Hospital Information System market size, share, and trends 2024 to 2034

Hospital Information System Market Size, Share, and Trends 2024 to 2034

The global hospital information system (HIS) market is projected to grow significantly over the next decade. This report provides a comprehensive analysis of market size, share, trends, and growth forecasts from 2024 to 2034, segmented by type, deployment, and component.

Key Market Insights:

Market Size: USD 134.64 billion in 2023, projected to reach USD 778.83 billion by 2034, expanding at a CAGR of 17.3%.

North America: Held the largest market share of 38% in 2023, characterized by high technology adoption and a focus on improving patient care.

Asia-Pacific: Expected to witness the fastest growth rate, driven by increasing healthcare IT adoption and digital transformation initiatives.

Key Segments:

By Type: Population health management held the largest market share (45%) in 2023.

By Deployment: Web-based deployment led with a 49% market share in 2023, while cloud-based solutions are expected to grow at a CAGR of 18.3%.

By Component: Software dominated with a 50% share in 2023, and services are projected to grow at a CAGR of 18%.

Regional Highlights:

North America:

Dominated by a well-established healthcare infrastructure and high technology adoption.

Emphasis on patient-centric care and interoperability is driving HIS adoption.

Asia-Pacific:

Rapid economic development and healthcare infrastructure investments.

Government initiatives promoting healthcare IT adoption.

Europe:

Strong focus on healthcare digitization and improving patient outcomes.

Adoption of advanced HIS features to enhance clinical workflows.

Market Dynamics:

Drivers:

Digital transformation in healthcare, shifting from paper-based systems to EHRs.

Government regulations promoting HIS adoption for improved patient care and data security.

Technological advancements such as AI and data analytics enhancing HIS capabilities.

Restraints:

Complex implementation processes involving data migration, system customization, and staff training.

Resistance to change among healthcare professionals.

Opportunities:

Adoption of cloud-based HIS solutions providing scalability, flexibility, and cost-effectiveness.

Integration of AI and predictive analytics for better patient outcomes.

Company Profiles:

Key players in the HIS market include:

Allscripts

Carestream Health

Cerner Corp. (Oracle)

GE Healthcare

McKesson Corp.

Merge Healthcare Inc. (IBM)

NextGen Healthcare

Philips Healthcare

Siemens Healthineers

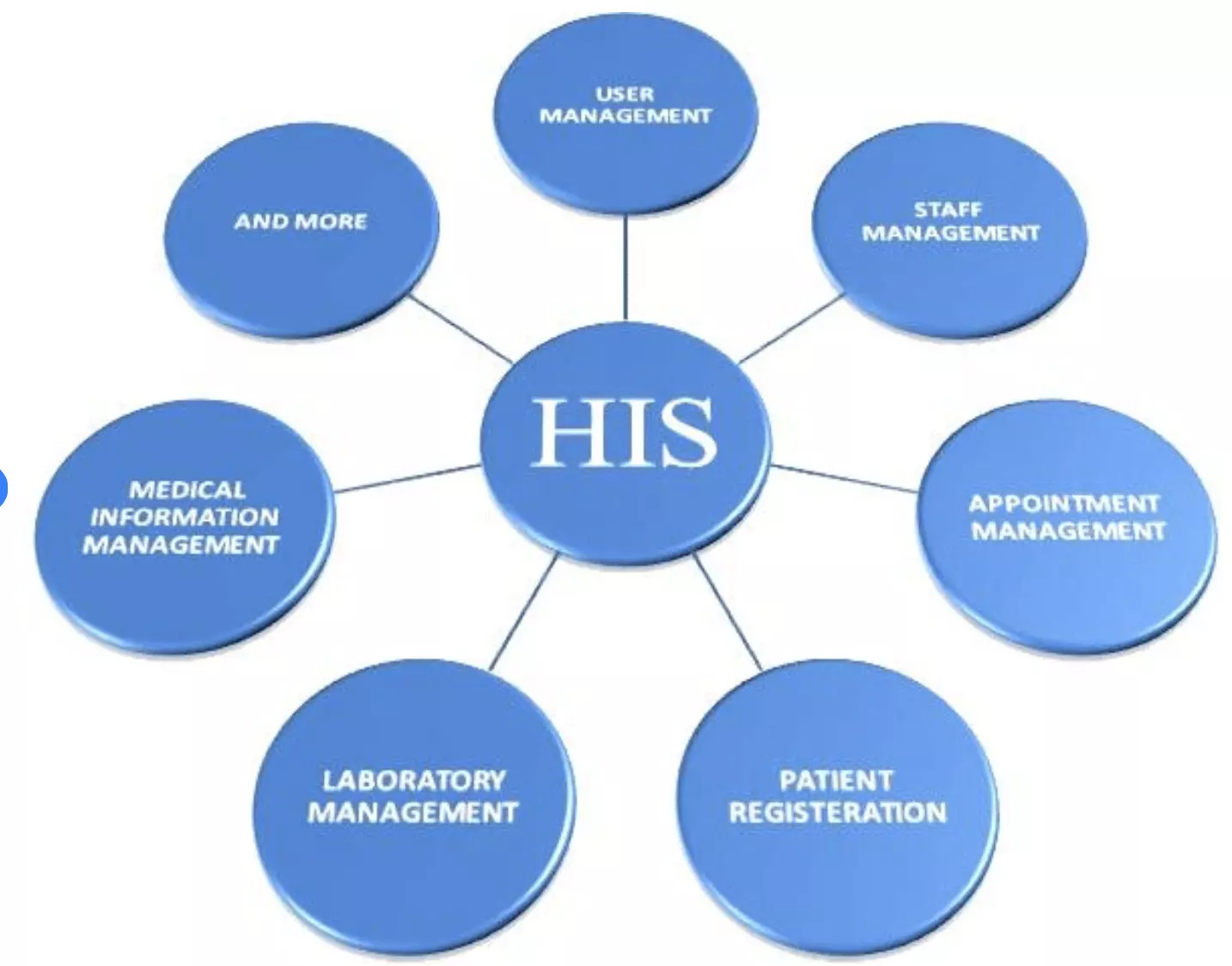

Among the many Hospital Information Management Systems (HIMS) available, Careaxes Hospital Information System, a SaaS-based application, is quickly gaining traction. It offers seamless patient care through its comprehensive suite of modules.

Recent Developments:

October 2023: Bahrain launched an enhanced electronic health information system to improve healthcare services.

May 2023: India’s Union Health Ministry launched SAKSHAM, a digital learning platform for health professionals.

Segments Covered in the Report:

By Type: Electronic Health Record, Electronic Medical Record, Real-time Healthcare, Patient Engagement Solution, Population Health Management.

By Deployment: Web-based, On-premises, Cloud-based.

By Component: Software, Hardware, Services.

By Geography: North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa.