Kospi declined 3.18 per cent to 2,516.95 as a truckers strike raised concern over supply chain disruptions. The Shanghai Composite index dropped 1 per cent to 3,253.04. Thailand's benchmark fell 1.4 per cent, and markets in Australia were closed for a holiday. Regional concerns have also been weighing on sentiment, as China combats more outbreaks of corona virus after easing some precautions in recent weeks. That means "previous optimism surrounding China's reopening may also take a pause, as the resumption of mass-testing in Beijing and Shanghai seems to place Covid-19 risks at the forefront once again," Jun Rong Yeap of IG said in a commentary.

On Friday, the S&P 500 shed 117 points to 3,900.86 and tumbling bond prices sent Treasury yields to their highest levels in years. The Dow Jones Industrial Average lost 2.7 per cent to 31,392.79, and the Nasdaq composite dropped 3.5 per cent to 11,340.02. The growing expectation is for the Fed to raise its key short-term interest rate by half a percentage point at each of its next three meetings, beginning next week. Only once since 2000 has the Fed raised rates by that much, last month. Surging prices and expectations about Fed policy have sent the two-year Treasury yield to its highest level since 2008 and the S&P 500 down 18.7 per cent from its record set in early January. High-growth technology stocks, crypto currencies and other big winners of the pandemic's earlier days have been hurting the most, but the damage is broadening as retailers and others warn about upcoming profits. Record-low interest rates engineered by the Fed and other central banks have helped keep investment prices high. Now the "easy mode" for investors is being switched off. Since higher interest rates make borrowing more expensive, dragging on spending and investments by households and companies, there also is a risk the Fed could push the U.S. economy into a recession. Investors also worry food and fuel costs may keep surging, regardless of how aggressively the Fed moves, partly because of the crisis in Ukraine, which is a major breadbasket for the world. Another report Friday showed consumer sentiment worsening more than economists expected. Much of the souring in the University of Michigan's preliminary reading was due to higher gasoline prices.