All indicators showing bearish strength

Nifty closed below the Anchored VWAP and all other indicators are showing bearish strength. As the monthly expiry in place, avoids aggressive positions on either side; Trading positionally in a series of gap openings is not an easy task

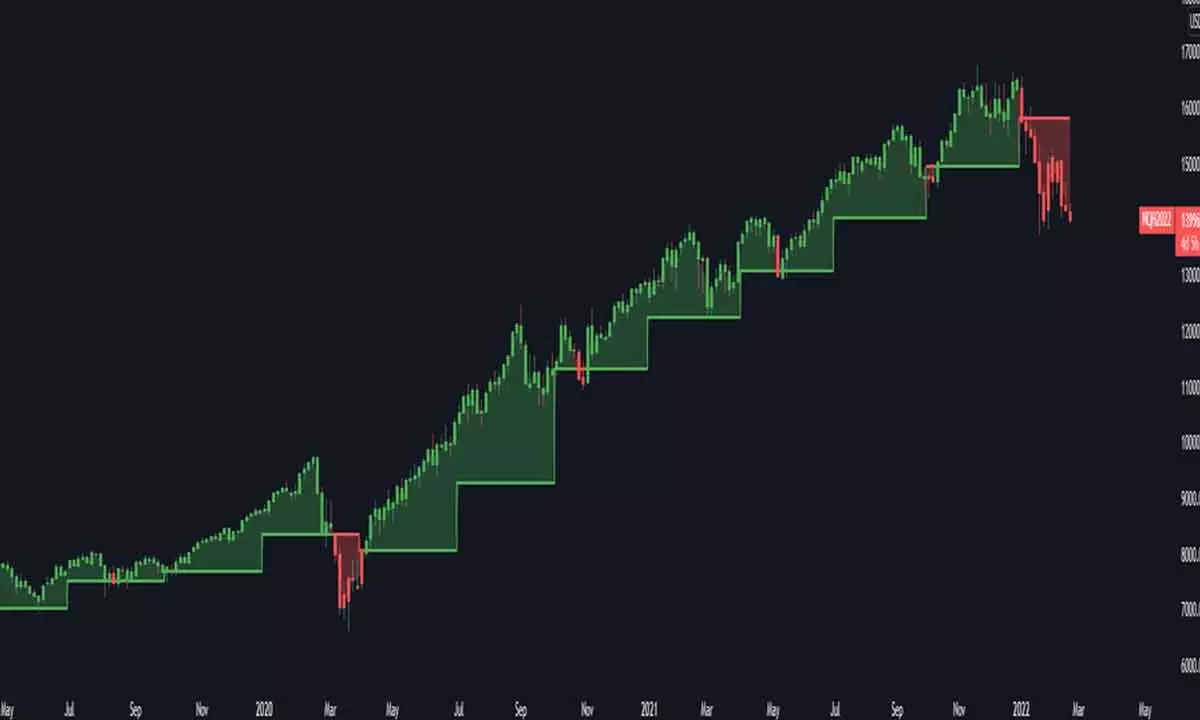

image for illustrative purpose

The domestic equity markets tumbled again in line with the global markets fall. The benchmark index NSE Nifty down by 162.40 points or 0.94 per cent and closed at 17038.40 points. Only the Media index closed flat with a positive bias. All the other indices ended in the red zone. Banks, and Financial Services, indices are down by 1.03 per cent and 1.47 per cent. The remaining sector indices are down by less than one per cent. The market breadth is negative as 1473 advances and 584 declines. About 49 stocks hit a new 52-week high, and 114 stocks traded in the lower circuit.

The equity benchmark indices collapsed once again by almost one per cent. Another gap down opening below the 50DMA and closing below the prior day low is not a good sign. Yesterday's positive gave hope as all the sectoral indices gained and breadth was improved. But, today it reversed all previous day gains in all sectoral indices, with a negative breadth.

The volatility index closed above the 20.60, with a 7.39 per cent surge. The volatility before the expiry is natural, but the market movements are a worry point. Trading positionally in a series of gap openings is not an easy task. At the same time, the market is not giving good trading opportunities on an intraday basis too.

On a short period timeframe, the risk-reward ratios are not favourable at all. The Only positive factor is, the Nifty is still above the minor low. Today, the 50DMA acted as a resistance. After three days of trading, it is still within the previous week's range. Yesterday's gap was a filled day. The erratic market behaviour is the character of the strong bear market. The Nifty closed below the Anchored VWAP, and all other indicators are showing bearish strength. As the monthly expiry in place, avoids aggressive positions on either side.

(The author is Chief Mentor, Indus School of Technical Analysis, Financial Journalist, Technical Analyst, Trainer and Family Fund Manager)