IRDAI Chairman Calls For 100% FDI In Insurance

IRDAI Chairman Calls For 100% FDI In Insurance

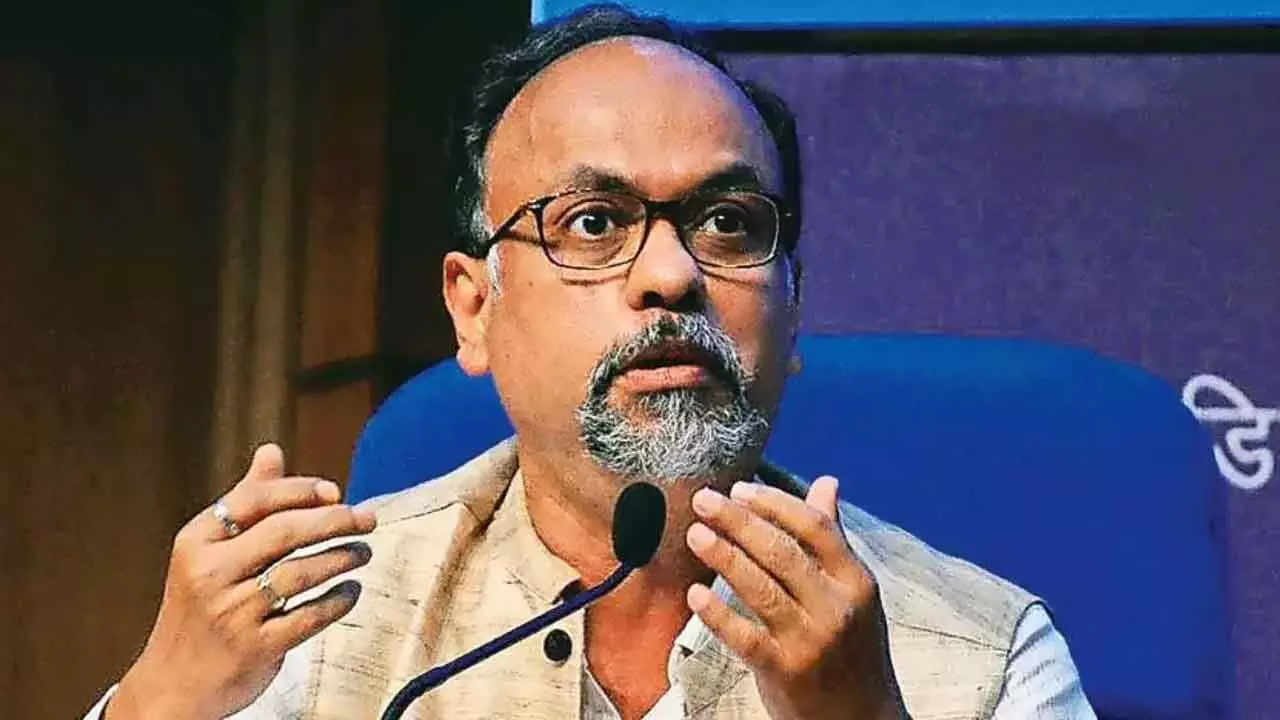

We need a lot of capital, which means we need a lot of new entities to come in. There may be some consolidation also happening. So, all of that churning will happen. And if the FDI route is also opened that will only augment the domestic investment as well -Debasish Panda, Irdai Chairman

Mumbai: Irdai Chairman Debasish Panda on Friday pitched for 100 per cent foreign direct investment in the insurance sector, saying a lot of capital is needed to achieve the goal of ‘insurance for all’ by 2027.

Speaking at Business Standard’s annual BFSI event, Panda said insurance is a capital-intensive sector, and the country would need more players in the segment to increase insurance penetration. India gradually started opening the insurance sector by allowing private and foreign investment in 2000. Currently, up to 74 per cent FDI is permitted in general, life and health insurance. “We need a lot of capital, which means we need a lot of new entities to come in. There may be some consolidation also happening,” he said.