Explained: How is Nvidia CEO Saving 8 Billion Dollars in Taxes?

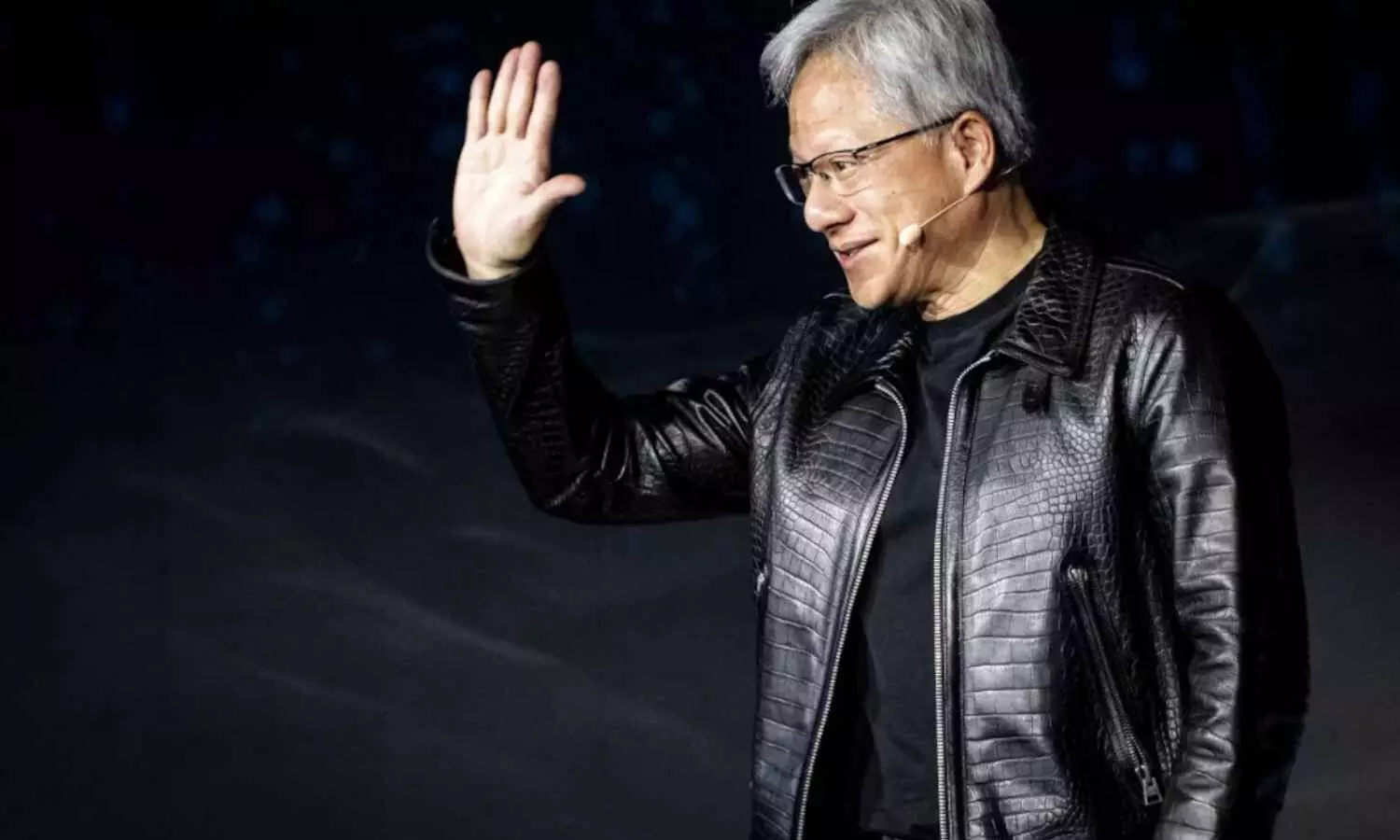

Nvidia CEO Jensen Huang is the 10th richest individual in the US with a net worth close to $127 billion. With smart investments strategies, Huang is saving $8 billion in taxes.

Explained: How is Nvidia CEO Saving 8 Bn in Taxes?

The world’s ultra-rich are not only good at handling their business empire, but are also intelligent enough to avoid taxes with their unique strategies.

Nvidia CEO Jensen Huang is the 10th richest individual in the US with a net worth close to $127 billion. In an ideal scenario, estate taxes in the US, collected from establishments having astronomical value should have surpassed 50 billion dollars, reports stated. However, in the case of the 61-year-old founder, this perceived reality won’t transform into fruition as he is set to pass on his savings to the family by evading taxes to the tune of $8 billion, New York Times reported.

How did the Nvidia CEO manage to avoid taxes?

In 2012 Huang set up an irrevocable trust by moving 5.84 lakh shares of Nvidia, valuing around $7 million at the time. Interestingly, this was part of a plan called “I Dig It”, which was known among the financial circles. Interestingly, this type of trust facilitates taxpayers in avoiding estate and gift taxes, thereby offering protection for assets whose value is set to appreciate soon.

In 2016 Huang and his wife reduced their tax liability by forming grantor-retained annuity trusts (GRATs). This financial tool facilitates taxpayers in the US to transfer assets to the beneficiaries without attracting any tax. Holdings in such trusts are now valued at over $15 billion.

How much did the ultra-wealthy avoid taxes in the US?

Since 2000, collections from the US estate tax system went downhill. As per NYT report, if tax collections were to keep pace with the growth of the ultra-wealthy, the economy could have generated $120 billion in 2023. However, only a small portion of the amount is received as taxes.